Every fall, retirees throughout America get an early holiday present when Social Security’s cost-of-living adjustment for the upcoming year is released.

This year, the 70 million Social Security recipients have had to exercise, as my mom would say, their “patience muscle.”

A government tit-for-tat has forced a shutdown in D.C., delaying the release of the September Consumer Price Index inflation (CPI) number. That inflation data is necessary to make the final call on how much more retirees can expect to see in their checks next year.

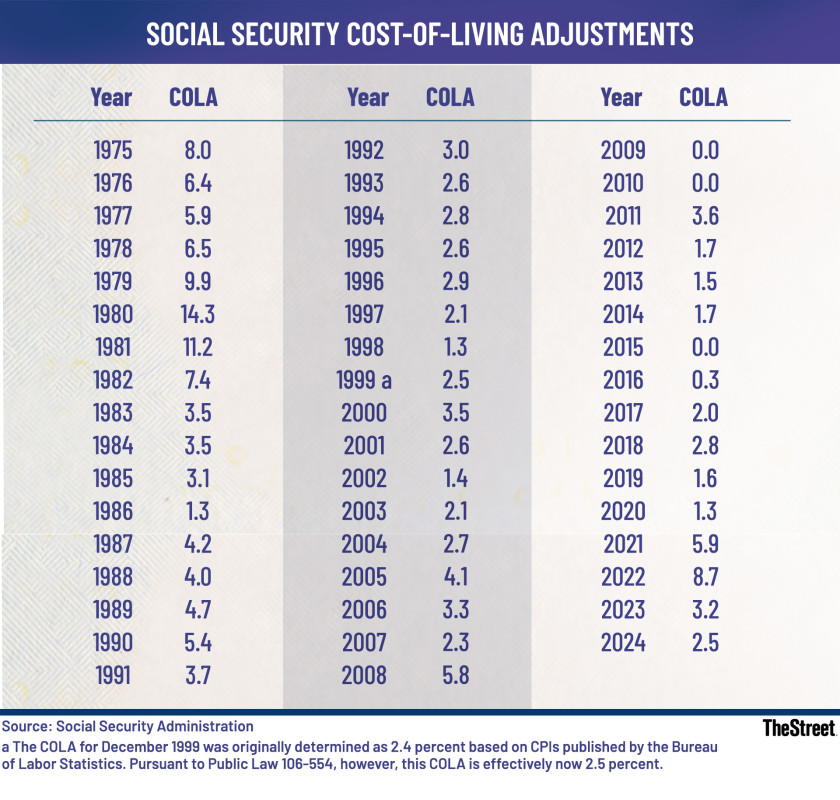

Social Security cost-of-living-adjustments:

- 2024: 2.5%

- 2023: 3.2%

- 2022: 8.7%

Fortunately, the wait is almost over. The Bureau of Labor Statistics, which calculates CPI, has said it will release the September data on Friday, Oct. 24. Assuming they stick to their promise, retirees will be able to use the data to calculate next year’s COLA ahead of the official press release expected from the Social Security Administration.

Social Security’s COLA is critical

Social Security is a major source of income for many retirees, so even small COLA increases are crucial to ensuring that retired workers don’t see more of their fixed income disappear because of inflation.

Retired workers are eagerly anticipating Social Security’s cost-of-living-adjustment for 2026.

Retired workers are eagerly anticipating Social Security’s cost-of-living-adjustment for 2026.

Image source: Shutterstock

According to the Social Security Administration, Social Security benefits account for nearly one-third of income for those over age 65, and 90% for over 1 in 10 seniors.

The Social Security Administration has been adjusting how much it pays recipients based on inflation since 1975.

More Personal Finance:

- Dave Ramsey, AARP sound alarm about Social Security

- In rural areas, lack of transport hinders access to health care

- How to get the maximum Social Security check in retirement

- Medicare open enrollment 2026: what you can do now

- How the government shutdown affects Social Security, Medicare

The calculation itself is straightforward. Simply average the third quarter Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W, and compare it to CPI-W for the third quarter from the most recent year a COLA increase was awarded (in this case, last year).

If the calendar third-quarter CPI-W is higher in 2025 than in 2024, Social Security benefits will increase by the same percentage as CPI-W. If CPI-W is unchanged (or lower), your benefits remain at last year’s level. For perspective, in 2024, third-quarter CPI-W increased 2.5% from Q3 2023, so benefits payable in 2021 were increased by 2.5%.

Q3 CPI-W (2023-2025)

Year

Q3 Average

COLA Change

2023

301.24

2024

308.73

2.49%

2025*

316.83

2.62% (est.)

*July & August CPI-W

How’s COLA shaping up for 2026?

The Social Security Administration won’t release official COLA figures until the BLS reports the September CPI-W on Friday.

However, CPI-W data from July and August suggest that retirees will see an increase in 2026 similar to last year’s.

Specifically, averaging the CPI-W for July and August results in a 2.6% increase from last year.

Social Security Cost-of-Living Adjustments by year since 1975.

Social Security Cost-of-Living Adjustments by year since 1975.

Source: SSA

Most Wall Street economists expect September inflation to remain somewhat similar to August, pressured upward by newly enacted tariffs, some of which have been passed on to consumers through price increases on everything from apparel to auto parts.

Now read:

The BLS calculates a series of inflation data for different population groups. The most commonly reported and watched is the Consumer Price Index for All Urban Consumers (CPI-U), which targets about 88% of Americans, including professionals, the self-employed, and retirees. CPI-W is a narrower basket targeting about 22% of the population.

CPI-U is the figure you’ll most often see reported, and it’s not used in Social Security’s calculation. Still, it can be directionally helpful, given the two tend to move somewhat in concert.

For September, Wall Street expects CPI-U (CPI) to clock in at 3%, slightly above the 2.9% reported for August. August CPI-W was up 2.8%, so 0.1% lower than CPI-U. In July CPI-U was 2.7% and CPI-W was 2.5%, so 0.2% lower.

If that trend continues, it’s reasonable to think that Wall Street’s guesstimate of 3% means CPI-W comes in at about 2.8%. If so, that would leave the COLA increase for 2026 at about 2.6%.

In 2025, the average retired worker collects $2,008 monthly in Social Security, so a 2.6% increase would mean an extra $52 per month, or a little more than $624 in extra income for retirees in 2026.

Key Takeaways:

- Social Security adjusts recipient payments annually for inflation (COLA)

- COLA is based on CPI-W

- The COLA increase for 2025, payable beginning in 2026, is tracking near 2.6%.

Related: How to get the maximum Social Security check in retirement