This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Wednesday. This is TheStreet’s Stock Market Today for Dec. 31, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 9:30 a.m. ET

Opening Bell

The U.S. stock market is now open. Reversing a small decline in the futures session, the Russell 2000 (+0.06%), Nasdaq (+0.04%), and S&P 500(+0.03%) briefly opened in the green. The Dow (-0.09%), meanwhile, remained about where it was in the overnight session.

At last glance, all four indexes are now underwater, even if by just a few basis points. That kicks off the final trading session on a lower note, with the possibility that today could mark a fourth consecutive day of declines in the S&P 500.

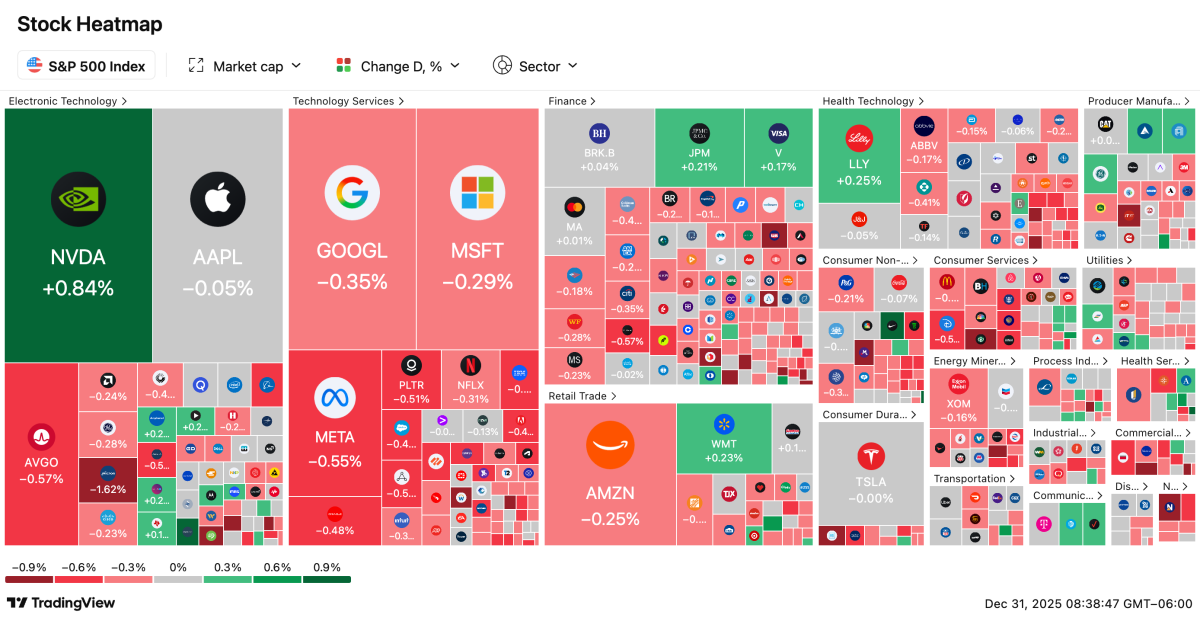

Speaking of which, here’s the index at last look — it looks rough:

There are some notable exceptions, likeNvidia(+0.84%), which is rallying after placing a hefty new order with chipmaker TSMC (+1.5%), spurred in part by robust demand in China for its new H200 chip. The boosted production comes as the former has over 2 million orders for the AI chip from Chinese firms, but just 700,000 units in stock.

It seems to be one of the few bright spots this morning. That said, we will update this section periodically with any other developments from the morning news cycle, if relevant.

Update: 8:36 a.m. ET

Jobless Claims Arrive Soft to Cap Off 2025

Jobless claims data is just out. In the week of Dec. 27, Initial Claims were 199,000, less than the 220,000 expected. That sub-200K report is the lowest report since the week of Nov. 29, which came towards the end of the government shutdown and was largely offset by a large jump in the following week.

Regardless, it underlays a sustained decline in jobless claims. Initial claims have declined now for four straight weeks. The same four weeks of decline could be seen in Continuing Claims for the week of Dec. 20, which came in at 1.866 million, declining from the 1.923 million reported in the previous week.

The key takeaway here is that the labor market is simply slowing, not shattering. That’s likely to be bad news for many of the ‘rate cut believers’, who might be banking on an amenable Fed Chair to accelerate the rate of cuts next year. As Fed Governors have demonstrated from yesterday’s FOMC commentary, they are definitely willing to prioritize their fight against inflation unless there’s reason to suspect further decay in the labor environment.

On the news, U.S. equity benchmarks have ticked up. The Nasdaq (-0.10%) and S&P 500 (-0.07%) are off just a few basis points in futures trading, with the market opening in about an hour’s time.

Update: 7:00 a.m. ET

A.M. Update

Good morning. It’s been a long time coming, but today, traders will bid farewell to a memorable year for markets. There’s only six and a half hours standing between us and the New Year’s Day holiday tomorrow, when the markets will be closed. Until then, Wall Street will be closing out books and locking in trades; it’ll be back to business as usual on Jan. 2 as we start anew.

A solid day of gains would be a welcome surprise for U.S. equities, but its been all downhill since the Christmas holiday. The S&P 500 has fallen in the last three sessions and futures this morning have us lined up for another day of declines. The Nasdaq (-0.28%), Russell 2000 (-0.23%), and S&P 500 (-0.21%) are all off more than a fifth of a percentage point, while the Dow (-0.15%) is on modestly warmer footing.

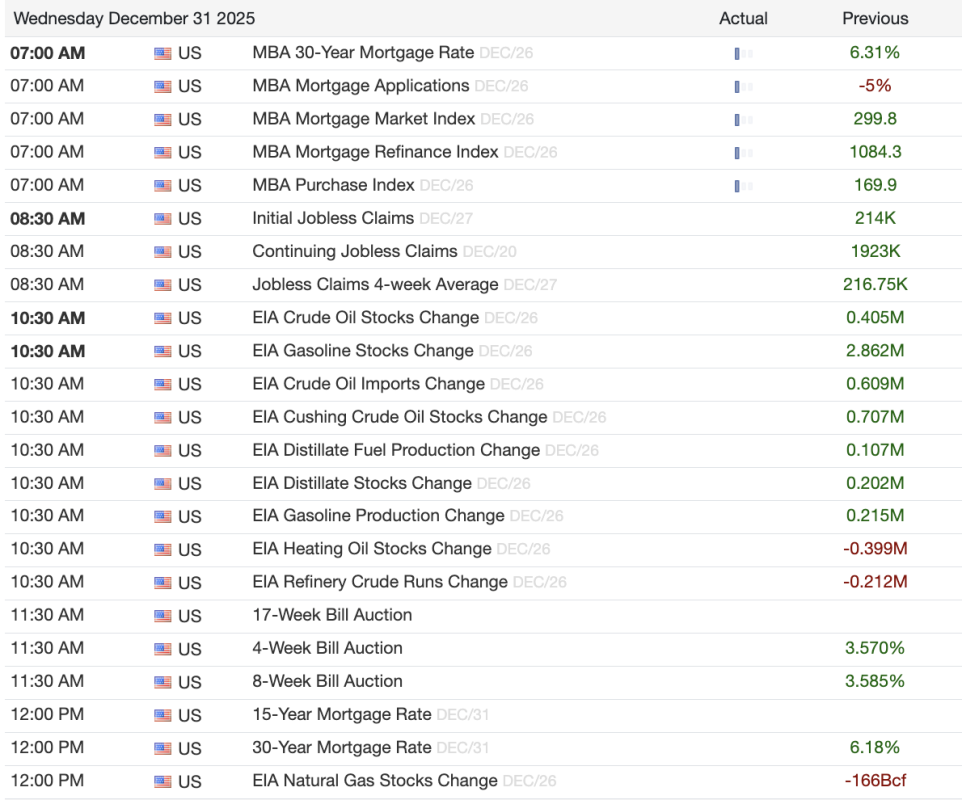

Here’s what we have on deck for this morning:

Economic Data + Events

Despite today being a full day of trading, we’ll pretty much be wrapped up with today’s data sets by lunchtime. We have data from the Mortgage Bankers Association, Jobless Claims, and a slew of energy stock and bond auctions taking place.

The housing data comes on the heels of the S&P/Case-Shiller Home index data yesterday, which showed home prices grew 1.3% in the month of October. The MBA’s data, which is more granular and captures the ‘here and now’ in the housing market, is seen as likely declining further after a tepid November. That data should be out any minute — and we’ll recap a little bit later if there are any interesting nuggets.

Initial claims, on the other hand, might be a little more of a wild card. The last three weeks of reports have shown declining rates of initial claims, while continuing claims have continued to tick up over that same period. It’ll be out at 8:30 a.m. ET.

Earnings Today

Aside from that, there are no significant earnings reports coming today, which is no surprise. Who wants to compete with New Year’s Eve festivities? Ryan Seacrest? Fireworks? Oregon vs. Texas Tech at the Orange Bowl? Enough said.

Silver & Gold, Silver & Gold…

Forgive the Rudolph reference, but ’tis the season (at least for a few more hours, we suppose). The last few days of trading in metals has been truly wild, so we’re keeping special tabs on silver and gold futures as they turn into more of a momentum play than a ‘slow and steady’ investment.

If the current vibe in these two assets are any indication this morning, the rocket money is not firing today. After gaining back some of its Monday losses yesterday, Silver futures at NYMEX are off more than 8.3% this morning at $71.50. Gold futures at NYMEX are off 1.42% at $4,324.10.