This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Dec. 19, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 4:01 p.m ET

Closing Bell

That’ll be the end of the last full trading week of 2025. The Nasdaq (+1.31%) finished out the day near day-highs, boosted by the staying power of the tech comeback.

The S&P 500(+0.89%) and Russell 2000 (+0.84%) also closed out the day up close to one percent, while the Dow (+0.34%) couldn’t find a good rhythm.

Update: 1:48 p.m ET

Midday Movers

As we count down the waning hours left in the session, 56.1% (3,121) U.S. issues are advancing today, against 40.7% (2,264) in decline. The Nasdaq (+1.14%) is just off its day highs, while the S&P 500 (+0.87%) and Russell 2000 (+0.85%) are vying to close out the week up 1%. The Dow (+0.62%), as it tends to be, is lagging the bunch.

That said, let’s turn our attention to the top and bottom 20 equities in our midday movers list, where we aim to capture the trendy stories in the market:

Winners

At the top of the market today, Intuitive Machines (+33.6%) is bursting higher after KeyBanc initiated coverage on the space-faring firm, starting it off at a $20 price target. Similar firms Firefly (+21.2%), AST SpaceMobile (+13.4%), Rocket Lab (+16.4%), and Planet Labs (+11.4%) are also on today’s list, rising in sympathy.

It’s joined by Amicus Therapeutics (+30.5%), which popped after announcing that it would be acquired by BioMarin in a $4.8 billion deal.

Rounding out the top three, CoreWeave (+21.5%) is appreciating from the rebound in debt-encumbered AI names, while also being buoyed by a press release that indicated that the firm would engage the the Department of Energy on U.S. research efforts.

Here’s the full list:

Losers

On the other end of the market, frozen potato and fries firm Lamb Weston (-24.1%) is having a catastrophic morning after reporting profit pressures in its latest quarterly report.

One-time retail favorite BlackBerry (-13.2%) is also getting hammered today after reporting its earnings. And so too is Nike (-10.4%), which is falling after investors really dug in on the firm’s struggles in the Chinese market.

Disc Medicine (-13.2%) rounded out the top three, declining just hours after a Norwegian bank analyst highlighted the biotech company.

Update: 11:07 a.m ET

In Focus: S&P 500

The Nasdaq (+1%) is now up more than one percent on the day, but for a real look across the market, the S&P 500 (+0.73%) really tells the story this morning. In the index, four of the top ten performers this morning — that’s Oracle (+7%), Sandisk (+6.5%), Micron (+5.7%), and Advanced Micro Devices (+4.3%) — are AI-related trades.

Of the remaining equities, three are cruise companies; Carnival (+9.7%) is up nearly 10% after reporting strong results this morning, lifting peers Norwegian (+6%) and Royal Caribbean (+4.3%) in the process.

In total, 319 of the index’s 503 holdings are up today. Here’s how the index looked at last glance:

Update: 10:02 a.m ET

UM Consumer Sentiment Sees Modest Improvement in December

The University of Michigan’s Consumer Sentiment data is out now, coming in at 52.9 in its final report for the month of December. That was up from 51.0 last month, making this the third consecutive month of improvement in the soft data index.

Headlining the modest increase were moderating inflation expectations, as well as an overall increase in consumer expectations — those jumped from a score of 51.1 to 54.6. However, the current conditions index sagged, falling from 51.1 to 50.4.

In response, U.S. equities have appreciated a small bump after a healthy showing in the opening minutes of trading. Also helping matters, existing home sales also grew in the month of November to 4.13 million (+0.5% month-over-month).

Update: 9:41 a.m ET

Opening Bell

The U.S markets are now open. After a strong Thursday, equities appear to be fixing for a strong close to the final full week of 2025, putting the kibosh on what was shaping up to be a five day-long decline in the S&P 500. Instead, tech stocks are once again lifting benchmarks like the Nasdaq (+0.78%). The Russell 2000 (+0.62%), S&P 500 (+0.61%), and Dow (+0.42%) are all coming along for the ride on similar optimism.

Particularly consequential in this morning’s trade, Oracle (+5%) appears to be leading some of the early day charge after sagging in recent sessions on angst surrounding its debt-heavy data center projects. A report from earlier this week had indicated that the hyperscaler’s endeavors faced a funding shortfall after a key backer decided to sidestep the company’s $10 billion Michigan data center. This morning, it seems to be leading the charge higher in AI stocks.

Outside of equity land, the 10Y Treasury is 1.9 bips higher at 4.135%. Continuous futures in metals like Silver and Gold, as well as energy commodities such as natural gas and WTI crude are higher this morning.

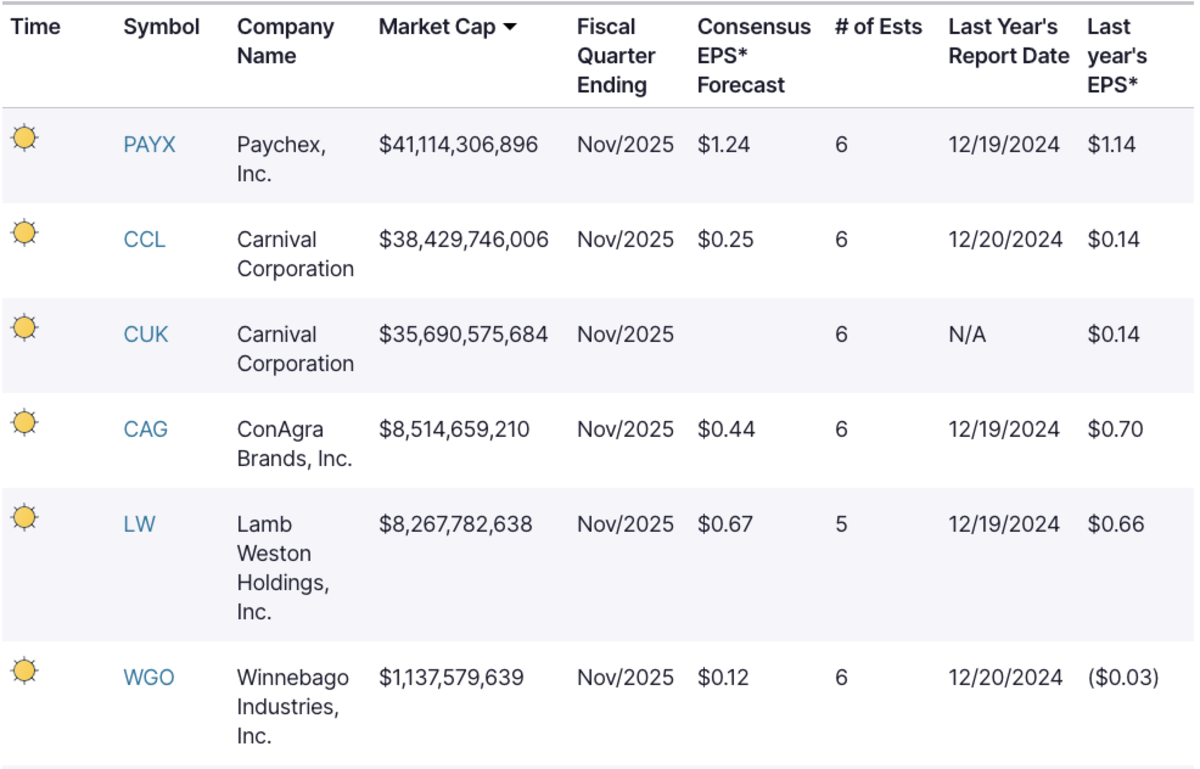

Earnings Today: Paychex, Carnival, ConAgra

Here are the earnings which reported this morning:

Economic Data + Events: Existing Home Sales & UM Consumer Sentiment

Rounding out one of the busiest remaining slates of economic data this year, traders will be treated to Existing Home Sales and the University of Michigan Consumer Sentiment data at 10:00 a.m. ET this morning. We’ll be back around then to hammer that.