Rocket Lab (RKLB) stock just earned a rare vote of confidence from Morgan Stanley.

The big bank upgraded the space stock to Overweight and tweaked its price target to $105 from $67.

Though that’s a steep reset on paper, it implies nearly a 10% upside from current levels, with the stock hovering near 52-week highs. So the note is much more about how the business is being reframed as it enters its penultimate year.

It’s fair to say space stocks have captured attention lately, especially after AST SpaceMobile’s recent surge, with the shares up nearly 20% over the past week.

However, having covered the space sporadically for a while, Rocket Lab is clearly the bellwether here, and that showed in what was an incredible 2025.

For a little color, shares of Rocket Lab skyrocketed an unbelievable 291% last year.

That’s why the Morgan Stanley note makes a lot more sense.

It points to a higher launch cadence, backed by brand-new products, policy support, and a more maturing market that favors scaled operators.

Rocket Lab posts record quarterly revenue as backlog tops $1.1 billion and launch cadence accelerates.

Rocket Lab posts record quarterly revenue as backlog tops $1.1 billion and launch cadence accelerates.

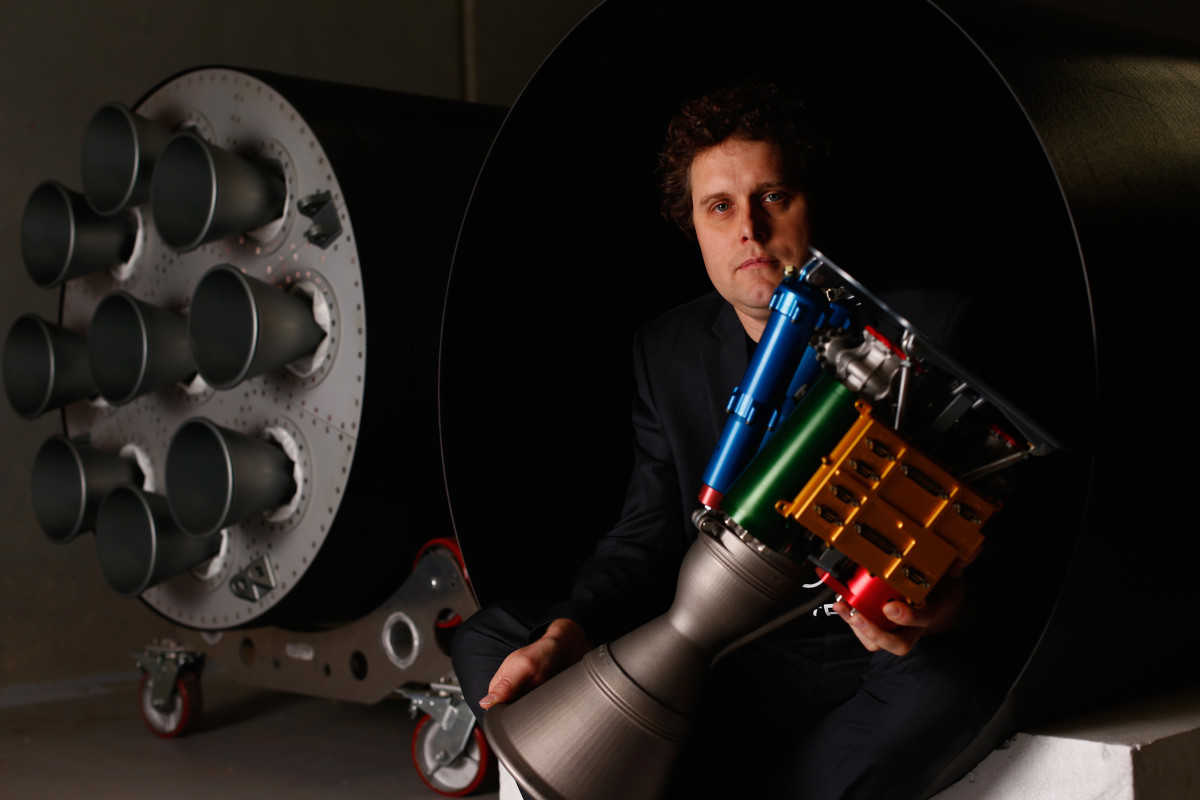

Photo by Phil Walter on Getty Images

Space economy’s growth story is gaining credibility

The space sector is red-hot, underscoring the depth of the space its shift from speculation to infrastructure.

- Market size is expanding quickly: According to the World Economic Forum, the global space economy could reach a whopping $1.8 trillion by 2035.

- Satellite demand is the engine: Growth is linked to robust demand for high-speed broadband connectivity, Earth observation/navigation, and data- and AI-heavy workloads moving into orbit.

- Defense spending adds durability: Governments are seeking smaller, more resilient satellite networks rather than just a handful of high-value assets.

Interestingly, on the topic of AI workloads moving to orbit, you’d remember Tesla CEO Elon Musk alluded to it during a fireside chat at the U.S.–Saudi Investment Forum, as Tom’s Hardware reported.

Morgan Stanley sees Rocket Lab entering a new phase

Morgan Stanley’s view is that Rocket Lab is entering into a far more durable phase of its growth cycle.

Given a more conducive environment (as mentioned earlier), Rocket Lab has effectively positioned itself as a multifaceted space company, rather than just a launch provider.

Rocket Lab’s end-to-end space model

- Launch: getting payloads to space

Electron and HASTE: Electron supports its popular small-satellite launches, having deployed 245 satellites already, while HASTE serves suborbital and hypersonic test missions.

Neutron: This reusable medium-lift rocket (touted as its next big growth catalyst) focuses on constellation deployment and cargo missions.

- Space Systems: building the spacecraft Platforms and components: Rocket Lab offers configurable spacecraft platforms and critical satellite components, with its hardware supporting over 1,700 missions to date.

The next big catalyst for Rocket Lab focuses on longer-term optionality, as it looks to carve out a credible pathway to enter the capacity-constrained medium-lift market through Neutron.

Why Neutron is so important

Neutron is essentially Rocket Lab’s next big step up toward meaningful space deployment economics.

So with Neutron, it’s looking to support mega-constellation deployment, cargo resupply missions, and exploring deeper-space use cases.

It also expects to deploy its first launch by Q1 2026, on the back of pending final qualifications and acceptance, according to TipRanks. If all goes smoothly, Rocket Lab transitions into a new tier, where it will gain access to even bigger contracts and repeat launch demand.

Rocket Lab’s recent wins point to a shift in scale and credibility

2025 emerged as a marquee year for Rocket Lab, as a wave of pertinent contract wins reshaped its outlook.

- Execution is showing up in the numbers: The company posted a record $155 million revenue quarter, grew its backlog to $1.1 billion across Launch and Space Systems, and wrapped up 21 successful Electron launches in 2025.

- SDA Tracking Layer win: Rocket Lab landed a major contract to develop 18 missile-warning and tracking satellites, with a base value of nearly $806 million and a total potential of a whopping $1 billion.

- Neutron added to Space Force launch pool: The U.S. Space Force added Rocket Lab’s Neutron to its NSSL Phase 3 Lane 1 launch vehicle, with an initial $5 million task order.

- NASA launch validation:NASA expanded Rocket Lab’s role under its VADR contract vehicle, green-lighting Neutron for future orders linked with constellation and national-security missions.

- Hypersonic test launch selection: Rocket Lab was selected by Kratos to support MACH-TB 2.0 hypersonic test launch for the Department of Defense, a program valued at $1.45 billion, scheduled for Q1 2026.

The Golden Dome becomes a tailwind for space companies

The buzz around the much-talked-about Golden Dome project has become a tailwind for multiple defense-space names.

For perspective, the Golden Dome is a Trump-ordered missile defense project aimed at building a layered architecture that includes space-based sensors and interceptors.

Though there isn’t a single price tag on it yet but public cost estimates stretch into the hundreds of billions over the next few years.

Related: Cathie Wood drops $50 million on AI stock, dumps favorite

Perhaps the biggest winner so far is AST SpaceMobile, whose stock went parabolic after it was selected as a prime contractor in the Missile Defense Agency’s SHIELD contract pool. Over the past month, the stock has surged almost 70%.

Moreover, Rocket Lab CEO Peter Beck also discussed aligning defense initiatives with programs like this.

Despite the promise of Golden Dome, Rocket Lab’s core driver remains execution at scale.

Risks to the Rocket Lab bull case

Rocket Lab has been on a tear, but its bull case isn’t without its fair share of holes.

Perhaps the obvious pushback is its valuation.

At a market cap north of $51 billion, Rocket Lab is essentially priced for perfection.

The stock is trading at nosebleed valuations, at a mind-boggling 85-times forward sales estimates, according to Seeking Alpha. So there’s virtually no margin for error in terms of bottom-line expansion, backlog conversion, and capital discipline.

More Tech Stocks:

- Morgan Stanley sets jaw-dropping Micron price target after event

- Nvidia’s China chip problem isn’t what most investors think

- Quantum Computing makes $110 million move nobody saw coming

- Morgan Stanley drops eye-popping Broadcom price target

- Apple analyst sets bold stock target for 2026

Speaking of profitability, that’s likely to remain a key problem for the business as it looks to scale up.

For perspective, in Q3 2025, revenue jumped to $155.1 million (compared to $104.8 million in the prior-year period), while gross profit improved to $57.3 million (gross margin 37%). However, the problem is that operating costs continue to swallow the business.

Case in point, selling and administrative costs of $45.6 million plus R&D $70.7 million drove total operating expenses to a concerning $116.3 million, resulting in a worrying operating loss of ($59 million).

Worse, that operating loss has been basically flat over the past three consecutive quarters at ($59.0 million), ($59.6 million), and ($59.2 million).

Then there’s Neutron.

The rocket’s first launch was recently pushed to this year, as management was working hard to “retire the risks.” As it goes toe-to-toe with SpaceX’s Falcon 9, that’s an incredibly high bar for cost, cadence, and reusability.

Related: Nvidia’s China ‘green light’ for H200 chip: Watch these 3 tripwires