It wasn’t too long ago that investors were nervous. Very nervous.

President Trump rocked the world in February with 25% tariffs on Canada and Mexico and harsher-than-hoped reciprocal tariffs on April 2, so-called Liberation Day.

The tariff plans forced investors to rethink their outlook for the economy, corporate revenue, and earnings growth projections. Suddenly, stocks looked too expensive—by a lot. As a result, the S&P 500 tumbled 19% from its February highs until President Trump paused most reciprocal tariffs on April 9.

The Presidential pause largely took the worst-case scenario — recession — off the table.

Encouraged that trade deals would result in better tariff rates than feared, investors flocked back to stocks, kicking off a rip-roaring rally that sent the S&P 500 surging 25% to new record highs.

There’s reason to think stocks could continue their winning ways over the next year, but concern is growing that the recent move higher has created a big problem for the benchmark index.

The S&P 500 has rallied 25% since President Trump paused reciprocal tariffs on April 9.

The S&P 500 has rallied 25% since President Trump paused reciprocal tariffs on April 9.

Image source: Triballeau/AFP via Getty Images

The economy isn’t great, but it’s better than it could be

The most significant risks facing the US economy earlier this year were stagflation or recession.

Tariffs are an import tax, and most economists and Wall Street veterans expect they’ll prove inflationary, increasing prices and slowing GDP growth.

Related: Morgan Stanley resets S&P 500 target for 2026

Yet, so far, the tariff bite has been mostly tame. Yes, there is some evidence that tariffs are starting to increase prices for some products, but essentially, June’s CPI inflation data wasn’t terrible. And not awful is pretty good given how dire the expectations were this spring.

Inflation clocked in at 2.7% and while that’s up from 2.3% in April, it’s still lower than the 3% recorded in December. As long as inflation stays near here, the US economy may be able to sidestep stagflation.

The latest PPI inflation data are encouraging. PPI measures inflation at the wholesale level and is, therefore, believed to be a leading indicator for what’s next. In June, it was 2.3%, its lowest level since last October.

The risk of unemployment surging also contributed to the S&P 500’s sell-off earlier this year. Again, that hasn’t happened; at least, not yet.

The Bureau of Labor reports that the unemployment rate was 4.1% in June, smack dab in the middle of its 4% to 4.2% range since May 2024. Until unemployment breaks higher, markets appear happy to shrug it off.

More on stocks:

- Veteran fund manager who forecast Nvidia stock rally reboots outlook

- Billionaire Ackman has one-word message on stock market

- Legendary fund manager reveals new trades after S&P 500 rally

The inflation and jobs picture may mean another headwind—the Federal Reserve’s monetary policy—eases, further supporting the economy and stocks.

So far, the Fed has remained neutral in 2025, leaving its Fed Funds Rate unchanged at a 4.25% to 4.5% range.

That disappointed many who hoped lower rates would kickstart GDP growth, driving corporate revenue and earnings higher, which would be bullish for stocks.

If inflation stays near current levels, Fed interest rate cuts could be a go as soon as September. Lower rates could offset any hit to GDP from tariffs, and that would be welcome news given GDP growth estimates for 2025 are 1.4%, down from 2.8% in 2024.

An S&P 500 problem could crimp further stock market returns

It could be, however, that much of this “not so bad news” is already priced into the stock market following its big move higher.

The stock market is forward-looking, and often seems to find a way to disappoint the masses. In April, that meant rallying when everyone was talking doom and gloom. Now, it could mean lackluster returns because many expect a goldilocks scenario of manageable inflation, jobs, and corporate earnings upside.

Related: The stock market is being led by a new group of winners

In short, the S&P 500 could be pricing itself for perfection.

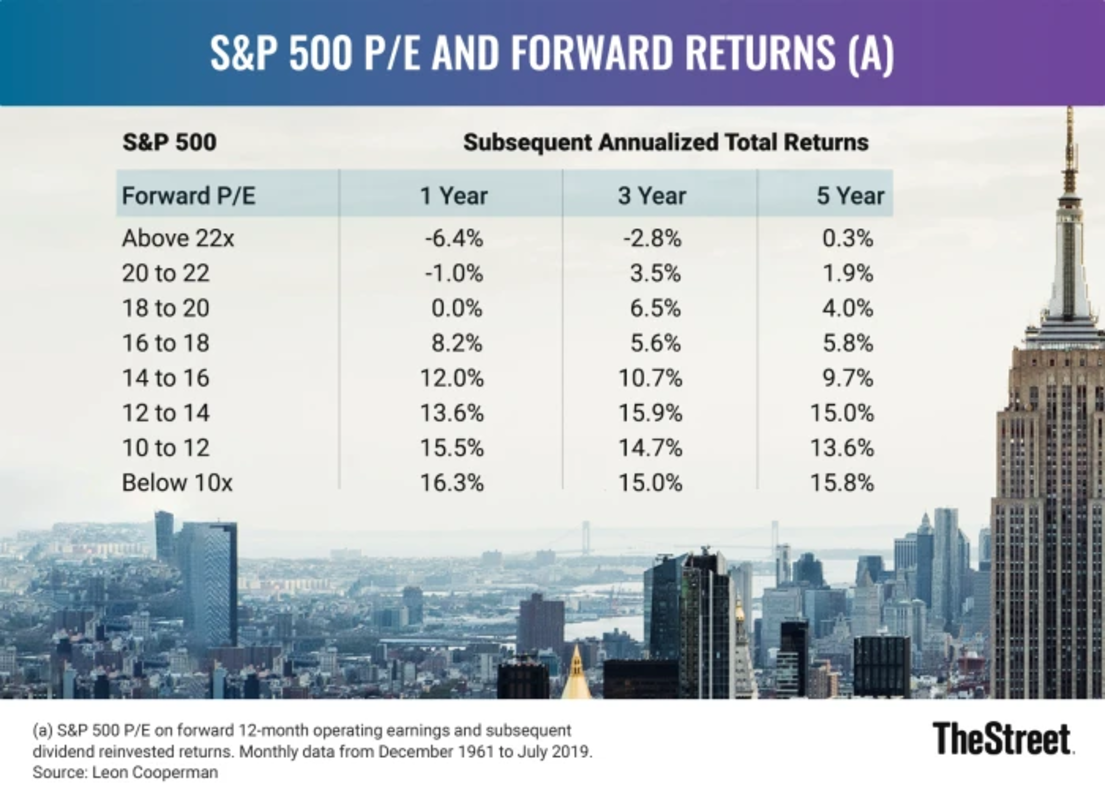

In April, its forward price-to-earnings ratio was about 19. Now, it’s over 22, roughly the same level as in February when the wheels came off the proverbial bus.

There’s no rule saying that the S&P 500’s valuation can’t go higher, but with each move up without a corresponding improvement in the “e” part of the P/E equation, more gains become harder to justify.

Historically, S&P 500 gains are middling in the year following a forward P/E ratio north of 22, where we sit today.

The S&P 500’s forward P/E ratio exceeds 22.

The S&P 500’s forward P/E ratio exceeds 22.

Images source: Leon Cooperman/Doug Kass

The odds of upside are much better when the S&P 500’s valuation is lower than higher, increasing the stakes this earnings season.

If S&P companies report better-than-expected earnings, analysts will raise their forward earnings estimates, providing some wiggle room.

However, if not, the S&P 500 may have a harder time delivering meaningful upside, especially if CEOs reveal that tariffs will hit the bottom line this year more than what investors expect.

Related: Legendary fund manager has blunt message on ‘Big Beautiful Bill’