Nvidia has a China problem. The company is the de facto gold standard when it comes to artificial intelligence chips, yet it has been excluded from the Chinese market, costing it billions of dollars in lost sales every quarter.

It’s not just U.S. regulations that have cut off China’s sales, either. The Chinese government is eager to close the gap with America in the field of AI. As part of that goal, it’s preventing many data centers from using Nvidia chips, fearing that doing so would make its AI infrastructure overly reliant on the United States’ political whims.

The situation appeared to ease earlier this year, when President Donald Trump cleared the way for Nvidia to sell its H20 AI chip in China, sparking hopes that the China revenue spigot was about to open. Yet Nvidia’s third-quarter results show that China sales remained a rounding error, partly because Nvidia’s still unable to sell its fastest chips there.

The question over whether Nvidia should or shouldn’t be able to sell chips to China has sparked debate. Opponents fear that giving China access to our latest technology would risk its use against us, while proponents argue that the best way to bring China into the Western world and prevent its overtaking us someday is to encourage the use of our gear.

What happens next is anyone’s guess, but Secretary Howard Lutnick recently said the decision whether to sell Nvidia’s H200 chip is on President Trump’s desk, not his.

Artificial intelligence hits a turning point

While it may seem like AI is new, it’s been discussed and researched for decades. Alan Turing contemplated AI, and the Rand Corp wrote the first AI program (The Logic Theorist) in 1956. Countless science fiction novels and movies have taken up the subject, from Isaac Asimov’s “I, Robot” in the 1940s to Disney’s “Tron: Ares” in 2025.

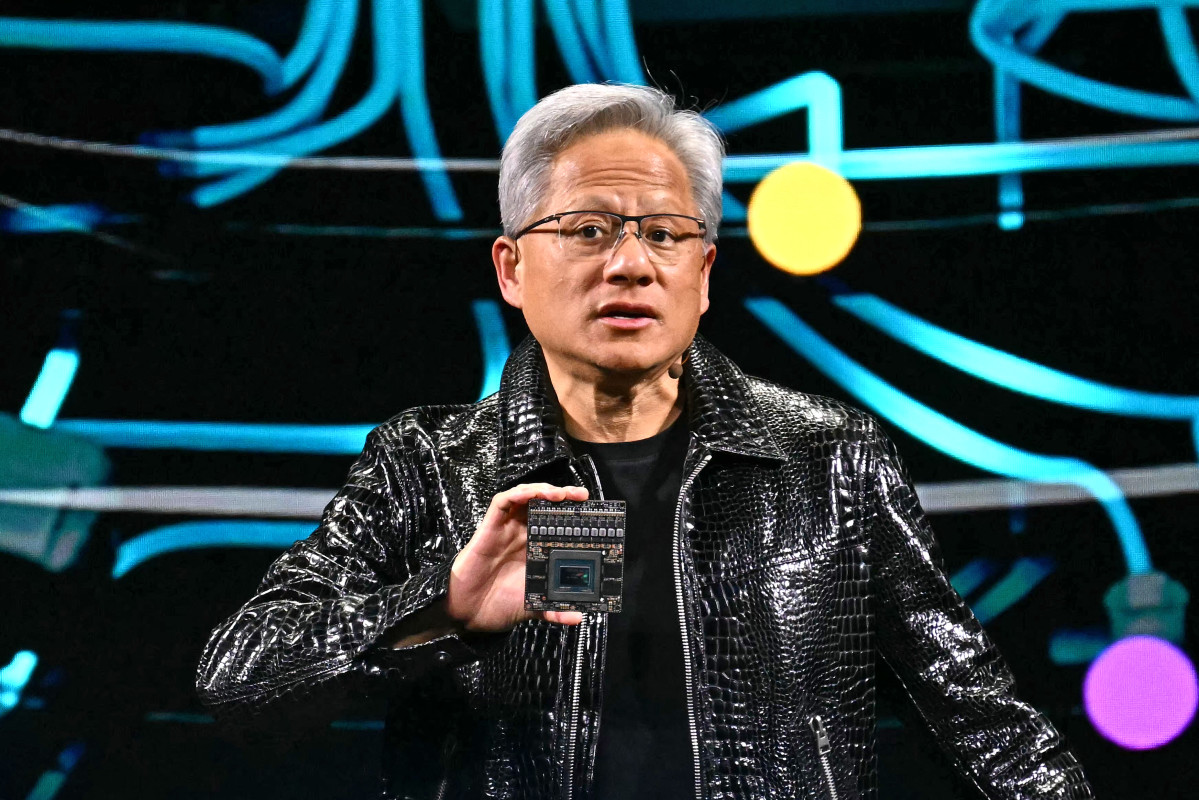

Nvidia CEO Jensen Huang awaits a decision from President Trump on whether it will be able to sell its H200 AI chip in China.

Nvidia CEO Jensen Huang awaits a decision from President Trump on whether it will be able to sell its H200 AI chip in China.

Photo by PATRICK T. FALLON on Getty Images

However, it’s only recently that AI has captured the world’s zeitgeist. The successful launch of OpenAI’s Chat GPT in 2022 (it was the fastest app ever to reach 1 million users) spawned a flurry of R&D across technology, leading to rival large language models, or AI chatbots, from the likes of Google (Gemini), Microsoft (Copilot), Anthropic (Claude), and Perplexity – to name a few.

Related: Cathie Wood buys $16.7 million of megacap AI stock

Developing those chatbots wasn’t easy, and it required massive compute power that strained legacy data centers, which relied heavily on central processing units, or CPUs, that weren’t up to the task. As a result, hyperscalers and other data centers quickly embraced Nvidia’s graphic processing units, or GPUs, which had proven particularly adept at handling heavy workloads in high-end video gaming and cryptocurrency mining.

Demand was so great (and occurred so quickly) that Nvidia couldn’t keep up with demand for its H100s (and successors) here or abroad, causing sales to skyrocket to $130.5 billion last fiscal year, up from $27 billion in 2022, when ChatGPT hit the scene.

The strength hasn’t abated, and if anything, has intensified as the industry shifts from building AI models to using them, something called inference. As models have been spun up, demand for computer power for operating them has exploded.

Just about every industry is researching the use of AI workers, agentic AI programs designed to assist workers. Banks are using AI to hedge risks, health care companies are using it to inform drug discoveries, manufacturers are using it to improve quality and reduce waste, and retailers are using it to improve supply chains and enhance customer service. Even the military is evaluating the use of it on the battlefield.

Nvidia faces major China roadblock

The hesitancy to sell Nvidia chips to China isn’t new. The U.S. government has been placing increasingly stringent restrictions on sales since 2022.

Nvidia China restrictions timeline:

- August 2022: The U.S. government announced licensing requirements that “with certain exceptions, impact exports to China (including Hong Kong and Macau) and Russia of our A100 and H100 integrated circuits, DGX or any other systems or boards which incorporate A100 or H100 integrated circuits.”

- July 2023: Additional licensing requirements enacted for a subset of A100 and H100 chips designed for certain customers and other regions.

- October 2023: Updated licensing requirements became effective in our fourth quarter of fiscal year 2024 for exports to “China and Country Groups D1, D4, and D5 (including but not limited to Saudi Arabia, the United Arab Emirates, and Vietnam, but excluding Israel) of our products exceeding certain performance thresholds, including, but not limited to, the A100, A800, H100, H800, L4, L40, L40S and RTX 4090.” Source: Nvidia SEC 10-K filing.

- April 2025: U.S. government requires a license to export to China (including Hong Kong and Macau) H20 integrated circuits and “any other circuits achieving the H20’s memory bandwidth, interconnect bandwidth, or combination thereof.”

Nvidia announces it will write off $5.5 billion in H20 inventory.

Source: SEC 8-K filing.

Nvidia was initially able to skirt restrictions by throttling certain aspects of its chips to comply with Commerce Department regulations. As a result, Nvidia was (eventually) able to generate sales in China before more widespread restrictions were put in place over the past year.

For instance, Nvidia was getting approximately 20-25% of its data-center revenue from impacted countries, mainly China, in the quarters leading up to the October 2023 restrictions announcement. In the fiscal third quarter, it accounted for only 5.3% of sales.

China sales dwindle as a percentage of Nvidia revenue:

- Fiscal year 2023: 21.5%

- Fiscal year 2024: 16.9%

- Fiscal year 2025: 13.1%

- Fiscal third quarter 2026: 5.3% Source: SEC 10-K/10-Q filings.

“Our competitive position has been harmed by the existing export controls, and our competitive position and future results may be further harmed, over the long term, if there are further changes in the USG’s export controls,” wrote Nvidia in its fiscal 2025 annual report.

President Trump holds the cards on Nvidia

Where past presidents may have delegated authority in determining restrictions on technology sales to foreign countries, including China, Secretary of Commerce Howard Lutnick told Bloomberg over the weekend that President Trump holds the keys to whether Nvidia will eventually be cleared to sell some variation of its H200.

More Nvidia:

- Is Nvidia’s AI boom already priced in? Oppenheimer doesn’t think so

- Morgan Stanley revamps Nvidia’s price target ahead of big Q3

- Investors hope good news from Nvidia gives the rally more life

- Bank of America resets Nvidia stock forecast before earnings

- AMD flips the script on Nvidia with bold new vision

A decision is important because Chinese chipmakers have made major advances in chip technology and software, making their domestic chips strong competitors to Nvidia’s Hopper lineup, and the H200 is the most advanced Hopper AI chip.

“There’s an enormous number of other people who think that’s something that should be deeply considered and the benefit that we have is we have Donald Trump in the Oval Office, and he is going to weigh those decisions,” said Lutnick.

Nvidia’s most recent quarterly results showed hardly any demand for Nvidia’s H20, a prior-gen chip that President Trump cleared for sale earlier this year.

“H20 sales were approximately $50 million,” said CFO Colette Kress on Nvidia’s recent earnings call. “Sizable purchase orders never materialized in the quarter due to geopolitical issues and the increasingly competitive market in China.”

Nvidia’s latest chips, built on the Blackwell architecture, replaced the Hopper lineup this year, representing a significant share of sales in the Western world. Hopper sales totaled $2 billion last quarter. Vera Rubin will replace Blackwell in the second half of 2026.

Still, the H200 is six times faster than the H20, so it would stand the best chance of competing with China’s domestic rivals.

“To establish a sustainable leadership position in AI computing, America must win the support of every developer and be the platform of choice for every commercial business, including those in China,” said Kress.

The timing of President Trump’s decision on the H200 remains anyone’s guess.

“It’s on his desk,” said Lutnick, “It’s in his hands. He has all the best experts talking to him, and he will decide which way he goes forward.”

In the meantime, Nvidia’s guidance is for investors to not assume “any data center compute revenue from China,” said Kress.