This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Nov. 11, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 7:28 a.m. ET

Everything Happening (That We Know Of)

Good morning. Berkshire Hathaway‘s Warren Buffett says he’s finally ready to take his leave after a decades-long tenure atop the company, paving the way for chosen-successor Greg Abel to take helm on the company’s quarterly earnings, shareholder letters, and annual shareholder meeting.

“I’m ‘going quiet,'” Buffett said in a letter to shareholders. The so-called Oracle of Omaha plans to vacate his position atop the trillion-dollar conglomerate at year-end, ending a 60+ year tenure.

The nonagenarian won’t be going completely dark, though. Buffett will hold on to his Class A shares, per WSJ, until shareholders grow comfortable with new management. He’ll also accelerate the distribution of his $150 billion fortune to family-operated charitable efforts.

And to that end, Buffett says he’ll write an annual Thanksgiving shareholder letter going forward, while contributing in the way we’ve come to expect from an investing mystic. Cheers to you, Mr. Buffett.

We’ll be back about an hour before the market opens to tackle the pre-market movers. Until then, here’s what to keep an eye out for this morning:

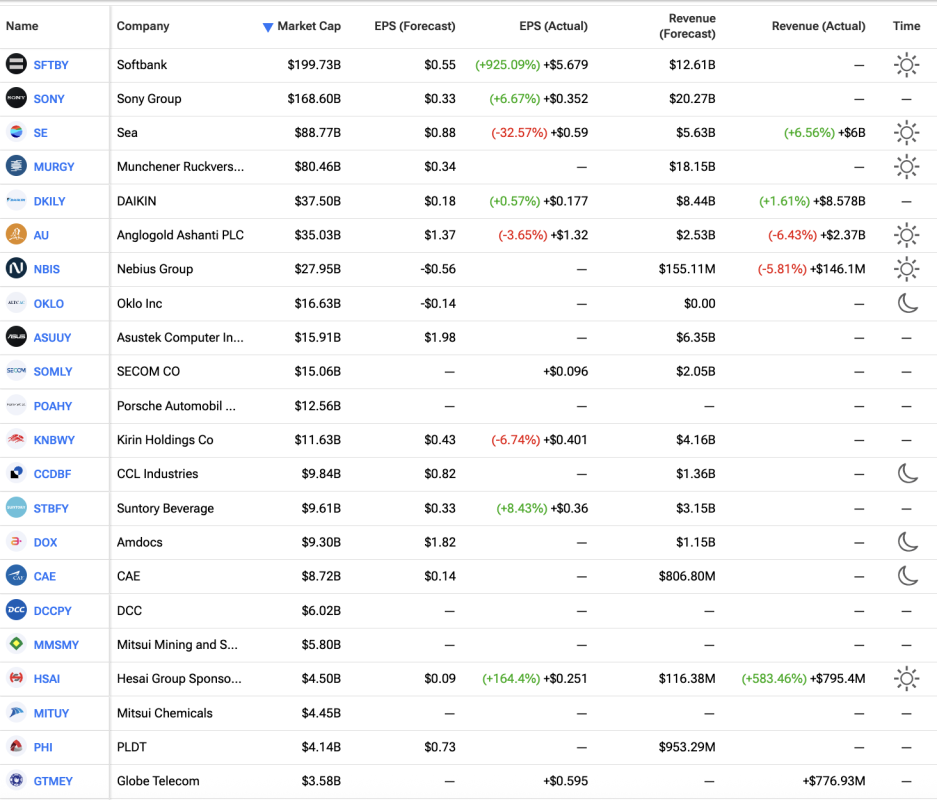

Earnings Today: SoftBank, Sony Group, Sea

With earnings slowing down a bit this week, today will see reports from less than 100 firms. Chief among them is SoftBank, which is making waves this morning after making the surprising decision to liquidate its $5.8 billion Nvidia stake. It plans to use those proceeds to make other AI bets.

Keeping up with the Asian stock theme, the largest reports today will be Sony Group and Sea. Both int’l names have already reported in the wee hours of this morning. Here are the (admittedly incomplete) results, per TipRanks:

Economic Data + Events

This morning, the NFIB Business Optimism Index released, showing a month-over-month decline in operators’ optimism. The index fell to 98.2 (from 98.8), missing forecasts.

Also coming up this morning, ADP Employment Change(Weekly) will be out. This special weekly report has been going since Oct. 28, supplementing the lack of establishment report. Last week, it showed that an average of approximately 14,250 jobs were added.

Finally, Fed Governors had continued to speak on a rolling basis during the government shutdown; now that it’s coming to a close, it’ll be interesting to see how (or if) their remarks change. We’ll cover any speeches or comments from central bank leaders as they arise, as usual.