This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Good morning. This is TheStreet’s Stock Market Today for Aug. 21, 2025. The stock market is set to open in short order. You can follow along all day with today’s biggest updates here, on our daily live blog.

This morning, futures are trending to the downside after Walmart reported earnings. Before the bell, here’s what you to know this A.M:

Update: 8:30 a.m. ET

Data Drop: Jobless Claims Hot; Philly Fed Manufacturing Plummets

A few moments ago, we were treated to the first major economic data point of the day when Initial and Continuing Jobless Claims dropped:

- Initial Jobless Claims: 235,000 [Prev: 224,000] [Consensus: 225,000]

- Continuing Jobless Claims: 1.972 million [Prev: 1.942 million]

Both figures were up month-over-month, which is not great. Stocks are now plummeting even further in futures trading.

The Philadelphia Fed also released a slew of data points, including the heavily-watched Manufacturing Index, which declined month-over-month. More on that shortly.

Update: 7:39 a.m. ET

Boeing in talks for China mega deal, Bloomberg reports

Boeing (BA) (+1.9% in premarket) is reportedly in talks to sell up to 500 aircraft to China, per Bloomberg. However, the deal is still in the works. A similar deal has been worked out in recent weeks between China and Airbus. More details will be added as they emerge.

Update: 7:31 a.m. ET

Earnings Today: Walmart, Zoom, Intuit

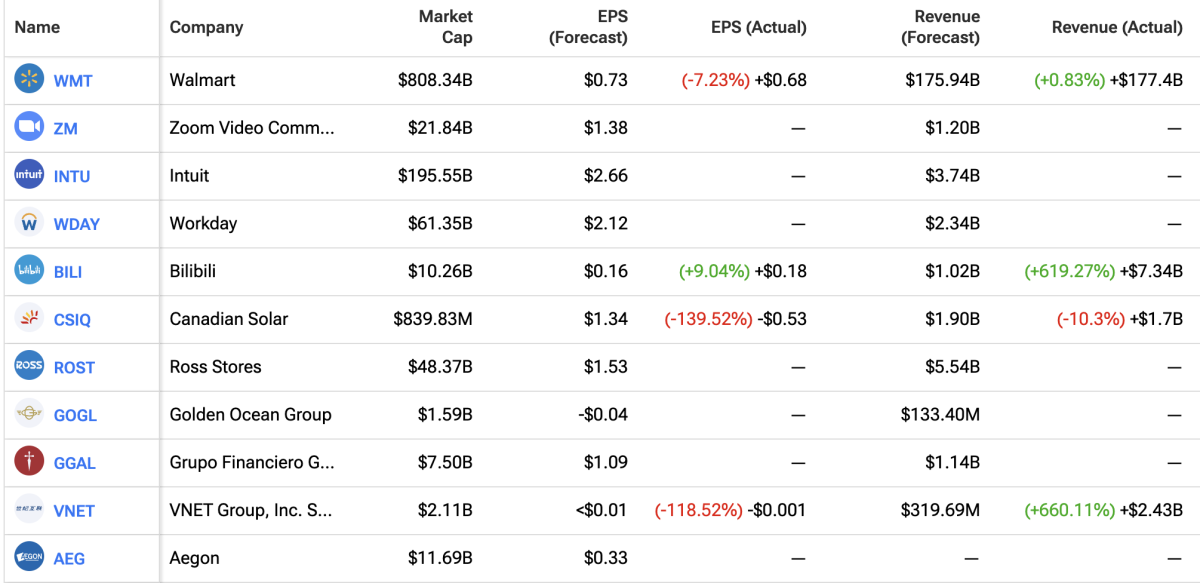

There are only 39 earnings reports today, per Nasdaq. Still, there are some heavyweights today. Walmart (WMT) (-2%) already reported this morning. And we’ll be getting earnings from software players like Zoom (ZM) , Intuit (INTU) , and Workday (WDAY) in the after hours session.

Here are the top ten reports coming down the line today:

Economic Data

Today, the Fed’s annual Jackson Hole symposium will kick off in Wyoming. It’ll also be a busy day for economic data. Here’s what investors will be keeping an eye on today, with forecasted figures provided by TradingEconomics.

(All times are in ET; all data is for August unless otherwise indicated.)

7:30 a.m.

- Atlanta Fed President Raphael Bostic is set to deliver remarks

8:30 a.m.

- Initial Jobless Claims (Wk of Aug. 16) [Prev: 224,000]

- 4-week avg: 221,750

9:45 a.m.

- S&P Global Composite PMI [Prev: 55.1] [Forecast: 53]

- S&P Global Manufacturing PMI Flash [Prev: 49.8] [Forecast: 49.7]

- S&P Global Services PMI Flash [Prev: 55.7] [Forecast: 53]

10:00 a.m.

- Existing Home Sales (Jul.) [Prev: 3.93 million] [Forecast: 3.9 million]

- Month-over-Month [Prev: -2.7%]

Other Data Points of Note:

- Philadelphia Fed CAPEX, Employment, New Orders, and Prices Paid at 8:30 a.m.

- EIA Natural Gas Stocks change at 10:30 a.m.

- 4- and 8- week bill auction at 11:30 a.m.

- 15- and 30-year mortgage rate at 12:00 p.m.

- 30-year TIPS auction at 1:00 p.m.

- Fed Balance Sheet out at 4:30 p.m.