Good morning. U.S. equities are little-moved this morning after a busy week of trade talks. The U.S. and European Union clinched a long-anticipated tariff deal, while the U.S. and China agreed to extend a tariff pause for another 90 days, allowing more time for negotiations.

We turn our attention this morning to what is bound to be a blockbuster week for earnings and data.

S&P 500 Seeks a Sixth Consecutive Record

Last Friday, the S&P 500 did something it had only done 57 times before by notching its fifth-consecutive record close. Whether it can score a sixth-consecutive record this week, and continue its upward lurch, might come down to data and earnings — and there will be no shortage of them this week.

S&P 500 chart for week of Jul. 21; compared with Dow 30 (purple), Russell 2000 (purple), and Nasdaq Composite (pink).

S&P 500 chart for week of Jul. 21; compared with Dow 30 (purple), Russell 2000 (purple), and Nasdaq Composite (pink).

TradingView

Earnings & Data Today

Our very own Charley Blaine wrote at length about the big reports coming up this week in It’s a Lollapalooza Week Ahead for Markets, highlighting some of the 873 earnings reports on deck this week, including reports from several of America’s most-valuable firms.

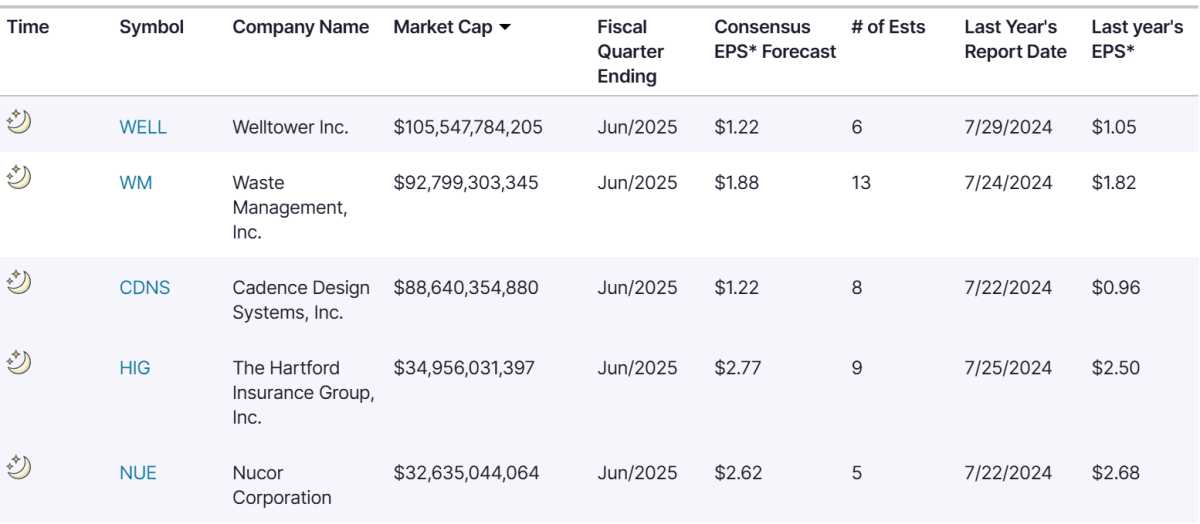

As the start and end of the week tend to be, today will be light, as we seek a number of after market reports from Welltower (WELL) , Waste Management (WM) , and others:

Earnings (Jul. 27, 2025)

Earnings (Jul. 27, 2025)

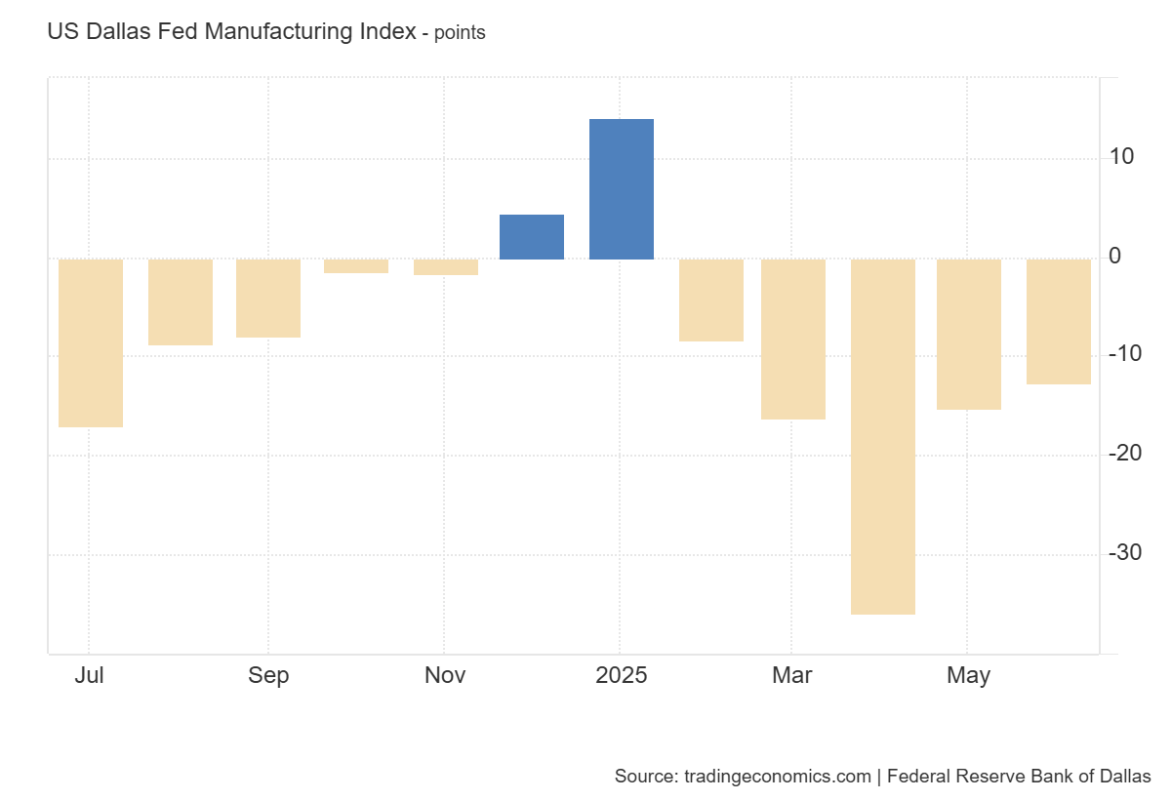

Aside from reports today, we’ll also be looking out for the Dallas Fed’s Manufacturing Index print this morning. The report could illuminate the state of affairs in U.S. manufacturing. The print is anticipated to be negative, implying continued contraction; it would be the sixth consecutive month decline.

U.S. Dallas Fed Manufacturing Index (Jul. 2024 to Jun. 2025)

U.S. Dallas Fed Manufacturing Index (Jul. 2024 to Jun. 2025)

America’s Even Larger Largest Railroad?

It turns out, the tariff talks weren’t the only deals that made inroads railroads this weekend.

During its Thursday earnings report, America’s largest railroad confirmed rumors that it was in merger talks with competitor Norfolk Southern, while drawing some caution.

But per Bloomberg, the two companies are reportedly close to reaching an agreement, creating a coast-to-coast rail giant worth over $200 billion. Their chart tells the story from last week; it’ll be one to watch this week as the companies converge on terms.

Norfolk Southern stock, week of Jul. 21, 2025; compared with Union Pacific (pink)

Norfolk Southern stock, week of Jul. 21, 2025; compared with Union Pacific (pink)

Even more so with Norfolk Southern set to report its earnings on Jul. 29.