Good morning. Futures this morning are higher after a disappointing decline yesterday, which came as investors digested the end of the tariff detente, disappointing jobs numbers, and some so-so earnings.

The Russell 2000 is up 0.68% in futures trading today, followed single-file by the Nasdaq (+0.35%), S&P 500 (+0.34%), and Dow (+0.29%). Gold is 0.53% higher at 3,471.90.

Update: 7:25 a.m. PDT

A.M. Earnings: ConocoPhillips, Peloton, Canopy Growth

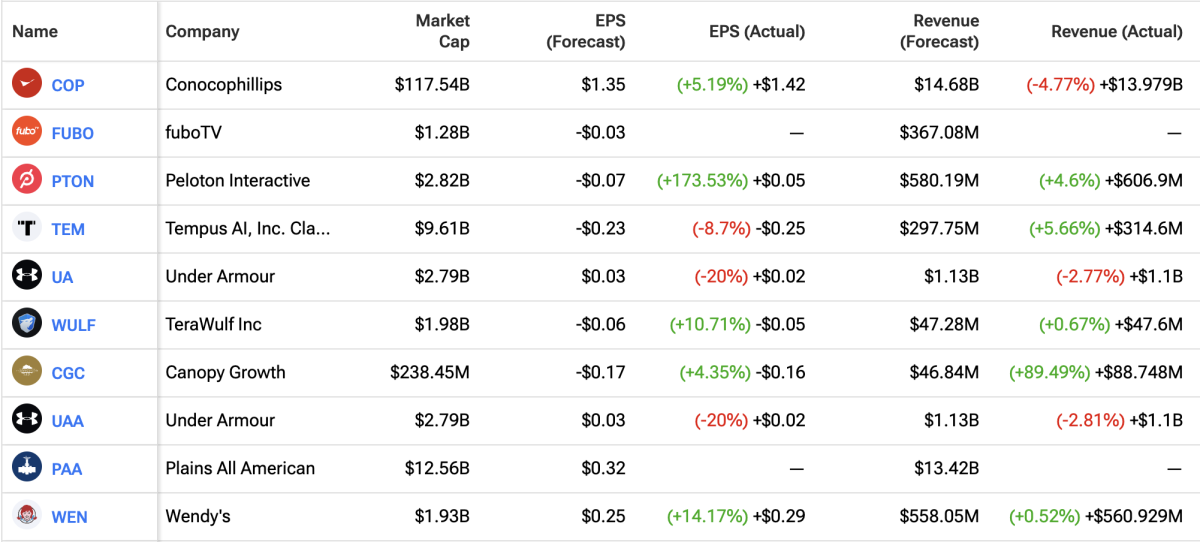

Capping off the week, we have about 92 earnings reports today, per TipRanks. Many of the biggest reports are already out this morning:

Before Market Earnings, Aug. 8

Before Market Earnings, Aug. 8

After reporting, Tempus AI (TEM) (+9.3% before market), Peloton (PTON) (+5%), and Canopy Growth (CGC) (+4.9%) are the seeing the biggest swings to the upside.

As losing hands go, Under Armour (UA) (-14%), Wendy’s (WEN) (-3%), and Lamar Advertising (LAMR) (-3%) are the only names really breaking to the downside.

Economic Data

In addition, there are no big economic data drops out today, aside from the Fed’s Musalem, who is slated to speak at 10:20 a.m. EDT.

Investors will be leaning in, seeking signs that the Fed is gearing up to cut rates at the September meeting of the Federal Open Market Committee (FOMC). However, although odds of a cut were seen higher after Thursday’s disappointing jobless claims, some market hawks are increasingly unsure whether the Fed will cut.

Those who remain worried, despite the overwhelming consensus that the Fed will cut in September, cite above-target inflation (the Consumer Price Index was 2.7% higher year-over-year in June) and rebounding consumer sentiment.