In a stunning blow for gamers, it seems that for the first time in decades, Nvidia (NVDA) might look to skip launching a fresh gaming GPU this year.

The tech behemoth is looking to forgo a 2026 gaming release due to the ongoing memory supply crunch, according to The Information.

Unsurprisingly, it’s the regular consumer who takes the hit here, as Nvidia prioritizes memory for its hot, in-demand AI accelerators.

Moreover, Nvidia acknowledged the memory constraint in a statement to Seeking Alpha.

To be fair, it was in the cards that the big AI giants would come first, not us regular consumers.

For some context, I covered memory giant Micron’s (MU) decision to exit its consumer memory business through Crucial, winding down Crucial-branded SSDs and memory modules.

On top of that, Micron CEO Sanjay Mehrotra acknowledged that memory markets will likely “remain tight past 2026.”

Moreover, AI’s insatiable demand for memory is only going to grow, as Mehrotra touched on at Davos.

This isn’t exactly about waning demand for gaming, however. Rather, Nvidia is reallocating resources toward AI chips, delivering far higher margins and strategic value.

The financial impact is obvious, but there’s also a symbolic shift.

Even if temporary, that pause will effectively redraw expectations for the AI bellwether’s roadmap and its relationship with the gaming sphere.

Nvidia’s booming AI business is forcing tough choices as tight memory supplies squeeze gaming GPUs.

Nvidia’s booming AI business is forcing tough choices as tight memory supplies squeeze gaming GPUs.

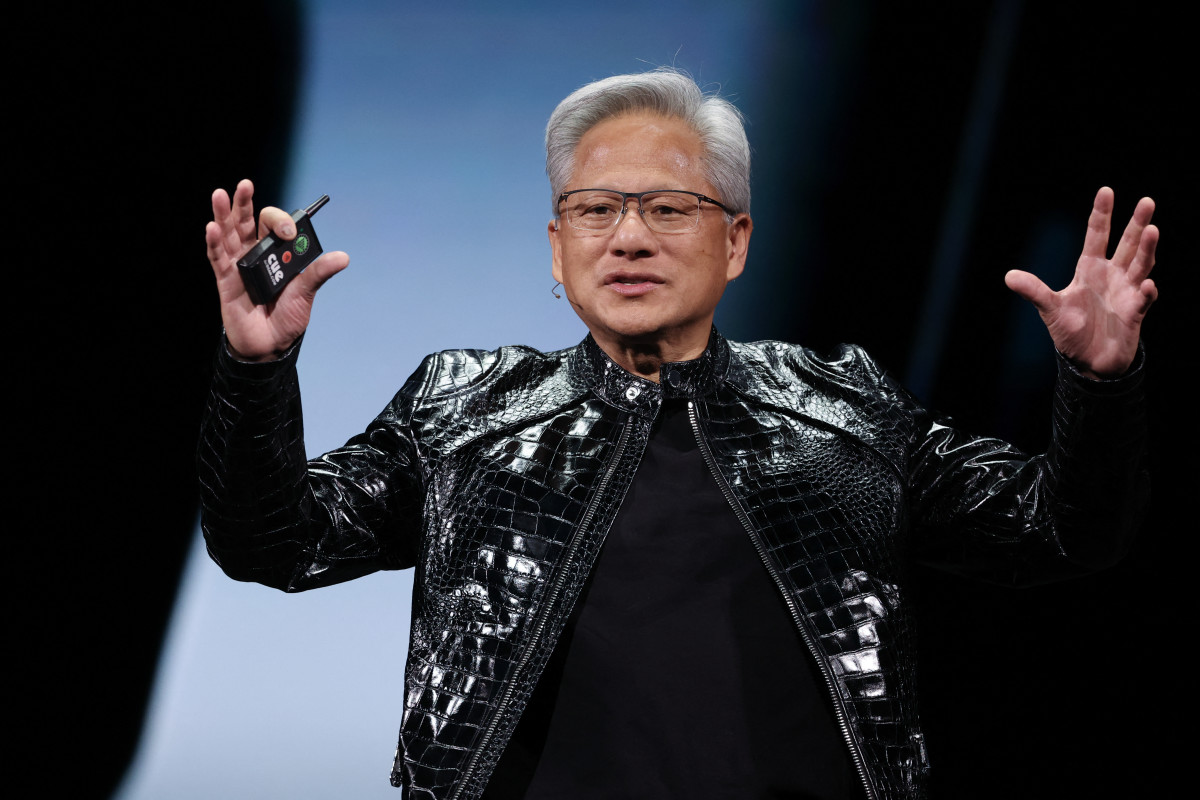

Photo by PATRICK T. FALLON on Getty Images

Nvidia gaming GPU series and key models (2015-2025)

- 2015: GeForce GTX 900 series (Maxwell) GTX 980 Ti, 980, 970, 960, 950 (plus enthusiast Titan X variants in that era)

- 2016-2018: GeForce GTX 10 series (Pascal) GTX 1080 Ti, 1080, 1070 Ti, 1070, 1060, 1050 Ti, 1050 (plus Titan X/Titan Xp variants)

- 2019: GeForce GTX 16 series (Turing, GTX-branded) GTX 1660 Ti, 1660 Super, 1660, 1650 Super, 1650

- 2018-2021: GeForce RTX 20 series (Turing, RTX-branded) RTX 2080 Ti, 2080 Super, 2080, 2070 Super, 2070, 2060 Super, 2060

- 2020-2022: GeForce RTX 30 series (Ampere) RTX 3090 Ti, 3090, 3080 Ti, 3080, 3070 Ti, 3070, 3060 Ti, 3060, 3050

- 2022-2024: GeForce RTX 40 series (Ada Lovelace) RTX 4090, 4080 Super, 4080, 4070 Ti Super, 4070 Ti, 4070 Super, 4070, 4060 Ti, 4060

- 2025: GeForce RTX 50 series (Blackwell) RTX 5090, 5080, 5070 Ti, 5070 (first wave announced/marketed in 2025)

- Source: Nvidia GeForce GPU Comparison tool

Related: History of Nvidia: Company timeline and facts

AI is monopolizing “premium memory” capacity

At this point, it may sound like a broken record, but the AI boom has clearly become a memory land grab.

For perspective, the gatekeepers in the memory space have already locked up supply, with SK hynix saying its HBM is sold out through 2026 and Samsung confirming customers are secured for upcoming output.

So we’re looking at three main players in the memory space that are firmly in the driver’s seat.

More Nvidia:

- Nvidia stock gets major reality check on ‘$100B’ number

- Veteran analyst delivers surprise verdict on Tesla, Nvidia

- NVDA, PLTR, small cap stock bets reset after U-turn

They dominate the most critical input for AI chips, and the demand/supply imbalance has effectively translated into stronger pricing power, long-term contracts, and tighter customer discipline.

In addition, Samsung is already looking at next-generation HBM timelines, including HBM4, underscoring the strategic nature of these supply agreements. At the same time, we’re seeing these memory makers effectively policing orders while tightening allocations.

AI quietly rewired Nvidia’s entire business model

AI has essentially rewired Nvidia’s entire growth engine.

Not too long ago, Nvidia was mostly a gaming chip company selling graphics cards in a hotly competitive market.

Today, it’s like a power-packed full-stack AI platform, offering GPUs bundled with CPUs and DPUs, networking backed by incredible, sticky software such as CUDA, and services such as DGX Cloud.

Related: Morgan Stanley tweaks AMD stock price target post-earnings

That shift has been huge, and Nvidia’s financials prove it.

As AI became the lion’s share of its business, Nvidia’s margins effectively leapt into rarefied territory.

- FY2025 GAAP gross margin:75%, up from 72.7% the year before, and substantially higher than the 62% figure it posted in FY2020.

- FY2025 GAAP operating income: $81.5 billion, up 147% year over year

- Q3 FY2026 revenue mix: $51.2 billion Data Center out of $57 billion total (roughly 90%)

Those aren’t just “good chip margins.” That’s software-like profitability on top of its mammoth hardware-scale sales.

Nvidia’s data center–driven business has also maintained gross margins near 75%, and management has guided to roughly the same level going forward.

With memory scarce, it seems only natural for Nvidia to follow the math and steer its efforts toward AI.

When AI wins, gaming waits

If Nvidia continues directing scarce memory and supply toward AI, the consequences will most likely go well beyond a single product launch.

Here’s how things could potentially play out.

- Gaming GPU cadence slows: We could probably see fewer launches and limited refreshes, leading to significantly longer gaps between generations.

- Scarcity props up prices: Nvidia’s own MSRP for the GeForce RTX 5090 starts at $1,999; however, third-party trackers show listings go as high as $4,438 on Amazon.

- Evidence from AMD points to a sluggish market: AMD warned in its most recent quarterly showing that its Gaming segment is up against some headwinds, forecasting double-digit sales decline in 2026, per Investing.com.

- Late-cycle drag pushes the reset out. For gamers, aging consoles essentially point to far fewer hardware sales and more promotions, which leaves the next-gen console ramp around 2027.

Related: Palantir CEO delivers curt 8-word message to investors