As January gets underway, AI stocks are in for a kicker at the CES event.

Nvidia (NVDA) and Advanced Micro Devices (AMD) are in the spotlight, with both expected to use the event as a stepping stone to shape the next phase of the AI race.

Having covered multiple tech cycles over the past several years, I know that stock markets typically don’t turn on earnings alone.

They need market-moving catalysts to give the narrative a much-needed kick in the pants.

AI chip stocks, in particular, have had a rough time of late.

For color, the PHLX Semiconductor Index dropped nearly 5% from its December 10 record (7,490) to its December 31 close (7,083).

Nevertheless, according to Wedbush Securities, both AI bellwethers are positioned to deliver some of the conference’s most compelling headlines.

CES puts Nvidia and AMD in focus as investors look for fresh AI catalysts.

CES puts Nvidia and AMD in focus as investors look for fresh AI catalysts.

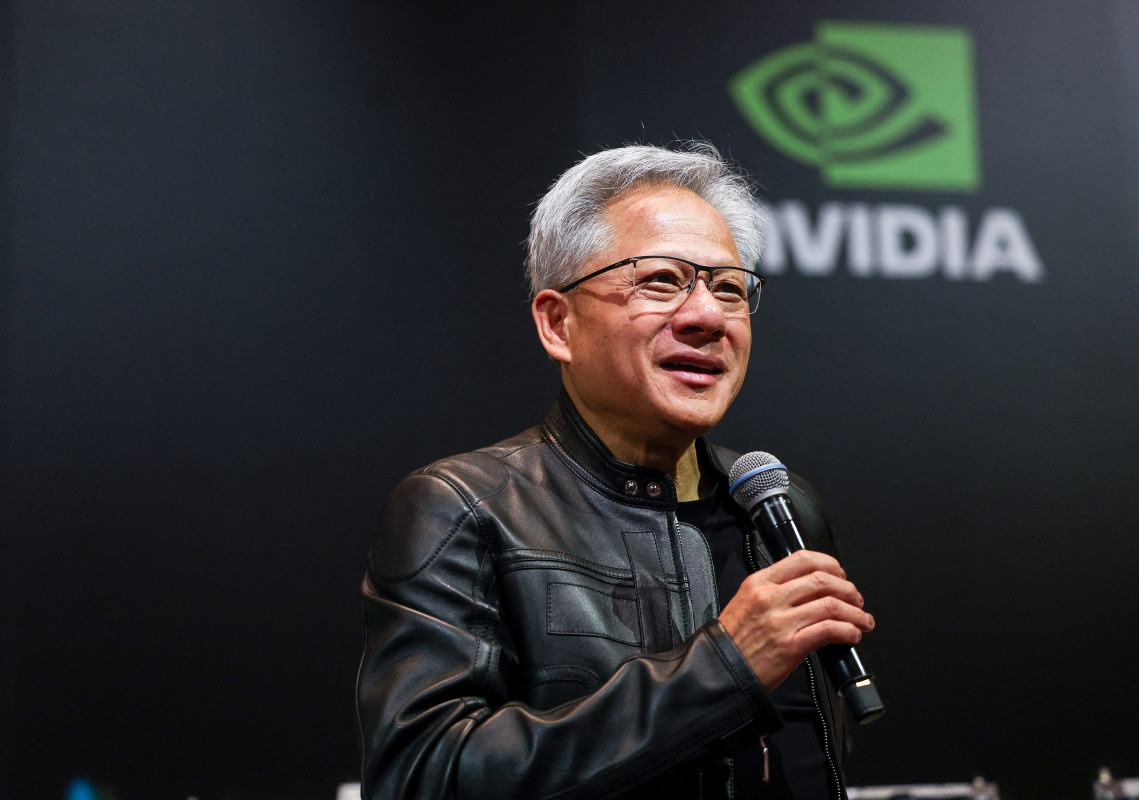

Photo by I-HWA CHENG on Getty Images

Wedbush says Nvidia, AMD expectations at stake for CES 2026

For Nvidia, CEO Jensen Huang will take the stage in his signature leather jacket to reinforce the AI leader’s vision around data centers, robotics, and what Wedbush calls the next phase of the AI revolution.

AMD will have its own moment, with CEO Lisa Su delivering the opening keynote, featuring key updates across PCs, data centers, and edge AI.

With valuations mostly stretched and expectations running high, the CES event could therefore help set the tone for what’s to come for these AI giants in 2026.

More Tech Stocks:

- Morgan Stanley sets jaw-dropping Micron price target after event

- Nvidia’s China chip problem isn’t what most investors think

- Quantum Computing makes $110 million move nobody saw coming

- Morgan Stanley drops eye-popping Broadcom price target

- Apple analyst sets bold stock target for 2026

Wedbush sees CES as a critical opening act for Nvidia and AMD, as expectations run sky-high.

Wedbush analysts offered further insight.

Analysts also expect updates linked to Nvidia’s robust software platforms, including gaming and simulation, underscoring that its AI story extends far beyond hyperscale customers.

For AMD, Wedbush expects major Ryzen updates and concrete updates around AI PCs, data centers, and edge computing. Moreover, AMD will be looking to build a platform, not just offer alternatives.

CES 2025 recap: what Nvidia and AMD showed last year

That said, here’s the lowdown from last year’s event for both tech giants.

- Nvidia showed off its powerful Cosmos platform for “physical AI,” positioning it as a foundation for real-world deployment.

- Nvidia introduced Blackwell-based GeForce RTX 50 Series GPUs while highlighting new RTX-PC AI tooling (including NIM microservices/Blueprints).

- AMD rolled out its AI PC portfolio, covering Ryzen AI Max/Max PRO, and expanded Ryzen AI 300 chips tailored to Copilot+ PCs.

- AMD leaned into gaming/graphics with Ryzen X3D desktop chips and Ryzen Z2 handheld processors. Also, it offered previews of the Radeon RX 9070-series (RDNA 4) GPUs and FSR 4.

At CES 2026, the real fight is over AI

CES 2026 runs January 6 to 9 in Las Vegas, and though it has historically been more of a gadget showcase, this year it’s shaping up to be the year’s first high-stakes tech meeting.

Investors expect a needle-moving event, spearheaded by concrete roadmaps, partnerships, and major commitments.

For the biggest chipmakers, CES will be all about owning the AI conversation early. Nvidia will seek to reinforce its dominance by rallying partners with demos, keynotes, and industry-wide signaling.

Related: Cathie Wood shells out $1.3 million on biotech stock

AMD will look to rain on Nvidia’s parade.

By spotlighting new PC platforms and capitalizing on a larger OEM market share, AMD will aim to carve out its own lane for AI-driven growth.

For perspective, the AI trade has lost its luster lately, and big-name skepticism targets are growing louder.

Front and center is the “Big Short” Michael Burry, who is openly comparing the current AI frenzy to past manias.

Burry delivered a scathing takedown of Nvidia.

That’s exactly why Nvidia and AMD will be looking for a strong start to set the tone early in 2026.

Big banks reset targets on Nvidia and AMD

Nvidia and AMD both had a solid outing at the stock market last year.

For perspective, Nvidia stock ended 2025 up 41%, while AMD posted an 83% gain.

Now, Wall Street is recalibrating its expectations for 2026, with investors in “show-me” mode when it comes to AI.

- Bank of America: Nvidia buy, $275 price target; AMD buy, $300 price target Source: Investing.com

- Morgan Stanley: Nvidia overweight, $250 price target; AMD equal weight, $260 price target

- UBS: Nvidia buy, $235 price target; AMD buy, $300 price target

- Goldman Sachs: Nvidia buy, $250 price target; AMD neutral, $210 price target Source: Investing.com

- JPMorgan: Nvidia overweight, $250 price target; AMD neutral, $270 price target Source: Barron’s