This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Feb. 12, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 10:00 a.m. ET

Existing Home Sales Fall 8.4%

Existing Home Sales fell 8.4% month-over-month in January to 3.91 million, falling short of the 4.15 million estimate.

Update: 9:30 a.m. ET

Opening Bell

The U.S. markets are open for the day.

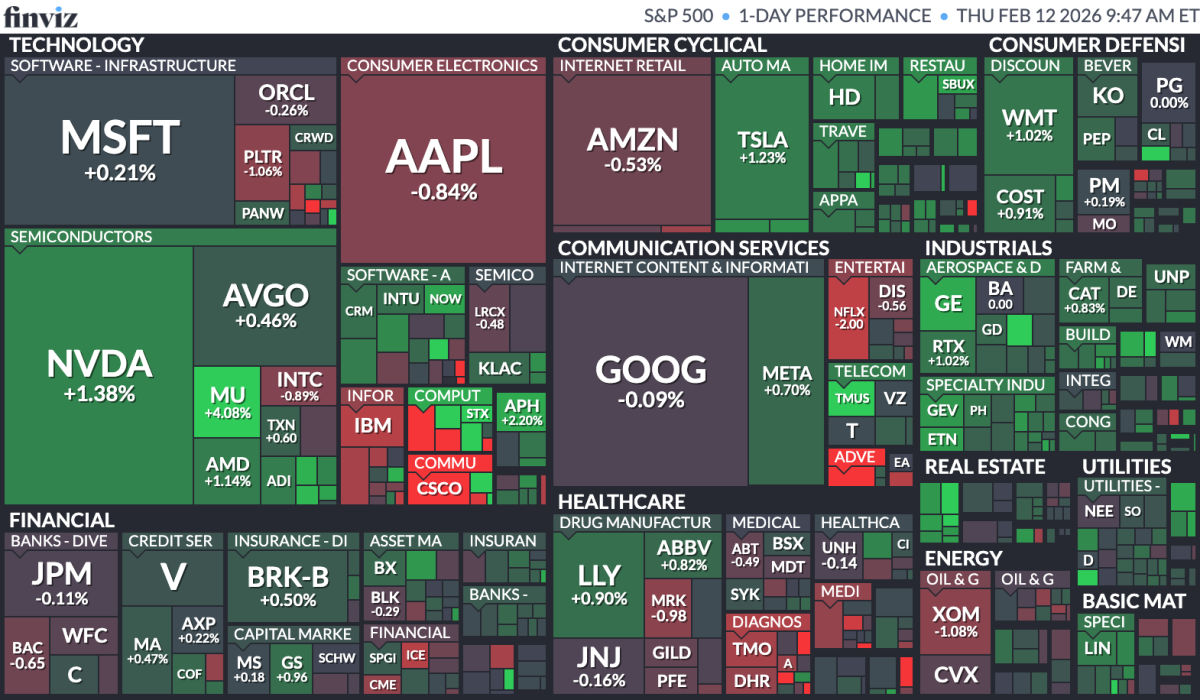

56.1% of issues are advancing this morning against 39.7% declining, per FinViz. Despite that, it’s only the Dow (+0.38%) and S&P 500(+0.12%) heading higher in the first few minutes of trading, while the Russell 2000 (-0.03%) and Nasdaq (-0.16%) are a touch lower.

The 10YTreasury is 3.1 bips lower at 4.152%, undoing some of yesterday’s steepening.

In Focus: S&P 500

After Hour & Premarket Earnings Reactions

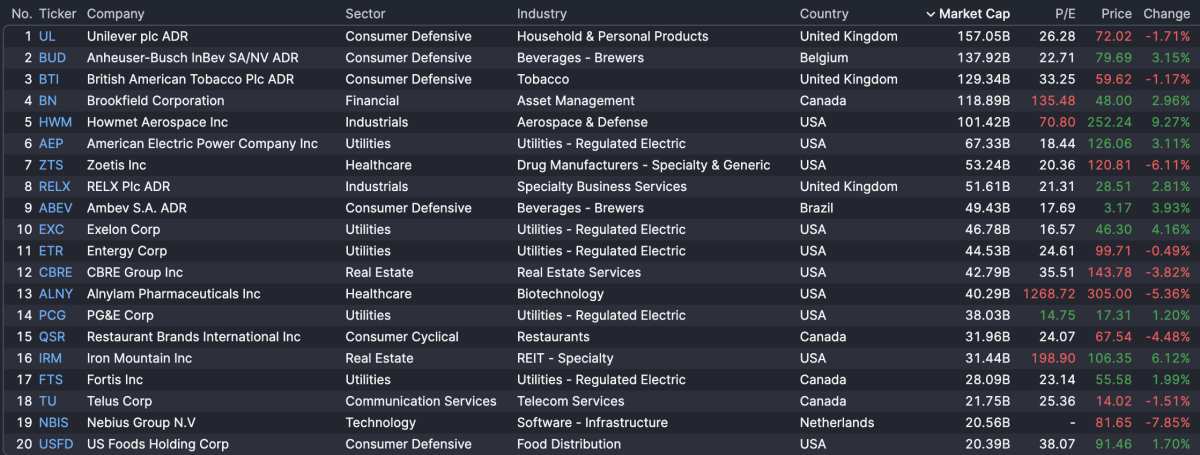

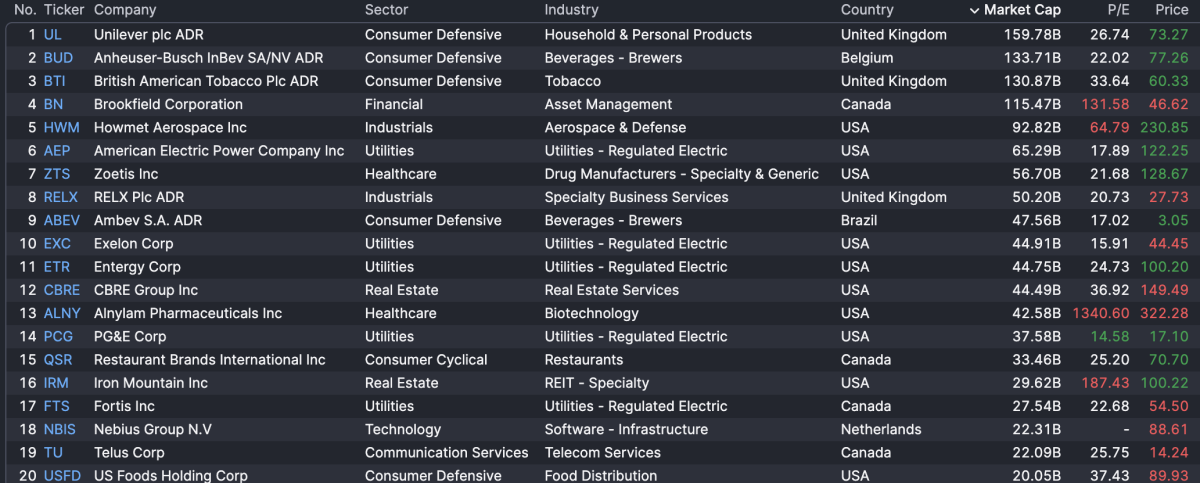

Sorting by market cap, we can get to the bottom of some of the largest earnings reactions this morning. We can include yesterday’s P.M. reports first, followed by the A.M. reports from this morning.

Starting from the reports at dusk, Applovin (-12.9%) and Cisco (-7.3%) are seeing some big declines this morning. On the flip, HubSpot (+16.4%) and Equinix (+12.1%) are higher after their respective after hour reports:

And here are the moves from this morning’s reports, which include some notable moves lower from Zoetis (-6.1%) and Alnylam Pharmaceuticals (-5.36%). On the flip side, Howmet Aerospace (+9.3%) and Iron Mountain (+6.1%) are heading higher this morning.

Update: 8:31 a.m. ET

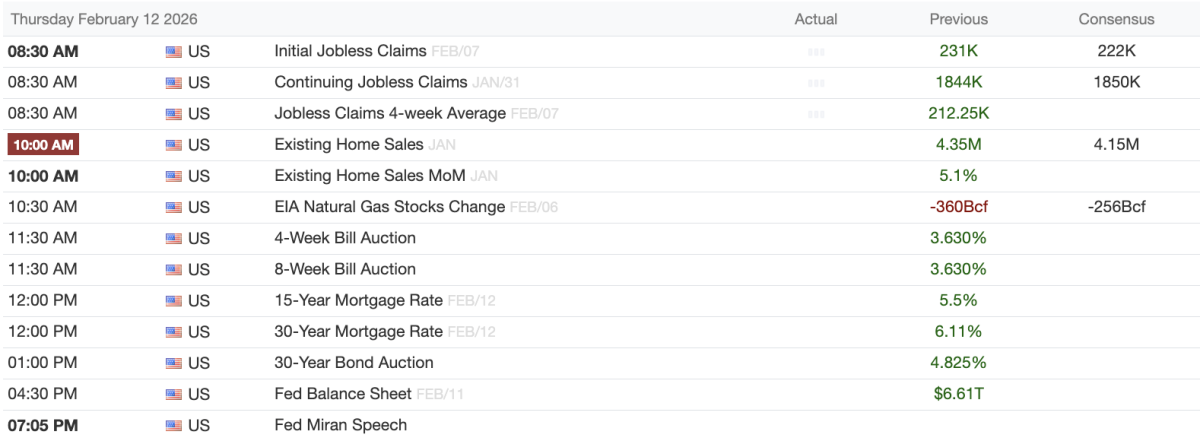

Initial and Continuing Claims Diverge In Latest Week

Initial & Continuing jobless claimsjust dropped at 8:30. Both prints were higher than analysts expected, but there’s at least a small consolation in the week-over-week decline in initial claims.

Initial Claims arrived in fashion at 227,000, down from 232,000 last week, but still above the analyst consensus of 225,000. Continuing Claims, on the other hand, rose to 1.862 million, up from 1.841 million last week; that print was quite a bit steeper than expected.

The report seems to have had little impact on futures, which are still tilted to the upside. At last look, both the Nasdaq and S&P 500 looked as though they would open up one-third of a percentage point, with the market slated to open in just an hour’s time.

Update: 8:21 a.m. ET

A.M. Update

Good morning. U.S. equity futures are seeing modest gains this morning after a decline in benchmarks yesterday.

That bout of selling yesterday was brought on by a healthy-looking jobs report, which caused stocks to pop, then plummet, then balance out a little bit. The good news for the labor market pales some bad news for investors sticking to bets on rate cuts, which harmed the Russell 2000 in particular.

I’m really taken aback by some of the revelations from yesterday’s (delayed) jobs data. For one, it’s starting to look as though things started to get materially worse for the labor market after that fabled day in the Rose Garden where President Donald Trump announced tariffs on a bunch of allies (and a few penguins, too).

Really, the only point of strength in the job market has been private education and health, which has added 773,000 jobs since Jan. 2025, while the rest of the economy has burned 414,000 jobs. In the Jan. 2026 report, it was ambulatory services and social assistance that saw the steepest gains (+42,000), while the white collar job market continued to ail.

And as we know, these numbers might continue to shape up differently as we continue to report downward revisions; it’s no secret that we have been systematically over-estimating the number of jobs added in the economy for over a year (by a million or more, actually).

That said, let’s turn our attention to today’s slate:

Earnings Today: Applied Materials, Unilever, AB InBev

Today, there are eight reports with a market cap clearing the $100 bil club, making today a pretty powerhouse day for earnings. This morning, it’s a bit of a globe-trotting affair: Unilever, Anheuser-Busch InBev, British American Tobacco, and Brookfield have reported (and we’ll follow back after the market to see their respective reactions.)

This evening, Applied Materials, Arista Networks, and Vertex Pharmaceuticals will round out the major earnings of the day. There will aos be some appearances from other retail-popular names such as Airbnb, Coinbase, and Rivian Automotive, among others.

Economic Data + Events: Initial & Continuing Claims

Before we get to the opening bell, we’re going to have Initial & Continuing Claims in just a few short moments. A bit later this morning, we’ll get Existing Home Sales, before we get some new commentary from the Fed’s Miran this evening. Here’s how it all breaks down: