It’s the first day of August, and stocks appear set to continue yesterday’s slide. S&P 500 futures are trading lower by nearly 0.8% and Nasdaq futures are off more than 0.92%.

The reason? As it’s been for so many days this year: tariffs. As Stephen Guilfoyle reports over on TheStreet Pro, “President Trump signed an executive order on Thursday revising tariffs on many nations around the planet that had failed to reach new trade deals with the U.S.

“The new rates will run from 10% to 41%. The White House informed trading partners that any goods transshipped in order to evade these new duties will face an additional tariff of 40%.”

He goes on to say, “As for the nations most commonly traded with that have not reached deals, goods from Taiwan will be hit with a 20% rate, lower than the 32% that had been threatened, as Canadian goods will face tariffs of 35%, up from 25%. Goods that qualify for preferential treatment under the USMCA agreement will continue to be eligible for duty-free import.

Fed Chairman Jerome Powell again heard President Trump demanding lower interest rates.

Fed Chairman Jerome Powell again heard President Trump demanding lower interest rates.

Chip Somodevilla/Getty Images

“President Trump has announced a new 90-day extension for goods imported from Mexico after having what he called a ‘very successful’ conversation with Mexican President Claudia Sheinbaum.”

As a result of the selling, Guilfoyle calls yesterday a potential “Day One” bearish reversal and says selling today will count as a continuation day, offering confirmation that a reversal is at hand.

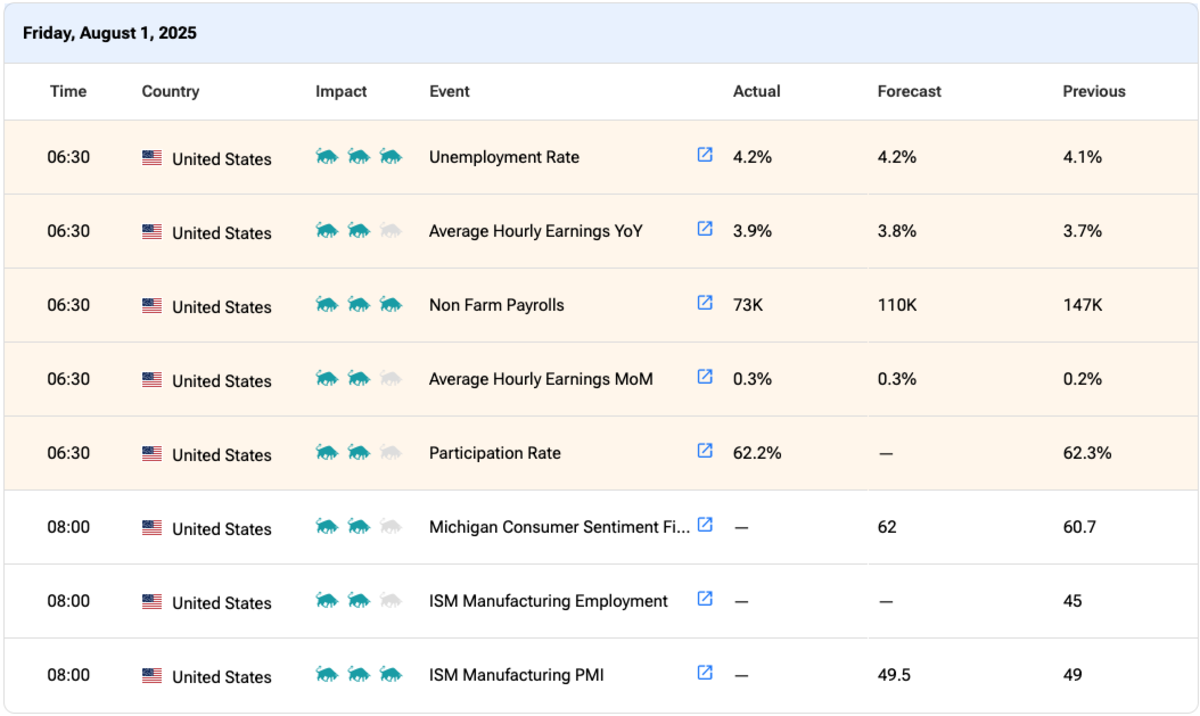

Adding fuel to the bearish fire, jobs data are out today. The Bureau of Labor Statistics reports that total nonfarm payroll changed little in July. The unemployment rate came in at 4.2%, as expected, but nonfarm payrolls increased just 73,000, which was around one-third below expectations. Combined with downward revisions for prior months, we’re seeing a slowing employment picture.

All times shown Mountain. Add 2 hours for Eastern Time Zone

All times shown Mountain. Add 2 hours for Eastern Time Zone

The bond market shot higher on the news, with the 10-year treasury rallying by nearly 0.7%, sending yields lower to 4.27%. Additional bond market news is that the president is calling on the Federal Reserve Board to seize control from Chairman Jerome Powell if rates are not cut.

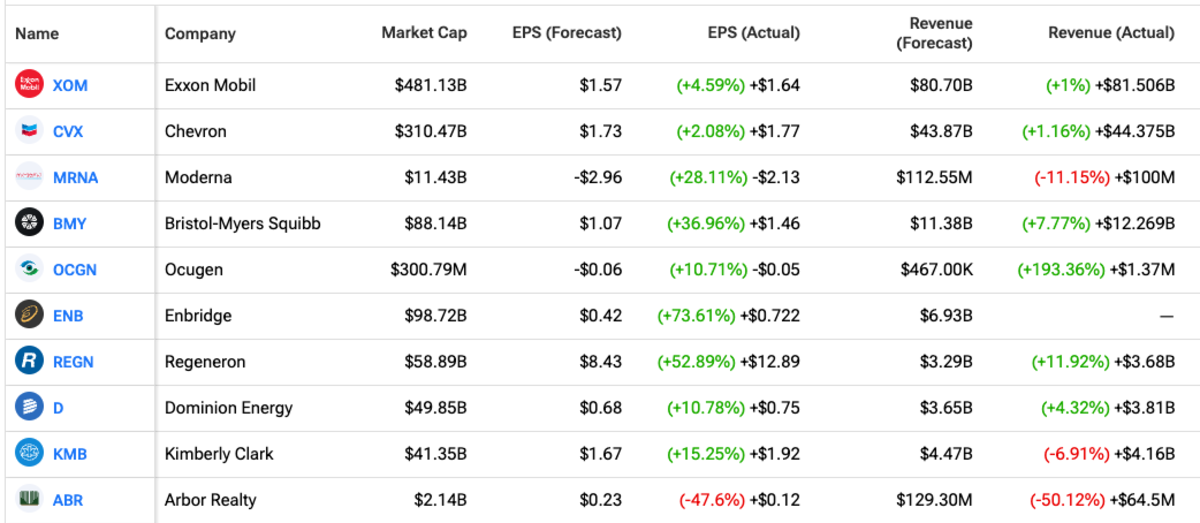

We’ve got earnings today, too. Exxon Mobil (XOM) and Chevron (CVX) both reported better than expected results and are trading higher. Several drug companies reported today, too, but expect the big news for them to be out of the White House, where Trump issued a 60-day ultimatum for drug prices to be cut.

Here are the top 10 reports by market cap.