It’s Tuesday, and it’s time to look at the markets.

Today, we’re expecting earnings from CrowdStrike (CRWD) after the close. After the close the $117 billion market-cap company is expected to report earnings of 66 cents a share.

CrowdStrike is working closely with Microsoft (MSFT) on threat-actor detection. According to TheStreet Pro’s Stephen “Sarge” Guilfoyle, the two companies claim to have already deconflicted more than 80 adversaries, including state-sponsored actors from China and Russia.

This comes just a little late for me. A former coworker’s LinkedIn account was recently hacked, and an unsuspecting me gave my phone number to the hackers.

I am now deluged with spam texts asking if I’m free for dinner and whether this is my number. So far, this phishing scheme is just annoying. But the big surprise was that I thought LinkedIn was more secure than Twitter (I know, X) or Facebook. It’s not. Beware.

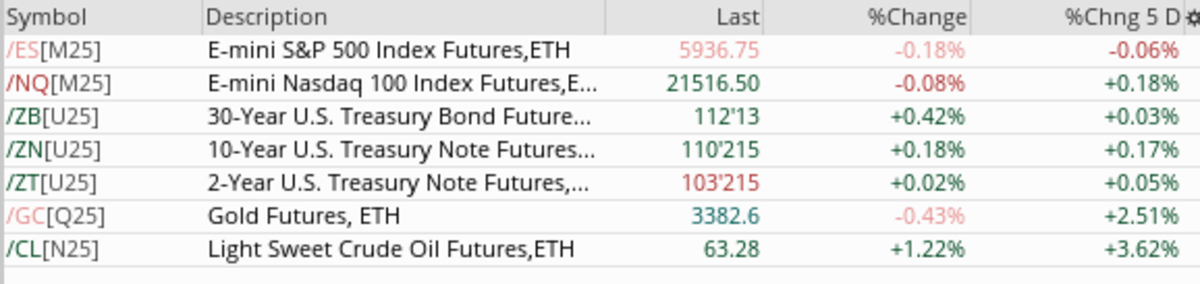

Let’s look at today’s markets.

Stock market futures are marginally lower. Yesterday was a low volume day, and there isn’t much news on the horizon today to spark trading activity. The big question is whether today will be like yesterday, where we start lower but rally to close up on the day.

Additionally, as I reported yesterday, the number of stocks that were up was about the same as the stocks that were down. Kind of a dull day, unless you owned steel stocks or big tech.

Here’s a chart of the futures. Following the market close on Monday, futures began trading lower but bottomed around 4:30 a.m. EDT and have been rallying into Tuesday’s market open.

Bonds, which remain higher, are beginning to struggle.

Gold and crude oil are higher.