Updated at 4:09 PM EDT

U.S. stocks closed massively higher Wednesday, with the S&P 500 notching its strongest single-day advance since 2008, after President Donald Trump has issued a 90-day pause on the so-called ‘reciprocal’ tariffs he put in place just two days ago.

The S&P 500 ended 474 points, or 9.52% higher on the day, with the Nasdaq gaining 1,857.06 points, or 12.16%. The Dow finished with a staggering 2,962.85 point surge. Overall trading market volume topped 30 billion shares, the most on record.

“The stock market rebound is a combination of speculative investors needing to cover short positions; less fear of recession and stagflation; and optimism that tariff rates will ultimately end up lower than they are threatened today,” said Bill Adams, chief economist for Comerica Bank in Dallas.

“Businesses will be relieved that the destination for trade policy looks like it could be less disruptive than seemed possible yesterday,” he added. “Even so, the huge overhang of policy uncertainty will weigh on investment and weak decisions in the next few months.”

NASDAQ 100 $QQQ just posted its 2nd best day ever, soaring 12.5% — the biggest one-day gain since Jan 3, 2001. S&P 500 $SPX jumped 9.5%, marking its 8th best session in history. Dow surged nearly 3,000 pts for the first time. And the MAG7? Best day on record. pic.twitter.com/GPCBJGUf1q

— Wall St Engine (@wallstengine) April 9, 2025

Updated at 2:15 PM EDT

Reversal gains

Stocks are adding to gains following the President’s tariff reversal, with the Nasdaq on pace for a 10% surge, its biggest single-day advance since 2008, and the S&P 500 last marked 371 points, or 7.46%. The Dow surged 2,400 points.

Today’s surge, however, still leaves the S&P 500 down 5.3% from Trump’s April 2 ‘Liberation Day’ tariff unveiling.

The market can change quickly. We are almost back to last week’s level now that #Tariffs have been paused for 90 days pic.twitter.com/wvg1FoGkDk

— Dividend Diplomats (@DvdndDiplomats) April 9, 2025

Updated at 1:25 PM EDT

Trump pause

President Trump has issued a 90-day pause on the so-called ‘reciprocal’ tariffs he put in place just two days ago, sparking a massive rally on Wall Street that was helped by a stronger-than-expected auction of $39 billion in 10-year notes.

Trump said the pause is effective immediately, but added that he would increase levies on China-made goods to 125%. A baseline 10% levy on all U.S. trading partners, however, will also remain in place.

“At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable,” the President said. “Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade …”

The S&P 500 was last marked 320 points, or 6.6% higher following the President’s remarks, with the Dow gaining 2,1050points and the Nasdaq up 1,169 points, or 7.66%.

10% – 90d pause https://t.co/8X1jGfWdz6

— The Long View (@HayekAndKeynes) April 9, 2025

Updated at 11:57 AM EDT

Recession risks

The latest update to the Atlanta Fed’s GDPNow tracker shows the U.S. economy contracted by 2.4% over the first quarter, a massive swing from the 2.4% growth rate recorded over the final three months of last year.

Even when adjusted for the huge increase in gold imports, which distort its overall calculations, the gauge indicates a first quarter contraction of 0.3%.

US Atlanta Fed GDPNow Q1: -2.4% (prev -2.8%)https://t.co/GIJHH2ZMsR pic.twitter.com/QZy5df4MwT

— LiveSquawk (@LiveSquawk) April 9, 2025

Updated at 10:46 AM EDT

Bottom fishing

Stocks are building gains in the opening hour, but elevated levels of volatility, in both the bond and equity markets, has investors on edge amid the escalating global trade war triggered by President Donald Trump.

The S&P 500 was last marked 24 points, or 0.48% higher on the session, with the Nasdaq rising 187 points, or 1.22%. The Dow was last seen 8 points higher.

“Markets are telling us there are buyers waiting in the wings for the faintest whiff of constructive news on tariffs, as we have seen in this week’s intraday movements,” said Carol Schleif, chief market strategist at BMO Private Wealth in Minneapolis.

“It may be a little too soon to bottom fish broadly, but for those with a very long term view and strong stomachs, putting a shopping list together is a viable consideration,” she added.

Volatility breeds uncertainty, and uncertainty gives birth to pessimism.Dumb Money Confidence has plunged, while Smart Money Confidence has jumped.The spread between them is now 2nd only to the re-opening after the 9/11 attack. pic.twitter.com/K84bbMOABP

— Jason Goepfert (@jasongoepfert) April 9, 2025

Updated at 9:38 AM EDT

Mixed open

The S&P 500 was marked 19 points lower, or 0.41%, while the Nasdaq gained 45 points, or 0.28%.

The Dow, meanwhile, fell 252 points with the Russell 2000 down 13 points, or 0.75%.

The VIX index surged past $54 in early trading, but was last marked at $52.01, suggesting daily swings of around 3.25%, or 160 points, for the S&P 500.

“While most hard data, including last week’s jobs report, suggests the US economy is still on relatively solid ground, financial markets remain volatile, reflecting potential tremors beneath the surface,” said Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team.

“Tariffs remain top of mind, and we don’t have much more clarity about them than we did before last week’s announcement,” he added. “Until we get it, stocks may have difficulty gaining traction. But this isn’t a time for investors to abandon a long-term outlook. We’re in one of those challenging, but inevitable, periods of volatility that investors have to navigate to reach their goals.”

S&P 500 Opening Bell Heatmap (Apr. 09, 2025)$SPY -0.37% 🟥 $QQQ +0.23% 🟩$DJI -0.71% 🟥 $IWM -0.66% 🟥 pic.twitter.com/LDP0SDFMOB

— Wall St Engine (@wallstengine) April 9, 2025

Updated at 8:05 AM EDT

Turmoil in Treasuries

Bond markets continued their worst selloff in five years, with benchmark 10-year Treasury note yields rising to 4.461% in early Wednesday trading heading into a key $39 billion auction later in the session.

Treasury Secretary Scott Bessent, speaking to Fox News, described the moves as “normal deleveraging” that aren’t an indication of systemic concerns in the world’s biggest financial market.

“Investors began to question whether U.S. government debt still qualifies as a reliable safe haven amid geopolitical and fiscal uncertainty,” said David Morrison, senior market analyst at Trade Nation.

“But there are also concerns of forced selling amid fears that something has come untethered in the complex financial plumbing on which all markets are based,” he added.

“In addition, this steep rise in yields adds to broader market pressure and raises questions about how long risk assets can stay supported if borrowing costs continue to rise.”

Related: Bond markets whipsaw amid ‘sell America’ trade in safe-haven Treasuries

Updated at 7:05 AM EDT

China counter-punch

Stocks turned sharply lower in premarket trading after China’s Finance Ministry said it would impose an additional 84% tariff on U.S.-made goods in response to the 104% levy put in place by President Donald Trump earlier this week.

Futures tied to the S&P 500 now suggest an 85 point opening bell decline, with the Dow called 630 points lower and the Nasdaq priced for a 172 point slump

BREAKING: CHINA ANNOUNCES ADDITIONAL TARIFFS OF 84% ON US GOODS BEGINNING APRIL 10TH.WOW.

— The Kobeissi Letter (@KobeissiLetter) April 9, 2025

Stock Market Today

Stocks ended sharply lower on Tuesday following a volatile session that included a 360 point peak-to-trough swing for the S&P 500, one of the largest on record. The benchmark closed below the 5,000-point mark for the first time in more than a year.

The Nasdaq, now 25% south of its mid-December peak, fell 2.15% yesterday as China-sensitive stocks such as Apple (AAPL) and Tesla (TSLA) tumbled ahead of President Trump’s decision to impose a crippling 104% levy on goods from the world’s second-largest economy.

The midcap Russell 2000 index, meanwhile, entered bear-market territory at the close, defined as a 20% retreat from its recent peak, suggesting elevated odds of a U.S. recession over the next 12 months.

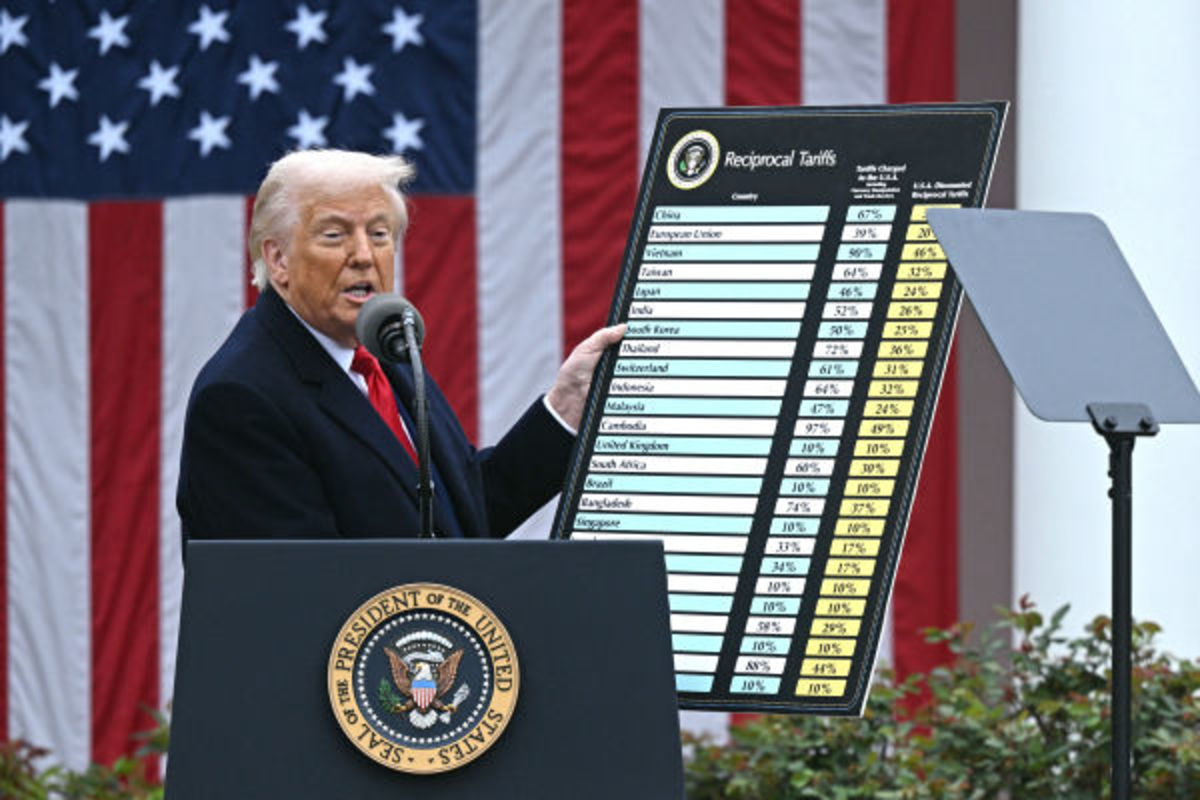

President Donald Trump’s sweeping tariffs, including a crippling 104% levy on China-made goods, kicked-in today at one minute past midnight.

President Donald Trump’s sweeping tariffs, including a crippling 104% levy on China-made goods, kicked-in today at one minute past midnight.

BRENDAN SMIALOWSKI/Getty Images

Markets are braced for a similarly wild session today, with CBOE Group’s VIX volatility index pegged at $48.63, near the highest in five years. The level suggests daily swings of around 3.05%, or 150 points, for the S&P 500.

Bond market volatility gauges are also on the rise, with Merrill Lynch’s Options Volatility Estimate, known as the MOVE index, trading at the highest levels in a year.

The index reading comes amid a violent bond market selloff that has added around 40 basis points to benchmark 10-year note yields over the past week.

The paper was last marked at 4.376% heading into the start of the New York trading session and a key $39 billion auction of reopened notes later in the session.

Related: 10-year bond auction will provide key test to Trump’s tariff strategy

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which has suffered the largest five-day loss since the index was established in the 1950s, suggest an opening bell decline of around 22 points.

Futures linked to the Dow Jones Industrial Average, meanwhile, are priced for a 255 point slump while the Nasdaq is called for a 10 point bump.

Stocks overseas are also in retreat, with Europe’s Stoxx 600 falling 14 points, or 2.82%, to drag the regional benchmark to within touching distance of bear-market territory. Britain’s FTSE 100, meanwhile, fell 2.4% in London.

Overnight in Asia, the Nikkei 225 slumped 3.93% on the first day of Trump’s so-called reciprocal tariffs on Japanese goods kicked in, pinning the index at its lowest levels since August.

The regionwide MSCI ex-Japan benchmark, meanwhile, fell 1.21% into the close of trading.

More Economic Analysis: