This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Wednesday. This is TheStreet’s Stock Market Today for Jan. 21, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 10:25 a.m. ET

Stocks Rise Despite Trump Remarks

This morning is already fixing to be the polar opposite of yesterday. About an hour into trading, all four U.S. equity indexes are in the green. A pretty astonishing 69.9% (3,859) issues are advancing.

Leading the pack is the Russell 2000 (+1.54%), which has led the way to start 2026, up more than 7% year-to-date. Large cap indexes are trailing, with the Nasdaq (+1.11%), S&P 500(+1.05%), and Dow (+1.02%) adding one percent. They still have a ways to go to undo yesterday’s steeper losses, but there haven’t been many red candles on the 10 min chart this morning.

Here’s the S&P 500 at last glance, which is shaping up pretty nicely this morning:

Update: 9:35 a.m. ET

Opening Bell: Trump Speaks

The U.S. markets are now open. Out of the gate, all four U.S. equity indexes are up. Precious metals are also up, Treasury yields are down slightly, and

For the moment, U.S. equities are to the upside, but President Donald Trump is speaking in Switzerland, delivering a unique set of remarks before an audience at the World Economic Forum. Among the remarks, Trump says that the U.S. believes “deeply” in bonds with Europe and wants them to do great, but doubled down on comments that Greenland is “our territory” and it should be acquired.

We’ll check back in on where these remarks ultimately land the market after they wrap, but for the moment, it looks like the market might be fixing to undo some of yesterday’s catastrophic trading.

Update: 3:57 a.m. ET

A.M. Update: Daylight in Davos

Good morning. After a longer holiday weekend, this week’s opening trade turned out to be quite a wreck. Over 70.7% (3,900) of U.S. issues declined on Tuesday against just 26.4% (1,457) that advanced as headlines declared that Europe was ready to resist President Donald Trump and his threat to seize Greenland.

The Nasdaq Composite and S&P 500 fell 2.39% and 2.06% respectively, while the Dow (-1.76%) and Russell 2000 (-1.20%) saddled similar losses. The events came as investors were left awaiting the Supreme Court’s decision on the fate of Trump’s tariffs, Trump’s trip to Switzerland for Davos, and the first wave of Q4 earnings.

Those of you who know your way around a Terminal know how these sorts of tumbles go. In futures trading this morning, U.S. equity benchmarks are up about one-third of a percentage point, undoing some of yesterday’s steep losses. The “buy the dip” mentality always seems to trail a “sell the news” event.

However, in light of the worst trading day since the Apr. 2024 Rose Garden tariff fiasco, you might just wake up to a bloodbath, especially as White House leadership embark to Davos. And based on how blasé and callous the American rhetoric has been, especially with regards to possible countermeasures, anything could undo a comeback bid.

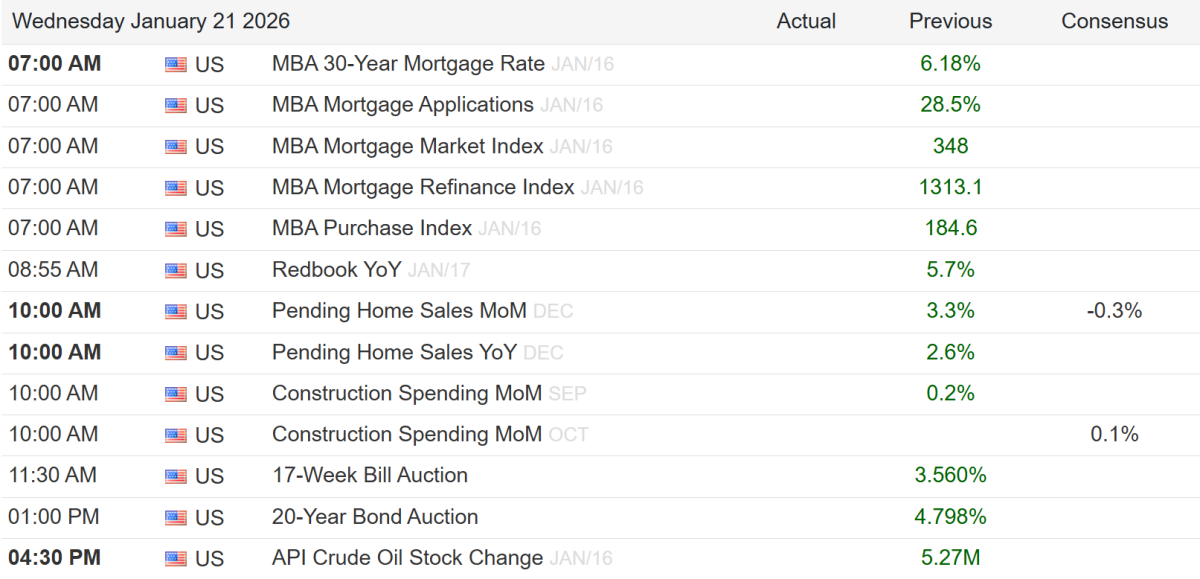

That said, here’s what is on deck for today:

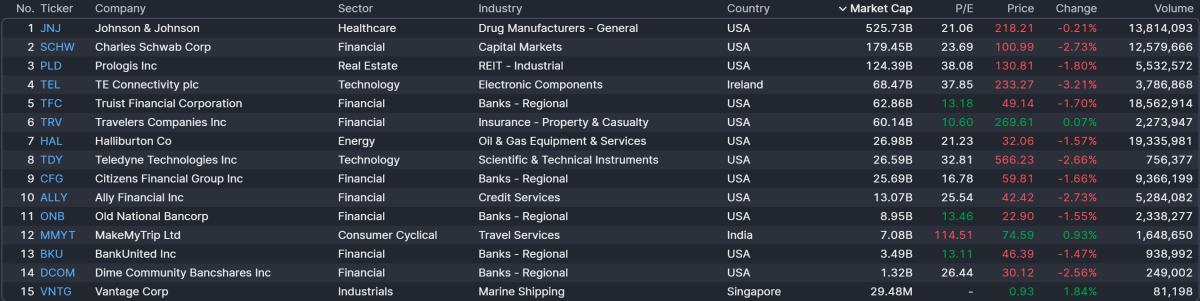

Earnings Today: Johnson & Johnson, Charles Schwab, Prologis

Today will see a wide variety of regional banks reporting, both in the premarket and aftermarket session. However, this morning’s biggest reports will come from health care giant Johnson & Johnson, brokerage Charles Schwab, and REIT Prologis, among others:

Then, after the market closes, we can expect another row of regional bank reports, along with reports from oil & gas company Kinder Morgan, IT company Caci International, and trucking company Knight-Swift:

With all of the regional banks reporting today, you’ll want to keep an eye on the S&P Regional Bank ETF ($KRE), which might be especially responsive to reports. Since its lows in Nov. 2025, the index is up more than 14%. If it were to have a breakout amid the recent geopolitical tremors, it would likely come from better-than-expected results from this pocket of the financial sector.

Economic Data + Events: Davos, Home Sales, Greenland Developments

As aforementioned, U.S. leadership are in Davos for the annual World Economic Forum summit. Before President Donald Trump has even arrived, it’s already shaping up to be quite the exchange of ideas, with U.S. Treasury Secretary Scott Bessent saying Denmark is “irrelevant” in regard to one of the country’s pension funds selling $100 million in Treasurys. (Bessent says that they have been doing that for years and that he’s not concerned.)

At the center of it all will be a highly anticipated speech from the President, which is sure to feature some fireworks, given the ongoing Greenland spat kickstarted by the administration. Of course, the infighting has offered cover for some of the more interesting touchpoints at the conference, including BlackRock CEO Larry Fink predicting “big failures” in the AI market.

In addition, we have the typical prescription of economic data. We’ll be getting new data from the Mortgage Bankers Association, plus the latest on pending home sales, construction spending, and Redbook: