This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Jan. 16, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 4:03 p.m. ET

Closing Bell

The U.S. markets are now closed for the day. It was a pretty negative one on the whole, with about 55.8% (3,086) U.S. issues declining against 40.3% (2,230) advancing.

The bright spots seemed to be in real estate, industrials, and certain pockets of tech. By contrast, consumer cyclical, consumer defensive, and health care stocks saw declines, while financials were mixed.

Let’s talk benchmarks, then: The Russell 2000 (+0.12%) was the only of the major U.S. indexes to hold on to its gains in the session, adding 3.18 points and rising to 2,677.74. It feels like it was just yesterday that the small cap index was struggling to get above the 2.5K mark. Look at it now, up about 7% year-to-date.

By contrast, the S&P 500(-0.06% to 6,940.01), Nasdaq (-0.06% to 23,515.39), and Dow (-0.17% to 49,359.33) didn’t shake out so well. Bouncing between green and red today, the large caps just couldn’t finish out the day on a high note, continuing a rough week of tumult for the indexes.

Update: 1:00 p.m. ET

Midday Movers

Through midday, there hasn’t been a whole lot of movement in the markets. The Russell 2000 (+0.49%) has been putting up a strong performance — as it has done a lot recently — while large cap indexes lag in the low-single bips.

Here’s how the indexes have been looking today, per FinViz. Looks like a leg lower, a leg higher, a small pullback, and perhaps the start of another jump for the four indexes. Of course, results are varying:

This week, of course, heralded the start of the Q4 earnings season. But despite strong bank earnings and impressive results from chipmaker Taiwan Semiconductor, it was by no means an easy week for the market as the S&P 500 booked its first back-to-back declines of the year.With big earnings, economic data, and the ongoing waiting game for the all-important tariff Supreme Court case, investors had to weigh the first real headwinds of the year. Despite that, U.S. stocks look like they’re fixing to end the week on a slightly higher note.

Even the large cap indexes like the S&P 500 (+0.08%), Nasdaq (+0.05%), and Dow (+0.03%) are staying in the green for the moment.Among S&P 500 sectors, technology, financials, and industrials are the best-performing today; materials, communications, and utilities are heading in the opposite direction.

That trend seems to shake for the Russell 2000 as well, which is seeing bright flashes of green in its industrials, utilities, technology, and financial sector today. Here’s the R2K in its current state:

That said, let’s zoom out and take a look at the broader market today. In our midday movers list — which looks at the best and worst-performing stocks with at least a $2 billion market cap — there might even more stories to dig in on:

Winners

Losers

Update: 9:46 a.m. ET

Opening Bell

The U.S. market is open for the day. Right out of the gate, stocks look to be biased to finish the week on a low note. All four major indexes opened and then plummeted.

The Nasdaq (+0.10%) remains the only major index in the green right now, while the Russell 2000 (-0.04%), S&P 500 (-0.06%) and Dow (-0.27%) are in tow.

Technology and industrials are currently the only S&P 500 sectors in the green, but they’ve been declining since the market opened.

Here’s a glimpse of all stocks on the U.S. markets for some more context (15 min delayed, so this would be at 9:44 a.m.):

That all said, we will update the section below with news from the morning (as it arises.) Check back soon for more.

Update: 9:01 a.m. ET

A.M. Update

Good morning. The U.S. markets are slated to open in less than 30 minutes. Futures are mixed this morning, ahead of what is slated to be another day of regional bank earnings. Here’s what is up:

Earnings Today: PNC Financial, State Street, M&T Bank

Many of the large bank reports have ceded room for smaller regional banks to report. Rounding out the first week of earnings season is PNC Financial, State Street, and M&T Bank Corp, among others. Notably, all of these firms but PNC are down after their report, while the broader regional bank ETF is off about 37 bips as of 10 a.m. ET.

Here’s the slate of all firms worth at least $1 billion that report today, per FinViz:

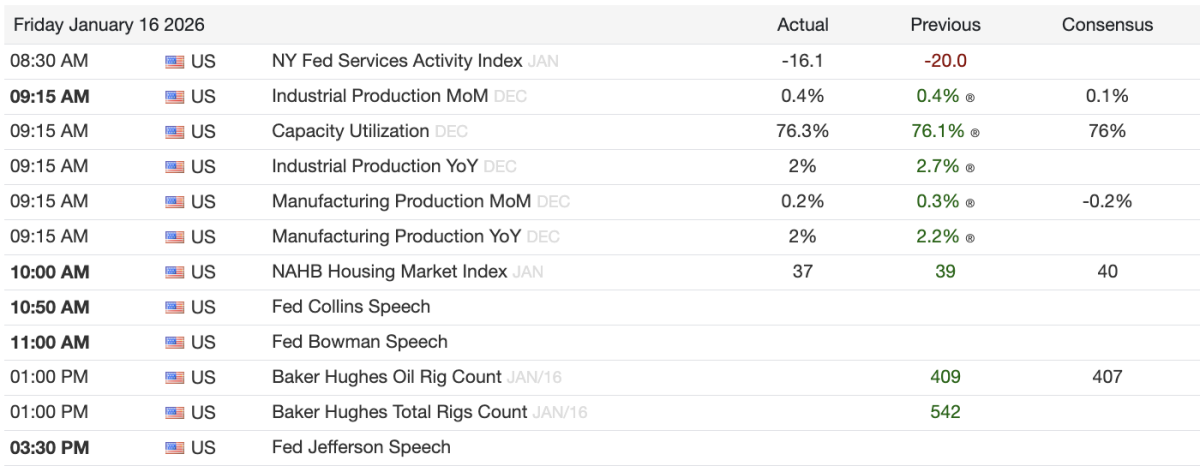

Economic Data: Industrial Production, NAHB Housing Market Index

Closing out this week, the U.S. economy is set to show off the latest industrial and manufacturing data it has for December. Initial indications show these reports are more or less in line, barring a disappointing report from the NAHB Housing Market Index in January.

Here’s today’s economic events as reported thus far: