Nvidia (NVDA) stock may be poised for another rally after a bullish revenue surprise from one of its key partners in the AI supply chain.

On June 10, Taiwan Semiconductor (TSM) , the world’s largest chip foundry and a critical manufacturer for Nvidia, reported May revenue of NT$320.52 billion (about $10.70 billion), up 39.6% from a year earlier but down 8% from April’s figure.

Despite the sequential dip, May still marked TSMC’s second-highest monthly revenue on record, behind only April 2025, which likely benefited from accelerated orders ahead of potential tariffs from President Trump’s administration.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

TSMC’s revenue for January through May 2025 increased by 42.6% compared to the same period in 2024, signaling that demand for AI chips is strong even amid macro uncertainty.

That bodes well for Nvidia, which relies heavily on TSMC to manufacture its high-performance AI GPUs.

Nvidia stock is up 7.2% year-to-date.

Nvidia stock is up 7.2% year-to-date.

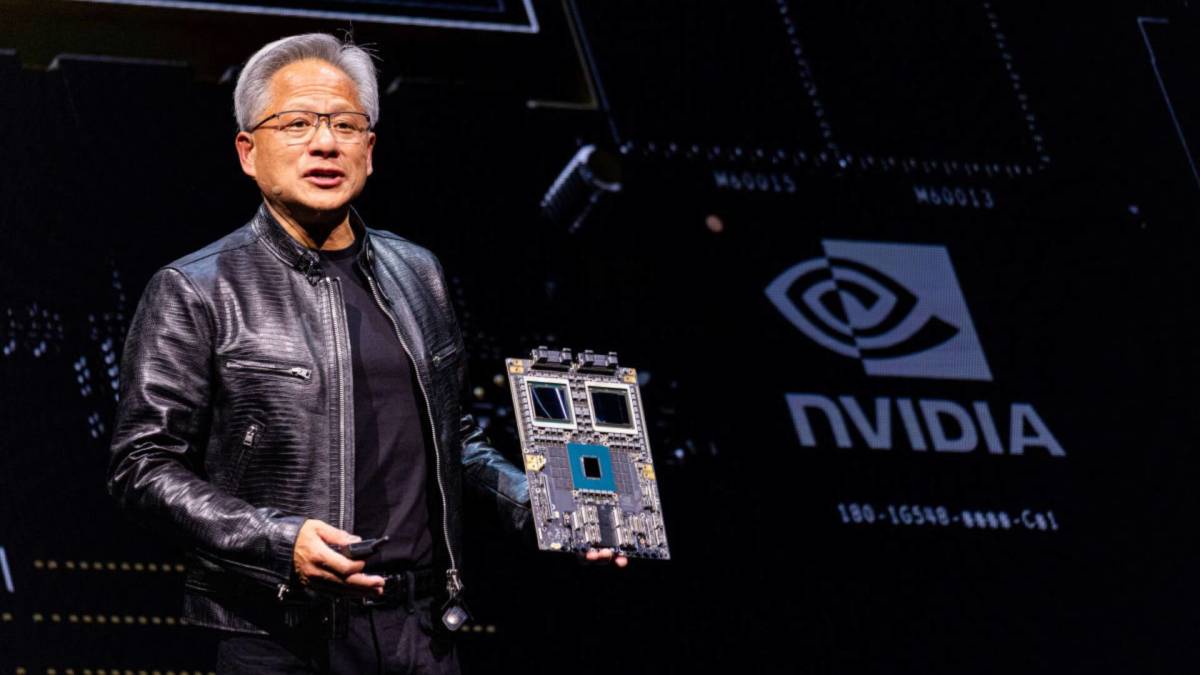

Image source: Chih/Bloomberg via Getty Images

Why Nvidia stock surged from its April lows

Nvidia was among the tech stocks hit hard in early April as tariff tensions flared and the U.S. tightened export restrictions on advanced chips. The company took a $4.5 billion charge in the fiscal first quarter ended April 27 and said it would have recorded an additional $2.5 billion in revenue without the restriction.

The stock later rebounded after the U.S. and China agreed to slash tariff rates on each other temporarily. Optimism also grew after the Trump administration scrapped the Biden-era AI diffusion rule, another export control on advanced AI chips.

Related: Analyst resets Nvidia stock price target after CEO slams U.S. chip policy

News that Nvidia will supply AI chips to Saudi Arabia’s Humain, an emerging tech player in the region, also boosted the stock.

On May 28, Nvidia reported strong fiscal first-quarter results. Adjusted earnings of 96 cents per share on $44.06 billion in revenue for its fiscal first quarter surpassed Wall Street’s expectations of 93 cents and $43.31 billion.

The company forecasts $45 billion, missing analysts’ projections of $45.9 billion. But it noted that the figure would have been roughly $8 billion higher without the China export curbs.

Tensions between China and the U.S. remain the Damocles’ sword hanging over Nvidia. Investors are now focused on the second round of U.S.-China trade talks, which is taking place in London. If the world’s two largest economies fail to reach a trade deal, it could hit Nvidia’s bottom line.

Nvidia stock rose 1% on June 10 and closed at $143.96, just about 6% below its all-time high of $153.13.

Veteran fund manager backs Nvidia on robust AI demand

Chris Versace, a Wall Street veteran fund manager who oversees TheStreet Pro’s portfolio, said TSM’s May revenue “stuns” the market, and expressed that “robust” demand for AI and data centers is a “positive signal for our positions in Nvidia and Marvell (MRVL) .”

Versace began to purchase Nvidia stock in February 2024, and the stock now accounts for 4.3% of the portfolio. His average gain on the stock is 64.6%.

Related: Analysts unveil bold forecast for Alphabet stock despite ChatGPT threat

Still, he cautioned that investors need more information, such as May revenue reports from Foxconn (FXCOF) , a key supplier of Nvidia and Apple (AAPL) .

Versace also noted the market is in a holding pattern as investors await more details on U.S.-China trade talks and key inflation data.

“What we and the rest of the market are waiting for are more details to emerge from U.S.-China trade talks, which so far have been categorized as ‘going well,’” Versace wrote in a memo for TheStreet Pro.

More Nvidia:

- Analysts issue rare warning on Nvidia stock before key earnings

- Analysts double price target of new AI stock backed by Nvidia

- Nvidia CEO shares blunt message on China chip sales ban

Versace said he’s seen reports suggesting President Trump could loosen chip export limits in exchange for faster rare earth shipments from China.

He also warned that the May CPI report, due Wednesday, might cause some market volatility as investors reassess expectations for Fed rate cuts.