Many gig workers and small-business owners are told to open what’s known as a solo, or one-participant, 401(k). Fewer are told why it can be one of the most powerful retirement savings tools available to people who work for themselves.

The short answer is contribution limits. A solo 401(k) allows eligible business owners to save far more than they could in an IRA and, in many cases, more than in a traditional workplace 401(k).

The IRS defines a one-participant 401(k) as a plan covering a business owner with no employees other than a spouse. These plans are often referred to as solo 401(k)s, solo Ks or uni-Ks.

Gig workers and small-business owners often overlook the solo 401(k). Here’s how the 2026 contribution limits work and why some high earners can bypass a new catch-up rule.

Gig workers and small-business owners often overlook the solo 401(k). Here’s how the 2026 contribution limits work and why some high earners can bypass a new catch-up rule.

What’s the appeal of solo 401(k) plans?

What makes the solo 401(k) especially attractive is how contributions work. The business owner effectively wears two hats, employee and employer, and can contribute in both roles.

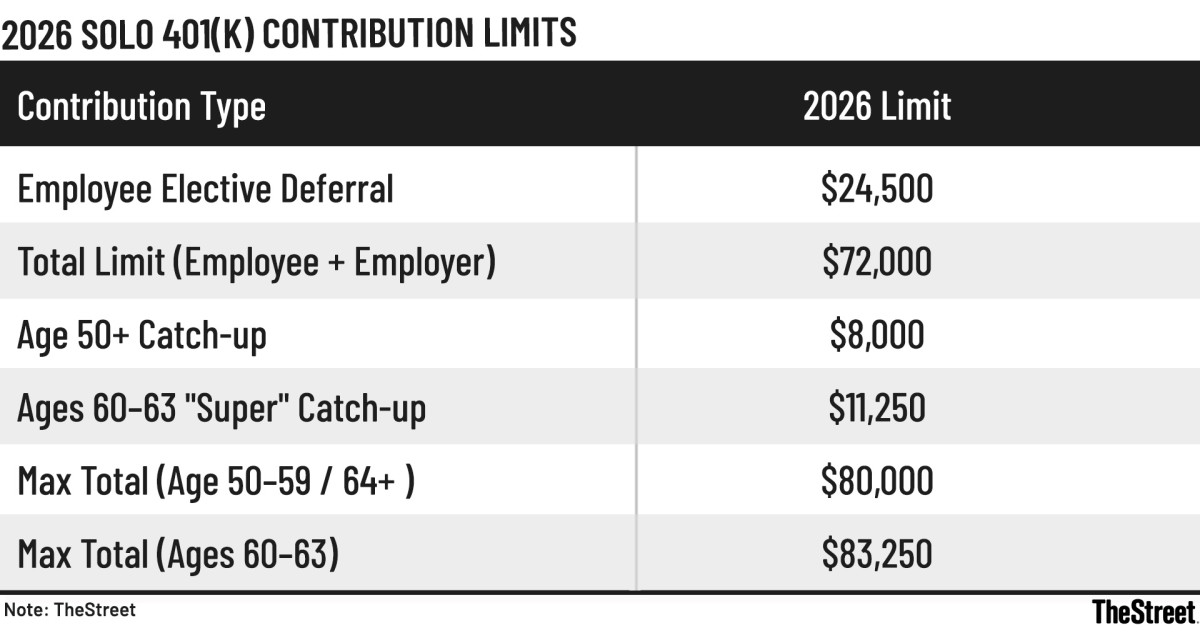

As the employee, the owner can make elective deferrals of up to 100% of compensation, or earned income for the self-employed, capped at the annual deferral limit. For 2026, that limit rises to $24,500. The combined employee and employer contribution limit climbs to $72,000 before any catch-up contributions, according to Fidelity Investments.

As the employer, the owner can make nonelective contributions of up to 25% of compensation, as defined by the plan. The calculation differs slightly for self-employed individuals, as explained below.

Related: Medicare mistakes seniors wish they’d known sooner

Taken together, those limits allow a high-earning solo entrepreneur to shelter up to $72,000 in 2026. For those eligible for catch-up contributions, the total can reach $83,250.

There is an important caveat for business owners who also participate in a 401(k) through another employer. Elective deferral limits apply per person, not per plan. Deferrals made to any 401(k) during the year count toward the same annual cap.

Calculating contributions is more complex for self-employed individuals. The IRS requires a special computation to determine the maximum elective deferrals and employer contributions you can make for yourself.

In this case, compensation is defined as earned income, which means net earnings from self-employment after subtracting one-half of your self-employment tax and any contributions made on your behalf.

That complexity is one reason advisers say many solo workers underfund these plans or avoid them altogether. For those willing to do the math or get help, the payoff can be substantial.

In practical terms, here are the key rules solo entrepreneurs need to understand.

TheStreet

Employee deferral limits for 2026 (solo 401(k))

When acting as the employee, a business owner can make elective deferrals up to the annual IRS cap. For 2026, those limits rise with inflation.

- Base employee salary-deferral limit: $24,500 in 2026. This limit applies per person, not per plan, and includes all 401(k) or 403(b) plans in which you participate during the year.

- Flexibility of choice: Deferrals can be made on a pre-tax basis, as Roth contributions, or as a combination of the two.

Total solo 401(k) contribution limit (employee plus employer)

The real power of the solo 401(k) lies in the combined contribution limit. Because the business owner acts as both employee and employer, the total amount that can be saved is far higher than in most workplace plans.

- Combined limit: For 2026, the total per-person contribution limit is $72,000, before catch-up contributions.

- Employer contribution math: While employee deferrals are capped at $24,500, employer profit-sharing contributions are generally limited to 25% of compensation, or about 20% of net self-employment income for sole proprietors. Regardless of income level, the combined total cannot exceed the $72,000 ceiling.

Enhanced catch-up opportunities under SECURE 2.0

For those nearing retirement, 2026 includes a tiered catch-up structure created by the SECURE 2.0 Act.

- Standard catch-up (ages 50-59 and 64+): The catch-up contribution is $8,000 for 2026. That raises the maximum employee deferral to $32,500 and the overall solo 401(k) limit to $80,000.

- “Super” catch-up (ages 60-63): Individuals in this age band can make an enhanced catch-up contribution of $11,250.

Maximum employee deferral: $35,750.

Maximum total Solo 401(k): $83,250, assuming income supports it.

A note on the $150,000 Roth catch-up rule

SECURE 2.0 requires high earners with prior-year W-2 wages above $150,000 to make catch-up contributions on a Roth basis. In practice, this rule does not apply to most self-employed solo 401(k) owners because they do not receive wages subject to FICA in the traditional sense.

That exemption is one reason the solo 401(k) remains especially attractive for high-earning independent workers.

Even so, solo plans are more complex than IRAs and often more complicated than employer-sponsored 401(k)s. That complexity explains why account owners frequently have questions about eligibility and setup, contribution limits, Roth versus pre-tax strategies, the $150,000 catch-up rule, loans, rollovers, mega backdoor Roth conversions, and ongoing reporting and compliance.

The most common solo 401(k) questions, answered

With the rules laid out, the next challenge for many solo entrepreneurs is applying them in real life. The appeal of a solo 401(k) is clear. So is the complexity, which helps explain why questions about eligibility, Roth rules, reporting, and compliance often arise only after a plan is in place.

Sarah Brenner, director of retirement education at Ed Slott & Co., said the following are among the most common solo 401(k) questions her firm hears from advisers.

Is a solo 401(k) a separate type of 401(k) plan?

No. A one-participant 401(k) is not a distinct plan type. It is simply a 401(k) that covers a business owner with no employees, or the owner and a spouse. The same core rules and requirements that apply to other 401(k) plans apply here as well.

What makes solo 401(k)s unique?

The defining feature is that the business owner wears two hats, employee and employer. That allows contributions in both roles: elective deferrals as the employee and profit-sharing contributions as the employer. Each contribution type has its own limits, and both are subject to an overall annual cap.

How does the mandatory Roth catch-up rule apply to solo 401(k)s?

Beginning in 2026, certain older, higher-paid employees who want to make catch-up contributions must do so on a Roth basis. The rule applies to those with prior-year W-2 wages above $150,000. But it generally does not apply to self-employed solo 401(k) owners because they do not receive wages subject to FICA.

Does a solo 401(k) sponsor have to file Form 5500?

A solo 401(k) sponsor never files a full Form 5500. However, Form 5500-EZ must be filed once plan assets exceed $250,000 at the end of a plan year, or in the year the plan is terminated, even if assets are below that threshold.

Does nondiscrimination testing apply?

No. Because there are no non-owner employees, nondiscrimination testing is not required.