Intel (INTC) stock erupted around 30% in pre-market trading on Sept. 18 — and it wasn’t because of a new chip. It was because Nvidia picked up the phone.

The two rivals — one the undisputed king of AI infrastructure, the other a struggling legacy giant — just made an unexpected alliance that’s already rewriting the rules of the semiconductor war.

What Wall Street thought it knew about the chip race got torched in a matter of hours. Nvidia, which could’ve doubled down on AMD (AMD) , ARM (ARM) , or its own dominance, instead made a bet no one saw coming: It partnered with Intel.

On the surface, it looks like a scale play. But dig deeper, and it may be about something else entirely: control, regulation, and who gets to build the future of AI on their own terms.

Nvidia’s surprising partnership with Intel signals a major shift in the AI chip race.

Nvidia’s surprising partnership with Intel signals a major shift in the AI chip race.

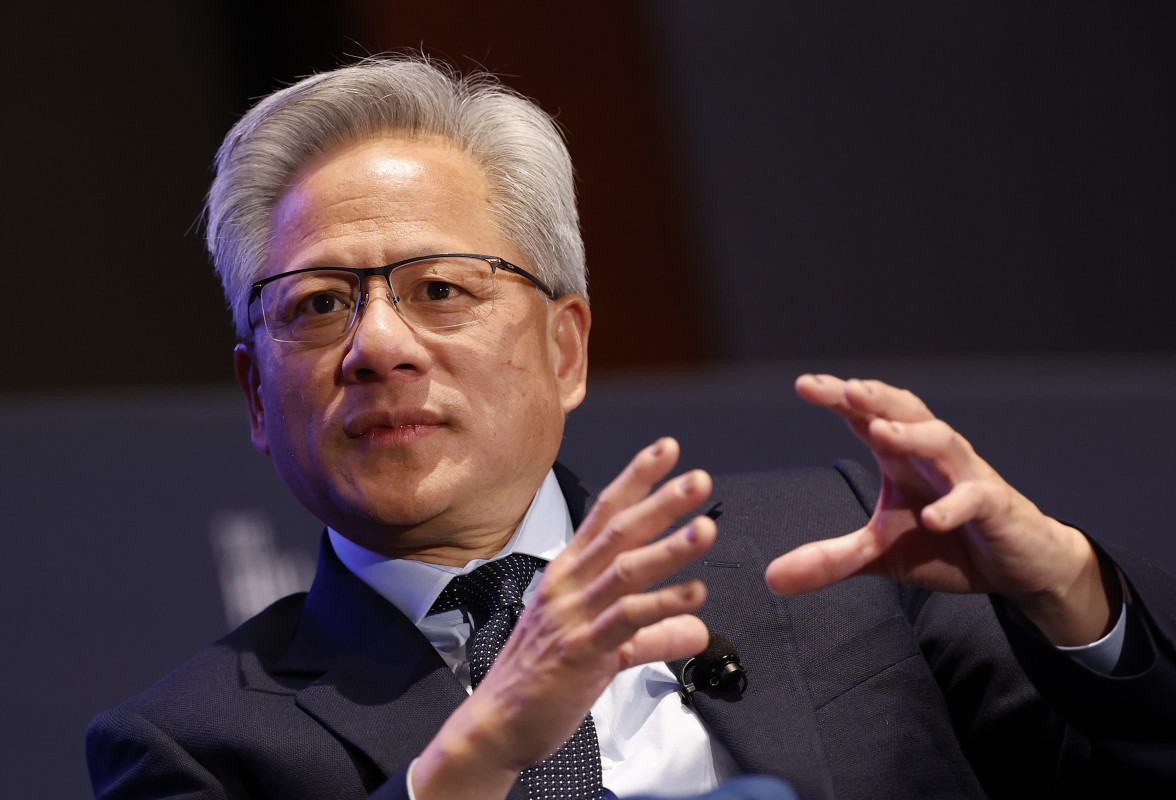

Image source: Kevin Dietsch/Getty Images

Why Nvidia picked Intel, not AMD or ARM

Nvidia did not need Intel. Head-to-head, there is no comparison. Although Intel is streamlining its operations, cutting costs, and making the right moves, AI-wise, it still does not hold a candle to Nvidia in any domain, making a partnership unlikely.

Ultimately, this is what led to the surprising pop for INTC stock.

In sophisticated semiconductors, Nvidia already controls the AI stack, thanks to its market-leading H100 and H200 GPUs and the CUDA software layer, making switching practically hard for developers. It could have easily doubled down on AMD, ARM, or created more in-house if it wanted to grow. None of its recent moves indicated it was looking into a deal with Intel.

However, none of that matters now; the deal with Intel is sealed. And everyone is wondering why.

Well, it’s got nothing to do with performance and everything to do with location.

Related: Wall Street blinked, then Nvidia built its boldest partnership yet

Intel possesses something that not many other companies can provide in today’s world: the ability to make things in the U.S.

Nvidia has depended on TSMC (TSM) a lot to make chips, but tensions are developing around Taiwan and Washington’s desire for “AI sovereignty,” which has altered the math.

Intel’s sophisticated foundries, like the ones it is building in Ohio and Arizona, provide Nvidia a means to protect itself against problems in the supply chain and political backlash.

Insulating a company against political headwinds is critical. Under the current Trump administration, it’s key to remain ahead of the curve and the policy shifts to avoid getting burned.

Diversification is another thing to think about. AMD competes too directly in the GPU market. The ARM ecosystem is becoming bigger, but it still doesn’t have the type of high-performance power that business AI applications need.

Intel, on the other hand, has been sitting on unused capacity and needs a big change.

Just think about the disparity in scale: AMD hit a record high of $7.685 billion in total sales for the second quarter of FY2025. But Nvidia pulled in $41.1 billion from data center sales alone in Q2 FY2026 — part of a $46.7 billion quarterly haul that grew 56% year-over-year.

Intel may not be as good at AI as Nvidia is. But it has the fabs, the flag, and a tale that investors want to believe in again.

Nvidia didn’t merely get a partner. It figured out how to to de-risk its future.

What Wall Street has just priced in, and what it hasn’t

Intel’s more than 30% increase is characteristic of a major earnings beat, not a press release about a handshake. That alone demonstrates how desperate investors were for any indication that Intel may matter in the AI future.

But is this the beginning of a meaningful renaissance, or just a relief rally?

So far, markets have seen the Nvidia transaction as a watershed moment, rather than a mere narrative change. However, for that to be true, Intel must demonstrate that it can truly deliver on the promise of AI infrastructure, rather than just talking about it.

Nvidia, for its part, will need to demonstrate that this was more than a political optics move.

In any case, the next several quarters will tell if this was a one-day market surge — or the point when the semiconductor chessboard was turned.

Because if Intel can translate momentum into market share, this will be more than simply a comeback story. It will be one of the most improbable shifts in technology history.

Related: Klarna IPO, Mistral mega-round fuel Europe’s Wall Street tech revival