This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Monday. This is TheStreet’s Stock Market Today for Dec. 8, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 4:00 p.m.

Closing Bell

The U.S. markets are now closed for the day. The Russell 2000 (+0.13%) rose, while the Nasdaq (-0.14%), S&P 500(-0.35%), and Dow (-0.45%) sank despite a late rally from tech companies, which was driven by discussions involving Broadcom (+2.78%).

Toll Brothers Reports Higher Revenue, Lower Profit and Outlook

Luxury homebuilder Toll Brothers, the largest report of the day, just reported earnings. In total, the company reported 2,598 signed contracts for the recent quarter, higher than the 2,475 expected by Bloomberg analysts. The product meant higher revenue, but a lower profit, as margins compressed.

Worsening matters, the company forecasted between 10,300 and 10,700 home deliveries in 2026 — versus an average expectation of 10,843. The news sent shares of the homebuilder plummeting about 4% in after hours trading.

Update: 1:43 p.m.

Google Promises New AI Glasses in ’26

A decade after launching Google Glass, the tech giant says it’s ready to play around with a new XR wearable. This afternoon, the firm says it expects to launch its new AI glasses in 2026, made possible by a partnership with Warby Parker (+13.3%).

Despite the news, Google parent Alphabet (-2.7%) fell today. It’s up nearly 12% over the last month amid the launch of its new Gemini 3 AI model. The announcement comes after Google said it would add ads to the model next year. Over the last six months, it has risen more than 79%.

Update: 1:11 p.m.

Nvidia H200 Chip Exports to Be Allowed

Nvidia(+2.6%) is up amid murmurs that the U.S. Commerce Department will allow exports of the chipmaker’s last-gen H200 chips, likely reversing an earlier consideration by lawmakers.

Update: 1:00 p.m.

Midday Movers

Through midday, the Russell 2000 (+0.25%) is still holding on, with investors adding to expectations for an interest rate cut later this week, even as yields are seen rising this morning.

At the sometime, the large caps are struggling to keep pace. The Nasdaq (-0.07%), S&P 500 (-0.30%), and Dow (-0.45%) are dipping from record highs.

Per data from FinViz, about 50.8% (2,816) of issues are declining. Among them are 316 of the S&P 500’s 503 components. The Nasdaq 100 has 61 decliners and the Dow has 18 decliners.

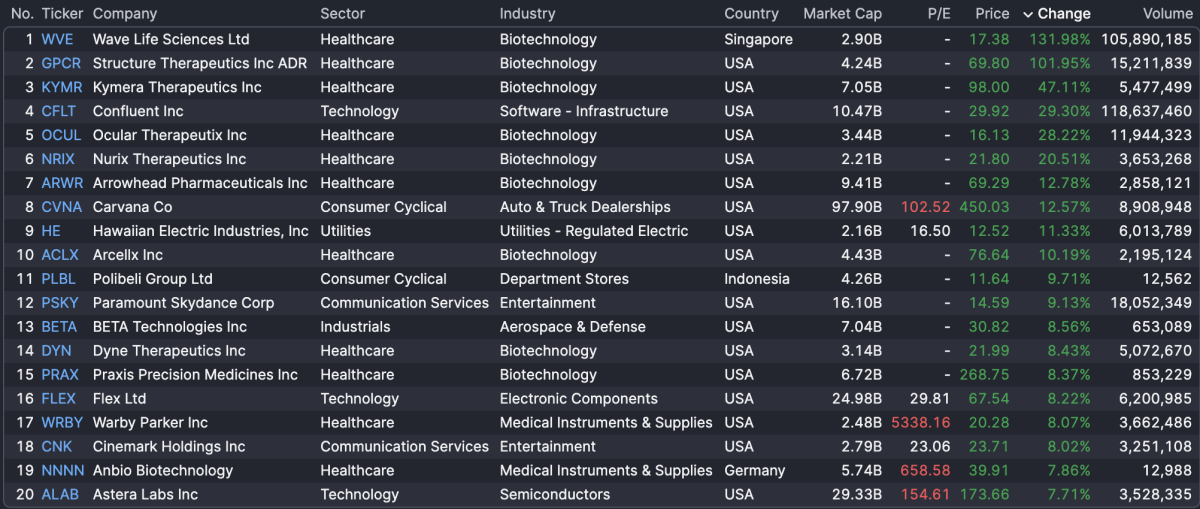

For a moment though, we’ll take a look at the best performers — at least over a $2 billion market capitalization — that are making moves higher and lower today in our daily midday movers list:

Movers

At the top of the market, we have two doubles today: Wave Life Sciences (+132%) and Structure Therapeutics (+102%), which are both up after results from their new weight loss treatment showed promise in a phase 1 trial. The drugs delivered similar weight loss to GLP-1 drugs, but without muscle loss. Instead, the total fat was replaced by lean mass, largely muscle. The company will now proceed to a phase 2 trial.

In total, 9 of the top 20 stocks today are biotech companies. Here’s the full list:

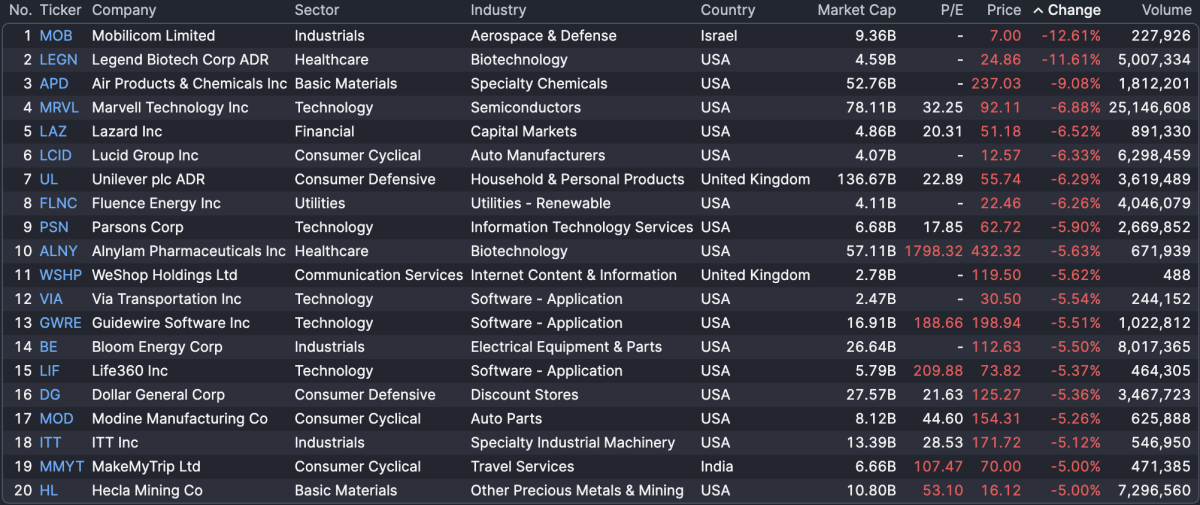

Losers

At the bottom of the market, the Mobilicom (-12.6%) is falling after the Israeli communication company announced it will transition to a direct listing, doing away with its American Depository Share (ADS) structure. As part of the move, the company will conduct a 1-for-275 reverse share split.

Meanwhile, Legend Biotech (-11.6%) is diving despite an upgrade from RBC, which holds an ‘outperform’ rating after new data from the company’s CAR-T drug CARVYKTI showed positive results in Non-Hodgkin Lymphoma.

Rounding out the top three, Air Products & Chemicals Inc (-9%) is falling after announcing plans to partner with Yara on low-emission ammonia production and distribution.

Also: Marvell Technology (-6.9%) is falling after a downgrade from Benchmark, who cites concerns about the company losing business from key partners Microsoft and Amazon. Worsening matters, the company was not included in the latest shakeup of the S&P 500 index.

Update: 9:36 a.m. / 10:14 a.m.

Opening Bell

The U.S. markets are now open for the week. The Russell 2000 (+0.32%) is in the green in anticipation of this week’s Fed meeting, where the central bank is widely expected to cut rates, granting small cap stocks a small reprieve.

Meanwhile, the tech-centric Nasdaq (+0.08%) has up a few basis points, while similarly-situated large cap indexes like the S&P 500 (-0.06%) and Dow (-0.08%) are facing small declines.

Also notable this morning: the 10Y Treasury (+3.9 bips to 4.178%) is up ahead of the Fed’s expected rate cut, which will be a theme to watch this week as bond traders price expectations.

Here are some of this morning’s stories:

Paramount Skydance Launches $30/sh Bid for WBD

Paramount Skydance has launched a competing offer for Warner Bros. Discovery, valuing the entertainment giant at over $108 billion. The fresh offer is likely to complicate an existing deal from Netflix, which offered to purchase the firm for over $82 billion last week.

PSKY was seen as an early contender in the two-part bidding war, thanks to the deep pockets of the Ellison Family, particularly Oracle CEO Larry Ellison, one of the world’s richest men. His son, David Ellison, is the Chairman & CEO of Paramount Skydance.

On the news, Netflix stock is down more than 3%. Paramount Skydance, by contrast, is up 3.5%. Warner Bros. Discovery is up 6.4%.

Mag7 Gyrate Post-Yardeni Downgrade

After Yardeni downgraded Mag7 tech names, there hasn’t been much of a reaction. In fact, Microsoft (+1.22%) and Nvidia (+0.66%) are outperforming the index for the moment, even as Tesla (-2.03%), Google (-0.84%), and Meta (-0.83%) see a modest downturn. This theme will be one to watch as the week progresses.

Here is the S&P 500 index as of 10:14 a.m. ET:

Oppenheimer Issues Highest 2026 S&P 500 Target Yet

Investment bank Oppenheimer has issued the most optimistic forecast for the S&P 500 index that the Street has seen so far. For year-end, the company now sees S&P 8,100 — approximately a 17% increase from this morning’s prices.

Data Station: No October PPI; Modest Inflation Expectations

The NY Fed’s report on current finances showed, although households grew more pessimistic in the month of November, inflation expectations remained steady in the month.

Households now expect one-year inflation to rise 3.2%, while longer-term expectations see prices rising just 3% year-over-year.

In addition, the BLS says there will be no October Producer Price Index (PPI) released, citing the government shutdown’s impact on collection.

Update: 8:41 a.m. ET

A.M. Update

Good morning. It’s going to be a quiet Monday, with just a few earnings and economic reports slated for today — a sort of calm before the storm Fed Meeting.

That’s not to say that there isn’t some cloudiness today, though. Futures remain tepid after longtime tech bull Ed Yardeni now says that it’s time to underweight the Magnificent 7 tech stocks, adding a preference for the remainder of the S&P 500, as “every company is evolving into a technology company.”

That’s likely to be a big theme this week, especially as Fed cut talks loom. With a cut widely-expected by investors, the cards could already be set for small cap outperformance through year-end, particularly if tech peers respond to the commentary.

New S&P Holdings Incoming: Carvana, CRH, Comfort Systems

Speaking of the S&P 500, there’s a shake-up in the making, with online car retailer Carvana slated to join the market after a nearly 22,000% rally and a years-long controversy involving numerous short sellers.

It’ll be joined by building materials company CRH plc and mechanical and electrical contracting company Comfort Systems.

The three firms will replace auto parts company LKQ Corp., specialty materials company Solstice Advanced Materials, and flooring manufacturer Mohawk Industries.

Today: Earnings + Economic Data

Today, we’ll get a glimpse of Consumer Inflation Expectations from the NY Fed, which were last seen up 3.2% year-over-year. In tandem, there will be a 3-month and 6-month bill auction, along with a 3-year note auction this afternoon.

And on the earnings front, homebuilder Toll Brothers will report after the market closes today, making it the largest report of the day. The only other reports from firms over a $1 billion market cap will be Chinese financial services company Lufax Holdings, healthcare software Phreesia, Inc., and ‘digital presence’ software firm Yext, Inc.