Thought crypto was wild? Quantum computing stocks keep turning heads with surging gains.

It’s been a crazy few months for the quantum computing space, to say the least. Earlier this year, skeptics, including Mad Money‘s Jim Cramer, called out the “gamification” of quantum stocks, brushing off the rallies as short-lived hype.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Subsequently, we saw many pure-play names that 10x’d in late 2024 and early 2025, cooling off sharply.

Still, the bullishness around the industry held up well. In recent weeks, though, the sentiment has shifted sharply, with fresh interest from lawmakers and tech leaders.

Between Nvidia CEO Jensen Huang changing his tune on quantum and a flurry of legislative moves in Washington, the signs suggest that it’s not just theory anymore.

Hence, the vibe’s now mostly bullish, and the business specifics are starting to matter a lot more. Case in point? One eponymous quantum player quietly crushing it, without obsessing over qubits or cryogenics.

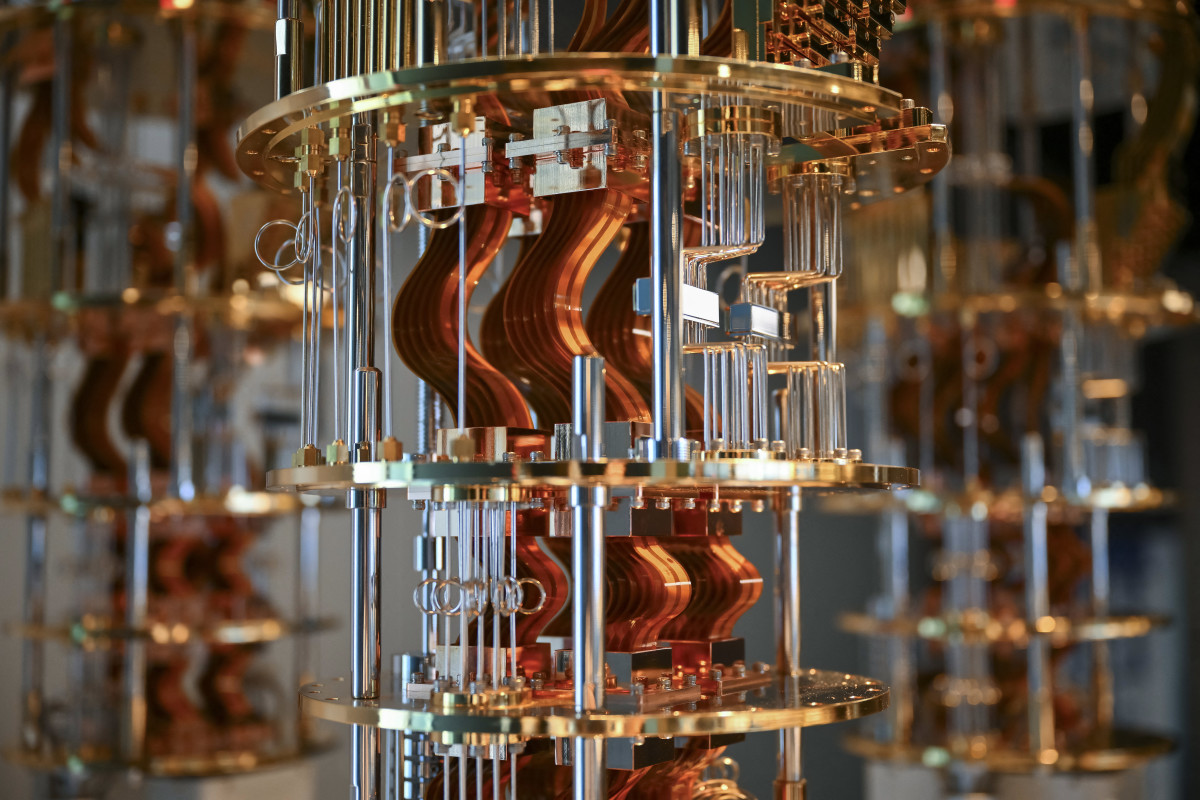

Quantum computing has captured investors’ attention in 2025.

Quantum computing has captured investors’ attention in 2025.

Quantum computing’s big moment

Quantum computing has been one of the hottest investing trends over the past year—and for good reason.

Related: 5 quantum computing stocks investors are targeting in 2025

In late 2019, Google’s Sycamore processors stunned us all by achieving “quantum supremacy,” solving a task in minutes that’d take classical supercomputers millennia.

Then, it took things up a notch or two again late last year, showing its Willow chip with 105 qubits and below-threshold error correction. That chip nailed a Random Circuit Sampling task in under five minutes, a feat today’s fastest supercomputers wouldn’t crack in 10²⁵ years.

Since then, multiple pure-play businesses in the niche have sprung up, vying for a lucrative bellwether position. Companies like Rigetti have taken qubit counts (a core building block of quantum tech) into the hundreds. Similarly, firms like D-Wave have commercialized quantum annealing systems for optimization tasks, with their share prices going parabolic.

A big part of the sentiment shift is the much-hyped quantum-AI marriage. Earlier this month, we saw Nvidia CEO Jensen Huang hailing quantum computing as the next “inflection point”. Also, he talked up the potential of quantum processors in AI workflows to speed up machine-learning training and complex simulations.

Unsurprisingly, the sector’s expected to rake in serious moolah.

More On Quantum Computing:

- Nvidia CEO sends blunt 7-word message on quantum computing

- Surprising tech giant aims to lead quantum computing revolution

- Veteran analyst who predicted quantum computing stocks rally unveils IonQ stock price target

According to Grand View Research, the global quantum computing space is set to grow from $1.42 billion in 2024 to $4.24 billion by 2030 (a 21.2% CAGR). Meanwhile, GlobeNewswire projects a steeper 31.6% CAGR, pushing the market from $1.79 billion in 2025 to over $7 billion by 2030.

Quantum computing stock continues hot streak

Quantum Computing (QUBT) notched a 27% gain yesterday, closing at $21.22. It marked the stock’s third double-digit jump and second 25%+ surge since the start of June.

Related: Google plans major AI shift after Meta’s surprising $14 billion move

Moreover, the company announced the shipment of its first commercial entangled-photon module to a leading Korean research institute. Unlike most of its peers, which are still pre-revenue, the announcement of its first order could be a sign of things to come.

To put things in perspective, Quantum Computing stock has been a big outperformer, clocking an eye-watering 3,152% gain last year, comfortably ahead of its peers.

In the past month alone, Quantum Computing stock surged 77%, once again outperforming the competition. Rigetti, D-Wave, and IonQ stocks were up 3.2%, 25%, and 12%, respectively, over the same period.

What gives Quantum Computing stock the edge?

For starters, its shipment to a Korean research institute shows that it’s already building the backbone for quantum communication. Unlike its peers, which continue tinkering with cryogenics and error correction, it stands out with its photonics-based gear, which works at room temperature and integrates efficiently into existing fiber networks.

Also, its Arizona foundry is pumping out thin-film lithium niobate chips for everything from telecom to sensing, with repeat customer orders stacking up. Hence, its catalog leans practical, not theoretical, and while its peers move forward on proprietary qubit platforms, Quantum Computing is positioning itself as the go-to enabler in the space.

Related: Circle’s stock price surges after stunning CEO comment