This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Wednesday. This is TheStreet’s Stock Market Today for Dec. 10, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 9:34 a.m. ET

Opening Bell

The U.S. markets are now open. The Dow (-0.05%) and S&P 500(-0.09%) are down just a few basis points this morning, while the Russell 2000 (-0.13%) and Nasdaq (-0.30%) are seeing slightly deeper losses as traders await the fruits of the Fed’s highly anticipated policy meeting.

At the same time, the Cboe Volatility Index is heading a little higher this morning, up 3% to 17.43. That’s not notably by itself.

Much attention will be paid to the Fed’s expected trajectory going forward, as well as possible interventions to stabilize the market. However, as President Donald Trump prepares to announce a new Fed Chair to replace an outgoing Jerome Powell, traders might hold off on big decisions today.

Aside from the Fed’s big decision, there’s a bunch of news to digest this morning. Here are some of the highlights:

Meta To Direct Attention Away From Open Source AI

Tech giant Meta made itself an early contender in AI with models like LLaMA, but the firm’s days as an open source hero might be numbered as it focuses ‘money-making’ models.

After spending billions on acquiring talent from competitors and billions more on infrastructure, the company has blown through its cash position — and Bloomberg and NYT report that CEO Mark Zuckerberg is focusing its new AI model, Avocado, over open source alternatives.

The reports come days after a report said the company would pale back its investment in its beleaguered VR investments, which were capped by a report today that the company would increase prices on its virtual reality devices next year as well.

Update: 8:04 a.m. ET

A.M Update: Cut O’Clock

Good morning. Today is the day that traders have been waiting for: the day of the Fed’s interest rate decision. However, aside from that, the market has a few other possible revelations in store for us today — namely on the AI front — as tech giant Oracle is set to report.

Here’s what is on deck for today, aside from the obvious:

Earnings Today: Oracle, Adobe, Synopsys

Per Nasdaq, there’s over 30 reports slated for today. Among them will be Oracle, Adobe, and Synopsys — all of them offering unique perspectives on the state of the AI boom.

Here are the reports that are from firms with at least $1 billion:

Economic Data + Events: Fed Time

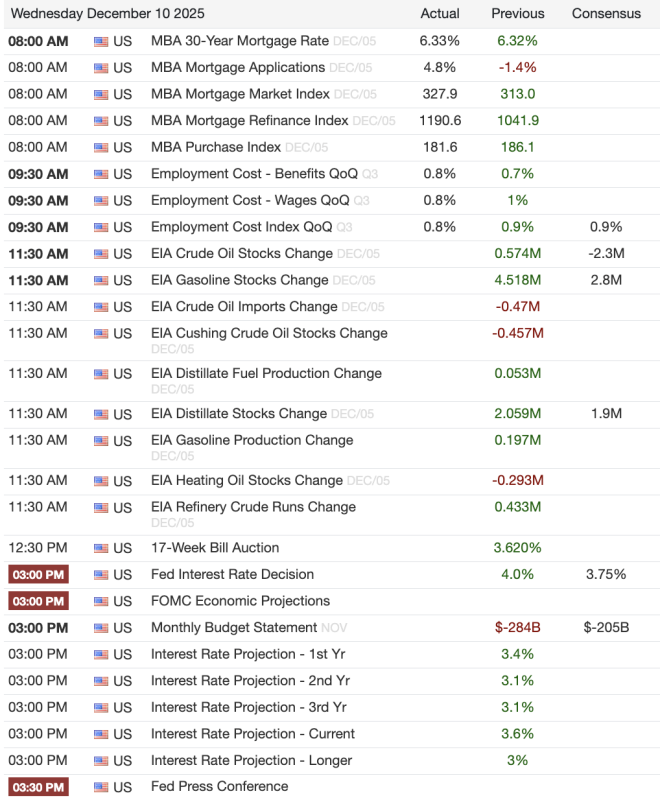

As most already know, the Fed is slated to announce its interest rate decision around 3 p.m. ET, just before the market close. However, between now and then, we’ve got a long list of economic data and reports to work through.

Here’s what is on deck, per TradingEconomics: