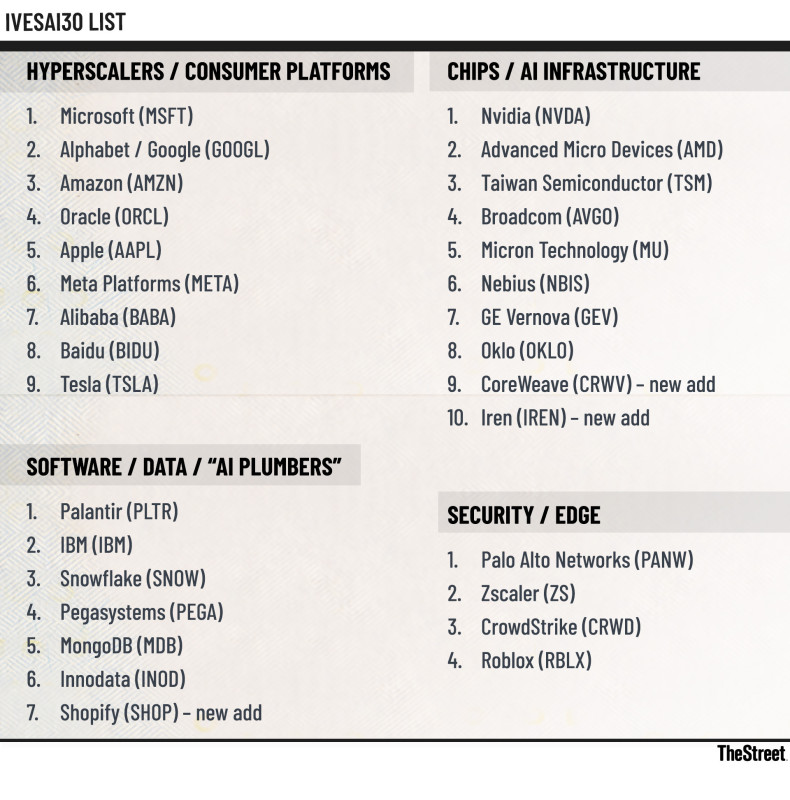

Dan Ives is back with a fresh shakeup to his popular IVESAI 30 list.

The veteran tech analyst at Wedbush just added two red-hot AI pure-plays in CoreWeave (CRW), Iren (IREN), and another tech giant, Shopify (SHOP), to his roster of AI winners heading into 2026.

He’s hailing them as arguably three of the best-positioned tech names for the sector’s shift from infrastructure buildout to real monetization.

Ives has been pounding the table on AI and its potential to spearhead a massive super-cycle, predicting another 20% jump in tech stocks next year.

In his opinion, it isn’t a bubble that’s waiting to burst, but the early innings of the Fourth Industrial Revolution, he told CNBC.

The refreshed list now offers a clearer snapshot of where the money and momentum are expected to move next.

Ives has built a reputation over the years with his prescient calls on the finest in tech, making it virtually impossible to ignore the list.

Dan Ives is pointing investors toward two fresh AI stocks he says could lead the 2026 surge.

Dan Ives is pointing investors toward two fresh AI stocks he says could lead the 2026 surge.

Photo by Myunggu Han on Getty Images

Ives expands his AI winners circle

Ives’ updated list leans heavily on businesses supplying the compute, the power, and the scale needed for AI’s next chapter.

That said, three fresh names just earned their way into the winner’s circle.

Dan Ives’ “AI 30” List

Dan Ives’ “AI 30” List

T

CoreWeave is the AI infrastructure rocket ship

CoreWeave’s insane rise in the AI infrastructure space has been nothing short of extraordinary.

It notched one of the biggest IPOs in modern tech history, valuing the business at a whopping $23 billion, Reuters reported.

Related: Cathie Wood dumps $8.46 million in software giant

Since then, it has ridden an incredible surge in demand for GPU-heavy cloud capacity, benefiting from an insatiable hunger for more compute.

Additionally, with its unique positioning as a “neocloud” tailored for AI model training and inference, it has been able to ink multi-billion-dollar contracts with tech heavyweights such as OpenAI, Meta, and Microsoft.

That includes a massive five-year OpenAI deal, initially worth $11.9 billion, which has now expanded to roughly $22.4 billion, along with a six-year, $14.2 billion agreement with Meta.

Nvidia is a significant part of the overall dynamic. It holds a 6% stake in the company and agreed to a $6.3 billion capacity backstop through 2032, according to Reuters, which guarantees CoreWeave’s demand, even during downturns.

Iren: Clean energy meets AI data centers

Iren is another red-hot stock (up almost 400% year to date) that’s gone from a Bitcoin to perhaps the biggest behind-the-scenes AI player.

Separating it from the pack is its buildout of vertically integrated AI data centers running on 100% clean energy.

That gives it a competitive edge as AI workloads explode.

According to a World Resources Institute report, the U.S. data centers could account for somewhere between 4.6% and 12% of total electricity demand by 2030, and currently, about 56% of that power comes from fossil fuels.

Related: Nvidia faces a fast-growing rival you need to know about

That explains Iren’s push to expand quickly, having secured 3 gigawatts of clean power capacity in North America, with 2.9 GW dedicated to GPU data centers.

A guaranteed power footprint is a major strategic asset, which is why Iren has grown as large as it has, with a market cap exceeding $13 billion as it secures more marquee AI hosting deals.

Shopify turns AI into real-world revenue

Shopify is not your classic AI stock, but it’s been weaving the technology through its sticky ecosystem to great effect.

It’s the kind of real-world AI monetization Ives feels could define 2026.

Shopify has the fundamentals to back it up, having grown its top line by over 23% in the past three years, and more than 30% year over year.

On top of that, it continues to scale profitably, with its three-year free cash flow growth at a superb 64%, along with $6.50 billion in its cash till.

With its immense scale, Shopify can continue layering AI across millions of merchants and shoppers, a far more immediate payoff than other speculative AI plays.

Wedbush shifts focus away from lagging plays

Wedbush’s latest update also highlighted names Ives believes are unlikely to keep up with the next phase of the AI cycle.

SoundHound, ServiceNow, and Salesforce got booted off the list, each for different reasons.

Once an Nvidia-backed company, SoundHound was touted as a promising voice-AI challenger. Since then, it has struggled to carve out a moat against the bigwigs in Amazon, Apple, and Google.

More Tech Stocks:

- Investors hope good news from Nvidia gives the rally more life

- Palantir CEO Karp just settled major debate

- Spotify just solved a major problem for listeners

- Amazon lawsuit could be a warning to other employers

Despite posting a 68% year-over-year revenue increase in Q3, it remains deeply in the red and depends on inorganic growth to drive expansion, a challenging mix when dilution and competitive pressure are rising.

ServiceNow and Salesforce were removed for their sluggishness in monetizing AI.

Both rolled out fresh AI features, but the impact on top-line expansion has been mostly modest.

Salesforce posted $1.2 billion in annualized AI-related sales, just about 5% of total sales, as competitive pressures from Microsoft continued weighing down results.

Moreover, ServiceNow has layered its popular Now Platform with nifty new generative AI assistants and workflow tools, but Wedbush notes that those gains have yet to produce meaningful AI-driven sales.

Related: This defense-AI stock is up 50 percent in 6 months: It’s not Palantir