Nvidia’s (NVDA) rise from a gaming pure-play to an AI kingmaker has been nothing short of amazing.

With cloud czars zooming to build the future with Nvidia chips at the heart of it, the company has become the cornerstone of a niche few even saw coming.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Its recent $4 trillion milestone wasn’t just a headline; it was a statement. However, staying on top in AI is far from easy.

Also, just as some thought the company may hit a massive speed bump, a quiet shift in Washington changed the game again.

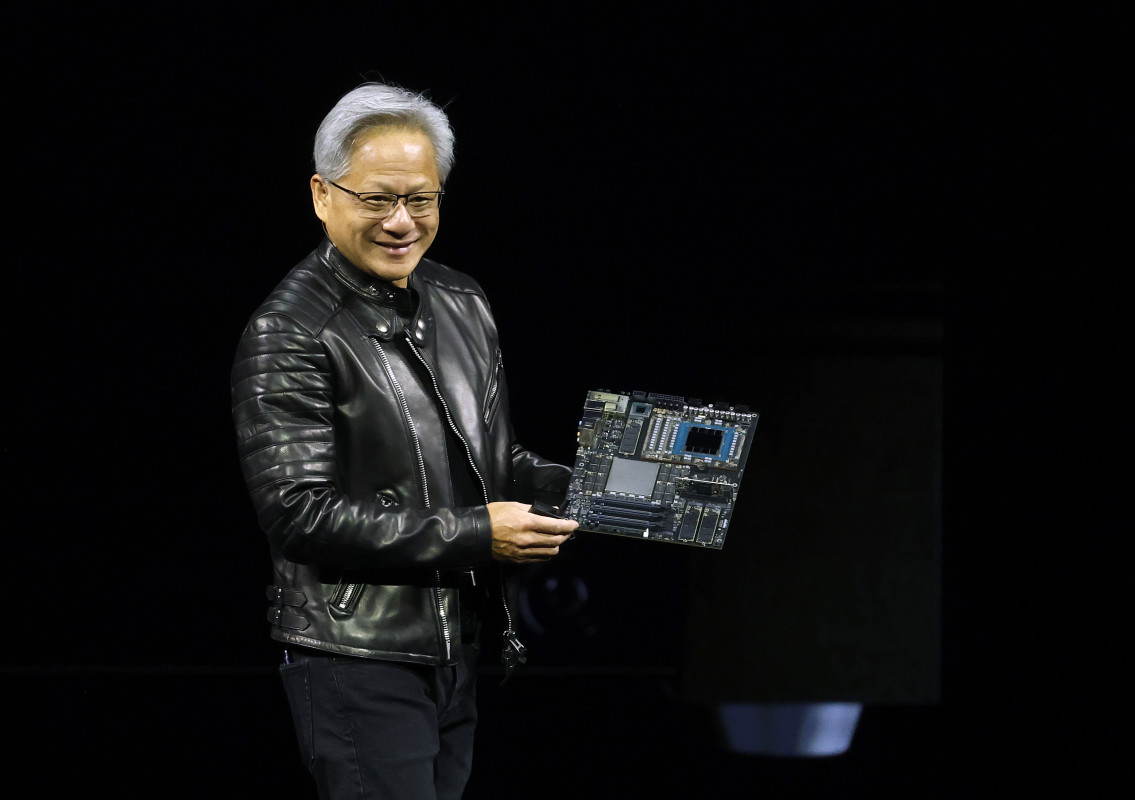

Nvidia stock rebounded after the Trump administration held back on a potentially disruptive move

Nvidia stock rebounded after the Trump administration held back on a potentially disruptive move

Justin Sullivan/Getty Images

Nvidia’s trillion-dollar AI engine keeps roaring

It’s hard to believe at this point that Nvidia used to be known for its gaming GPUs.

Related: Intel stock faces a chipmaking Catch-22, top analyst warns investors

Under CEO Jensen Huang, the chipmaker mounted a sharp pivot to AI and hasn’t looked back ever since.

Its robust H100 and H200 Tensor Core GPUs are powering the global AI boom, crunching workloads for everyone from OpenAI to Google.

The result is that Nvidia’s quarterly top-line numbers have tripled, from $16 billion in fiscal 2020 to over $40 billion in early 2025.

That momentum has also pushed the stock to meteoric heights, culminating on July 9 when it briefly became the first $4 trillion company.

The key to Nvidia’s climb has been Big Tech

Giant companies like Google pledged a whopping $85 billion in AI infrastructure spending.

Amazon and Microsoft are also developing Nvidia-powered AI into their cloud backbones.

That kind of growth gives Nvidia the impetus to continue growing its reach, along with serious pricing power.

Now the White House isn’t backing off either in its support.

Trump’s late-July AI action plan effectively rolled back export restrictions on Nvidia’s H200 chips while loosening permitting rules for AI data centers.

Huang called it a “critical tailwind” for keeping America’s AI edge.

Wall Street takes notice, sends Nvidia stock price surging

The consensus of 38 Wall Street analysts is that Nvidia’s stock price will hit $182.49 over the next year, with bullish targets as high as $250.

If that plays out, Nvidia’s valuation could soar to $6 trillion, effectively doubling from here.

It’s not hard to see why, either. Nvidia’s unmatched combo of hardware dominance, full-stack software, and deep developer lock-in gives it a near-monopoly on AI’s most valuable layer.

More Tech Stock News:

- Top economist drops 6-word verdict on Trump tariffs, inflation

- Amazon’s quiet pricing twist on tariffs stuns shoppers

- Microsoft software flaw leads to shock nuclear cyber breach

Rivals are trying to catch up, but at this point, Nvidia isn’t just the chip leader; it’s the AI infrastructure king.

Donald Trump considered breaking up Nvidia, then backed off

President Donald Trump made waves at an AI summit in Washington yesterday, admitting he once thought of breaking things up at Nvidia to potentially level the playing field in the AI chip market.

Related: Nvidia-backed stock sends a quiet shockwave through the AI world

“I said, ‘Look, we’ll break this guy up,’”

Trump told the crowd, before confessing that he was quickly told to pump the brakes on that idea”.

I found out it’s not easy in that business.” The comment drew laughs, but also raised some concerns across Silicon Valley and Wall Street.

Trump didn’t stop there.

He praised Nvidia CEO Jensen Huang, who was in attendance, calling his leadership “a job well done”.

Huang, in turn, hailed Trump as “America’s unique advantage,” in a moment of public flattery.

This comes at a time when the Department of Justice is conducting a lingering antitrust probe into Nvidia, which opened last year.

Though we haven’t seen much action on that front, Trump’s comment showed how close the chip giant was to facing serious trouble from the top.

It wasn’t all tension, though.

Trump used the event as a stepping stone to roll out his “AI Action Plan,” a pro-industry framework that looked to remove regulatory friction for developers and manufacturers.

That easing tone could explain why Nvidia shares held steady after the event, even as competitors braced for greater scrutiny.

Meanwhile, Nvidia supplier SK Hynix just posted a record $6.7 billion profit for Q2, announcing plans to take it up a notch with its AI chip investments.

This follows a trend where we’re seeing customers rushing to stockpile ahead of possible new U.S. tariffs.

The company says HBM chip demand, and deals with major clients like Nvidia, have held up remarkably well despite the volatility.