It’s only an estimate — but if history is any guide, it’s one you’ll want to watch.

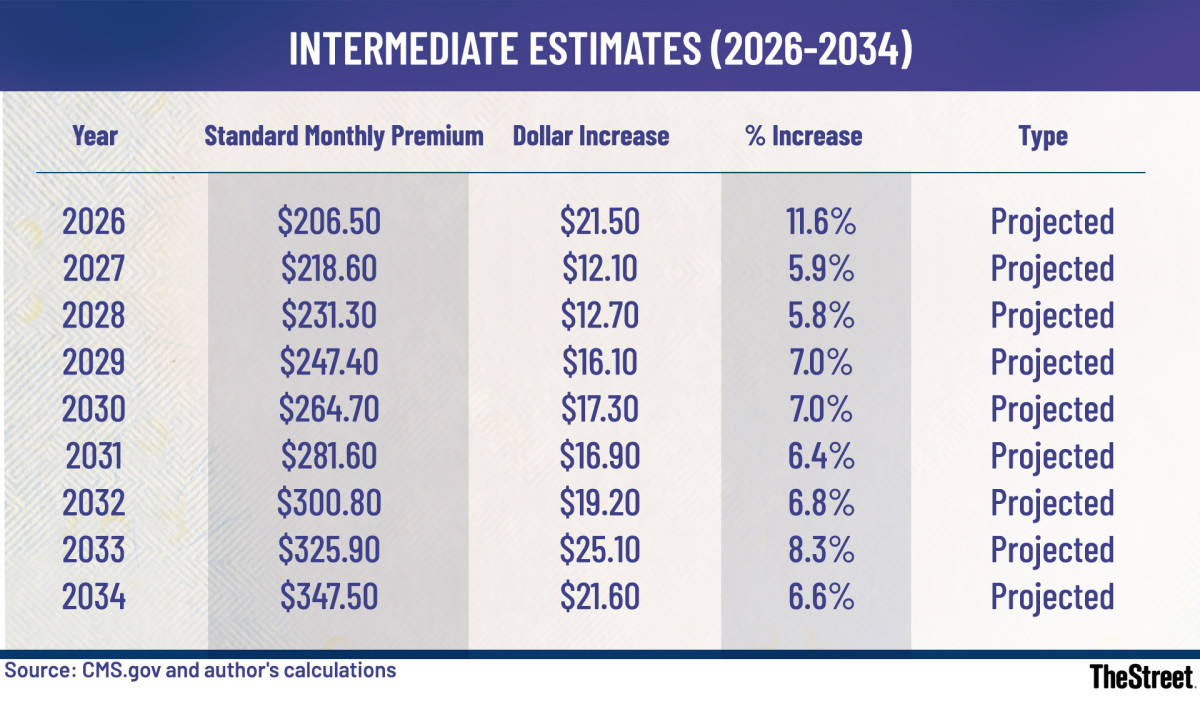

Tucked deep inside the 267-page 2025 Medicare Trustees report is a projection that the standard monthly Medicare Part B premium could rise to $206.50 in 2026.

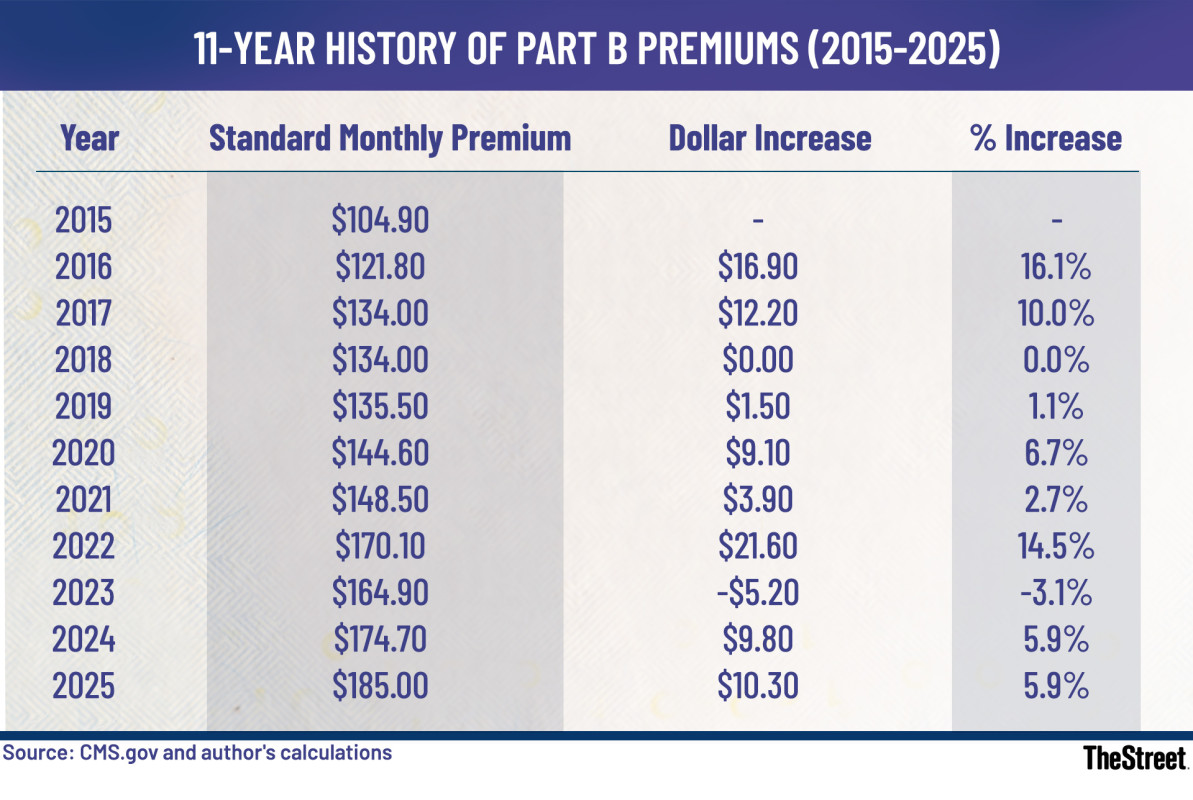

That’s an 11.6% jump from the $185 premium set for 2025 — and it would be the largest single-year increase since 2016, when premiums climbed 16.1%, from $104.90 to $121.80.

This estimate, however, is not the final number. In fact, it could be even higher.

💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰

“There is certainly a potential for the monthly premium to increase further,” said Marcia Mantell, president of Mantell Retirement Consulting. “And each person’s share — 25% of the total premium — could rise before the final numbers are published later this year in the third or fourth quarter.”

Retirees may receive an unpleasant surprise in their Medicare bill next year.

Retirees may receive an unpleasant surprise in their Medicare bill next year.

How Medicare Part B works and what it covers

Medicare Part B is the portion of Original Medicare that covers outpatient and preventive care, including:

- Doctor visits and lab tests

- Cancer screenings and flu shots

- Durable medical equipment (e.g., walkers, wheelchairs)

- Some prescription drugs administered in outpatient settings

- Home health care and skilled nursing

- Mental health services and ambulance transportation

In 2025, the standard monthly premium is $185. Beneficiaries also face a $257 annual deductible, and once that’s met, typically pay 20% coinsurance on covered services.

Related: Social Security payment dates for July 2025: what you need to know

Around 7-8% of the 68 million Medicare beneficiaries pay higher premiums due to income-related monthly adjustment amounts (IRMAA).

Most preventive services are covered at no cost if the provider accepts Medicare assignment.

Why it matters: premiums poised to climb for years

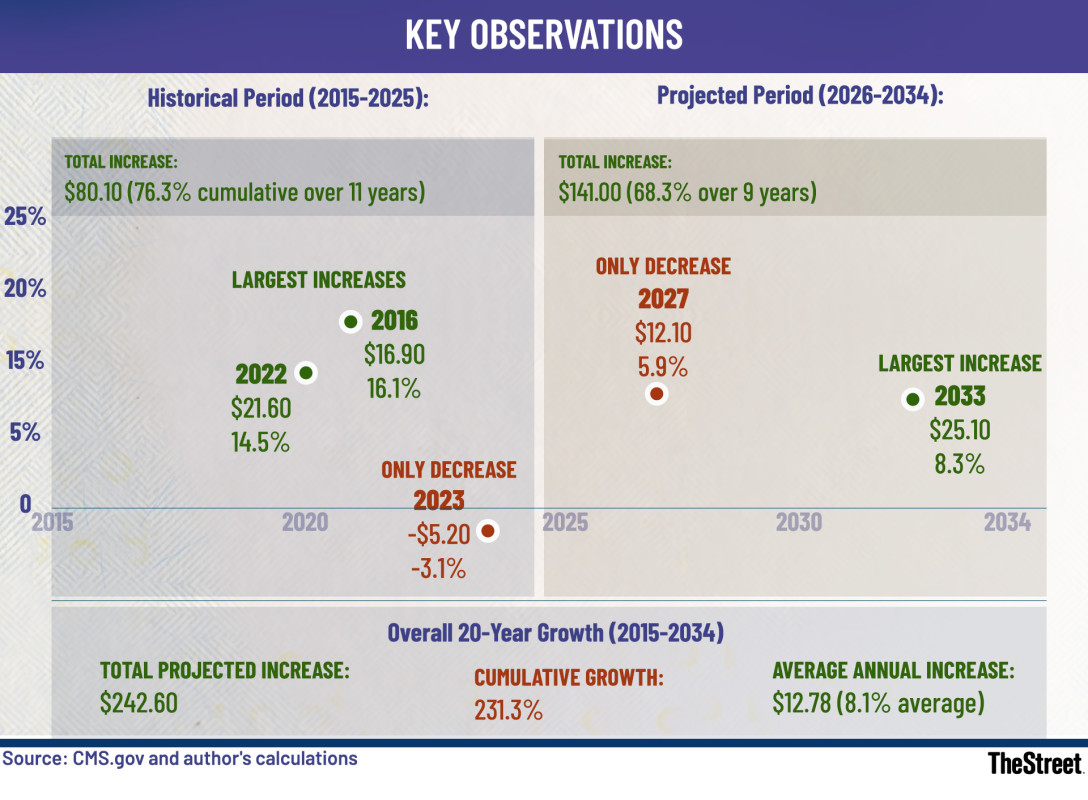

The projected jump to $206.50 in 2026 may be just the beginning. According to the Medicare Trustees, monthly Part B premiums are expected to continue rising, reaching $347.50 by 2034 — a $141 monthly increase per person over nine years.

Intermediate Estimates Table

Intermediate Estimates Table

CMS.gov/TheStreet

And that 2026 estimate doesn’t yet reflect potential changes from federal budget decisions or shifting health care spending trends.

“There is certainly a potential for the monthly premium to increase further,” said Marcia Mantell, president of Mantell Retirement Consulting. “And each person’s share — 25% of the total premium — could rise before the final numbers are published later this year in the third or fourth quarter.”

In recent years, the Trustees’ estimates have been remarkably accurate, often landing just a few dollars off the final figure.

But as Katy Votava, founder of Goodcare.com, points out, these aren’t just projections — they reflect a deeper cost trend.

“Medicare Part B premium estimates typically track within a reasonable margin of error year to year,” Votava said. “That said, Medicare B is in a hyper-inflation mode for the foreseeable future.”

She identified two long-term forces driving these increases:

- A shift of cost-intensive care from inpatient (Part A) to outpatient (Part B) settings, such as major surgeries or cancer treatments.

- The growing popularity of Medicare Advantage (MA) plans, which now cover 54% of all Medicare beneficiaries.

“The MA program costs 20% more than Original Medicare,” Votava explained. “Given these cost shifts, I anticipate a +/- 10% increase in Medicare Part B premiums going forward.”

Who pays and how Medicare Part B is funded

According to the 2025 Trustees Report:

- About 72-75% of Part B funding comes from general revenues from the U.S. Treasury.

- Roughly 25% comes from premiums paid by beneficiaries — totaling $139.8 billion in 2024.

- Additional revenue includes interest on trust fund investments ($3.5 billion) and brand-name drug fees ($2.8 billion).

11-year history of Part B Premiums

11-year history of Part B Premiums

CMS.gov/TheStreet

These Treasury contributions are legally required to automatically adjust to match program costs — helping keep Part B financially balanced.

What about Medicare’s ‘hold harmless’ rule?

One question on many retirees’ minds: Will the “hold harmless” rule kick in to protect benefits from the premium hike?

According to The Senior Citizens League, the projected Social Security cost-of-living adjustment (COLA) for 2026 is 2.5% — the same as for 2025. That translates to a $50 per month increase for someone receiving the average $2,000 Social Security benefit.

Since the projected Part B premium increase is $21.50, most beneficiaries will not be protected by the hold harmless provision — because the COLA is more than enough to absorb the increase.

Related: Young workers face stark Social Security reality

“The COLA would have to come in below 1.06% for hold harmless to apply broadly,” Mantell explained. “That’s highly unlikely. Only Social Security recipients receiving less than about $800 per month might be affected if the COLA is 2.5%.”

These might be, she said, dependent spouses whose spouse had low wages and lower-than-average benefits. Or an individual worker who spent many years outside the workforce and has many $0 years in their benefit calculation.”

According to the Social Security Administration, nearly 4 million Social Security beneficiaries receive less than $800 per month.

She added that historically, those subject to the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO) often had low benefits and would have been in the hold harmless group. But she noted, “With the Social Security Fairness Act eliminating those reductions, this should not be the case for most.”

Can you do anything about it?

There’s no way to avoid the premium increase, Mantell said.

Key Observations about historical and projected Medicare Part B premiums

Key Observations about historical and projected Medicare Part B premiums

CMS.gov/TheStreet

“By law, each Medicare beneficiary pays 25% of the overall premium,” she explained. “It is deducted from their Social Security payment automatically. If not yet claiming Social Security, premiums are generally paid quarterly from your checking account or using the online options at Medicare.”

But that doesn’t mean you’re powerless. Mantell offers these five planning steps:

Five things you can do right now

- Forecast your 2026 healthcare budget “The most important step to take now is to forecast your own budget for 2026,” Mantell said. “Consider all healthcare costs you can reasonably expect — there are often more costs than just Part B premiums.” (Use Mantell’s free worksheet: Boomer Retirement Briefs – Estimating Your Medicare Costs.)

- Learn to use the Medicare Plan Finder tool “Several major insurance companies are no longer paying brokers to sell their plans, so you will not necessarily see the lowest-cost providers this fall,” she said. “You need to find the lowest premium plans on your own from now on.” Use this tool, Medicare Plan Compare, during Open Enrollment (Oct. 15–Dec. 7).

- Call your members of Congress “Tell them you are not happy about such huge projected increases in your Part B premiums,” Mantell advised. “This is a significant burden to your budget along with all the other increases in goods and services and local taxes, etc.”

- Explore property tax relief locally “Talk to your town clerk or other local official who can help you find property tax savings opportunities in your town,” she said. “In some towns, you can work a certain number of hours to reduce property taxes.”

- File your taxes using IRS Form 1040-SR “It’s generally the same as the regular 1040,” Mantell noted, “but it includes the higher standard deduction for seniors.”

Don’t forget to stress-test your portfolio

In addition to budgeting and plan shopping, it’s wise to think about how rising premiums could impact your long-term investment plan.

“I think people might need to stress-test their portfolios,” said T. Rowe Price Senior Research Analyst Sudipto Banerjee. “Run your portfolio projections under current spending assumptions, and then test what happens if you increase your health care spending projections by X% (pick any number). If you don’t like the results, you’ll probably need to save more.”

Bottom line

If the Medicare Trustees are right — as they have been in recent years— beneficiaries will face the largest premium hike in a decade next year. And with health care costs continuing to outpace inflation, it puts pressure on retirement budgets.

“There is certainly a potential for the monthly premium to increase further,” Mantell warned. “And each person’s share…could rise.”

Got questions about retirement, email [email protected].