This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Monday. This is TheStreet’s Stock Market Today for Aug. 25, 2025. The stock market is set for a modest decline after Friday’s Fed Power Rally. You can follow today’s market updates all day here on our daily live blog.

Update: 7:35 a.m. ET

Bitcoin Teases Out Where Stocks Will Go

When Bitcoin dipped from its Friday highs this weekend, many traders took to X (formerly Twitter) to tell traders: expect a down market Monday.

Down 3% over the last 24 hours, Bitcoin reversed its week gains and sat just above 111,000 before the U.S. markets opened for the week.

Lo and behold, stock futures are set for declines of their own. According to futures, the Nasdaq (-0.33%) is set for a retreat, along with the S&P 500 (-0.28%), Dow (-0.21%), and Russell 2000 (-0.11%).

Turns out, it’s really no coincidence. Bitcoin has been sharing a greater correlation with the Nasdaq-100 and S&P 500 in recent weeks. Over the last month, it has shared a 0.48 correlation with the S&P 500, for example.

Whether that pattern holds remains to be seen, but amid excitement about possible rate cuts at the September FOMC meeting, investors across asset classes have been seen pumping valuations.

Update: 7:21 a.m. ET

Economic Data: New Home Sales; Chicago Nat’l Activity Index; Dallas Manufacturing Index

Despite Fed chair Jerome Powell’s indicates that a “policy adjustment” was in the cards for the central bank, many analysts believe it will ultimately be up to the data whether the Fed acts at its September meeting.

Today’s reports are unlikely to move the needle as substantially as labor market moves or an inflation report, but they might offer additional color on the state of the market.

At 8:30 a.m. ET, the Chicago Fed National Activity Index is out. It has declined in nine of the last 12 reports, a sign that economic activity is weaker.

At 10:00 a.m., we’ll be getting New Home Sales data for July. Last month, sales rose 0.6% to 627,000 sales. Analysts are looking for roughly the same figure this month.

Finally, at 10:30 a.m., we’ll be getting the Dallas Fed Manufacturing Index for August. This data point notched a narrow increase in July, ending five months of significant declines.

In smaller reports, the 3- and 6-month Bill Auctions are at 11:30 a.m. Final building permit figures for July are also due out at some point.

Update: 6:13 a.m. ET

Earnings Today: PDD Holdings & Heico

This week is set to be a big one for earnings, with Nvidia (NVDA) set to round out earnings season mid-week with its long-awaited report.

The market’s most-valuable stock, which represents nearly 10% of the S&P 500 and over 14% of the Nasdaq-100, will set the tone for the rest of the quarter.

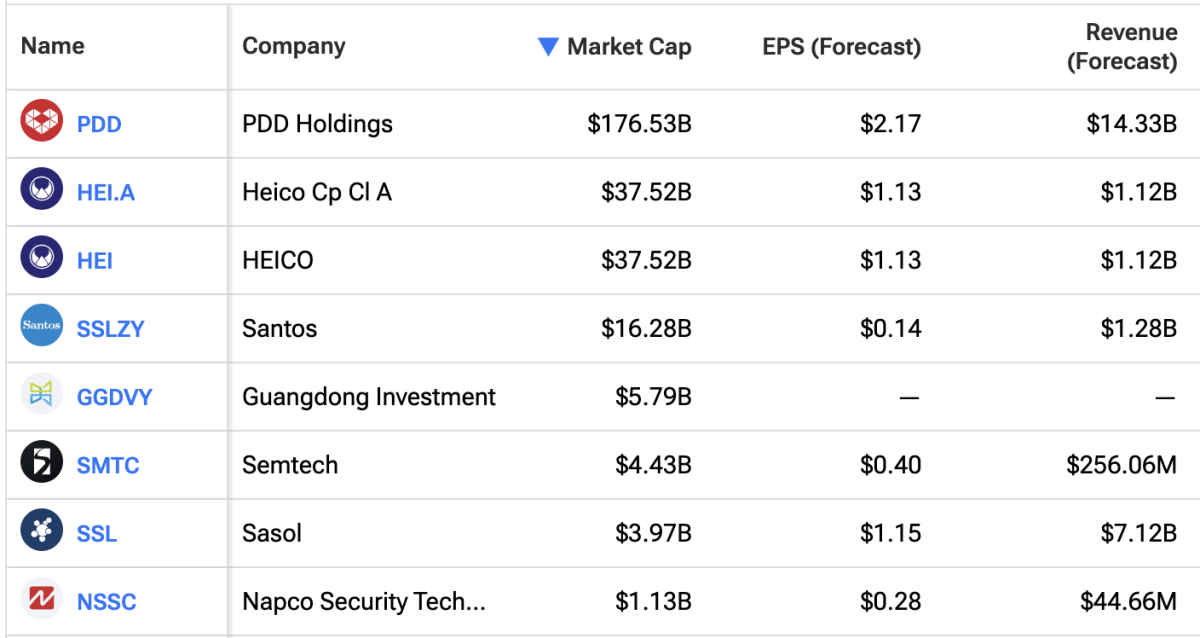

In the meantime, Nasdaq reports that there are 15 earnings slated for today. At the top of the docket is Temu parent company PDD Holdings (PDD) and aerospace company HEICO Corp (HEI) . Here’s all the reports slated for today, among firms with a market cap exceeding at least $1 billion:

Earnings today (Aug. 25, 2025)

Earnings today (Aug. 25, 2025)

TipRanks