Updated 10:18 a.m. EDT

Stocks Mixed Early On

In the first half-hour of trading, the major indexes were mostly higher. We say mostly because the Dow Jones Industrial Average was off 87 points, which is actually a small decline on a percentage basis. The blue-chips were at 44,373, off 0.2%.

The Standard & Poor’s 500 Index was up a modest eight points to 6,277, but that was after hitting a 52-week high right after the open.

The Nasdaq Composite had added 112 points or 0.5% to 20,753. It also hit a 52-week high soon after the open. Not to be a party pooper, the Nasdaq-100 Index was up 130 points to 22,986 after hitting a new high of 23.051.

Nvidia (NVDA) , Broadcom AVGO and Coinbase (COIN) also hit new highs. Bitcoin was off $1,559 to $118,377, a day after hitting a new high of $123,166.

Stock market today: The banks weigh in

This morning’s earnings reports are all about the banks.

JP Morgan Chase (JPM) , BlackRock (BLK) , Citigroup (C) , Wells Fargo (WFC) and Bank of New York Mellon (BK) all reported earnings that topped expectations. As for future statements, not all was rosy, with Wells Fargo guiding lower.

Citigroup is the only one trading higher, gaining as much as 3%, while Wells Fargo is down close to 4%.

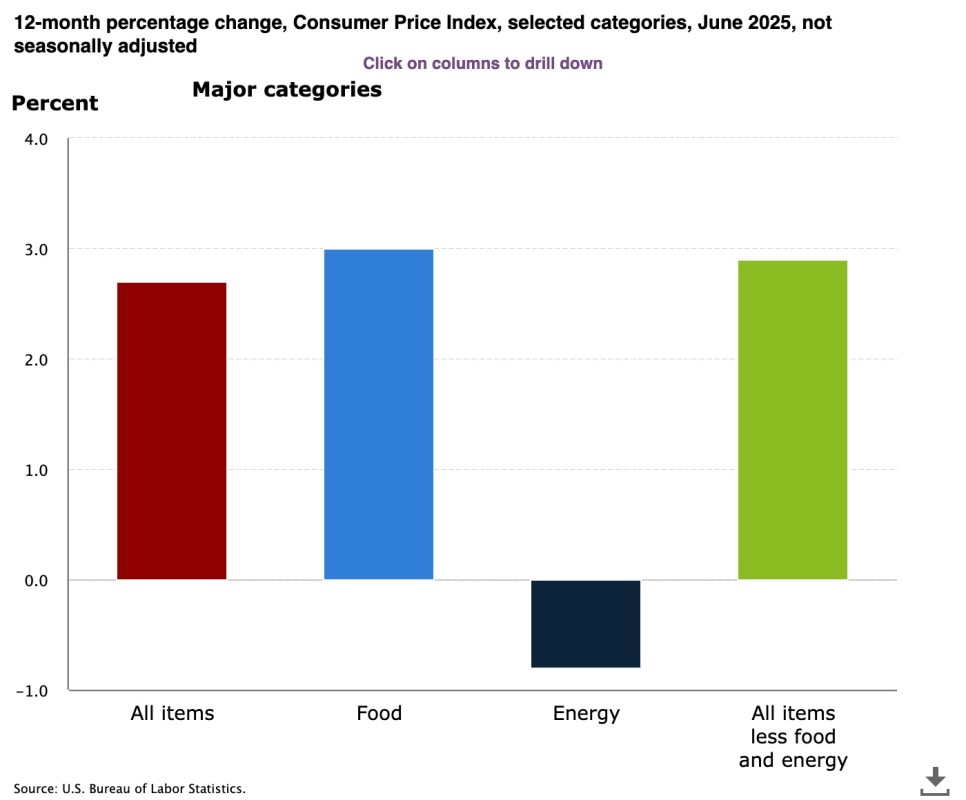

The Consumer Price Index is the other big news this morning. The U.S. Bureau of Labor Statistics reports that June CPI rose 0.3%, which was in line with expectations.

Year over year, the CPI gained 2.7%. That’s faster than May’s 2.4% increase. Higher food and energy costs were behind the faster inflation, Bloomberg reported.

Core CPI gained 0.2%, which was better than expected. The core figure was below forecasts for the fifth straight month, the news service reported.

So, how are stocks looking this morning?

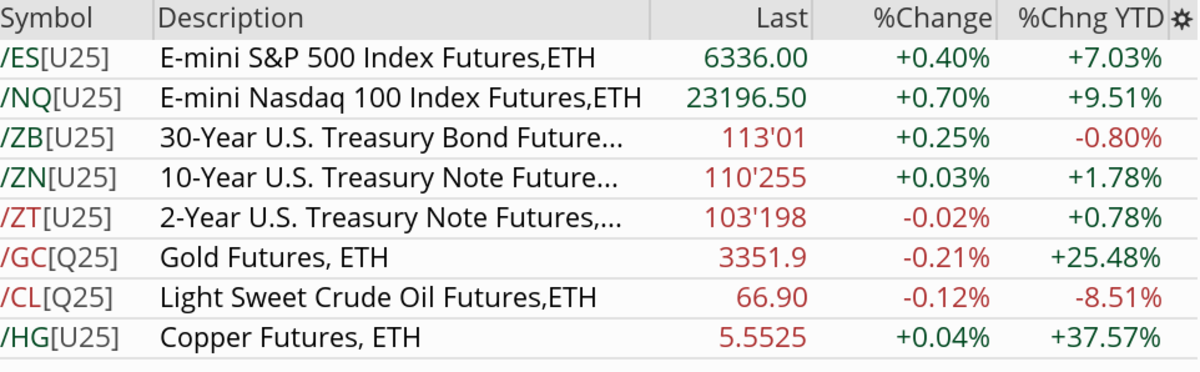

Up! S&P 500 futures have been rallying since yesterday’s close (black line, below) and are up 0.4%.

The tech-heavy Nasdaq is even stronger, gaining 0.7% in premarket trading.

The long end of the U.S. treasury curve is stronger (yields are down). Gold and crude are lower, while copper is slightly higher.