In retirement, you’ll likely need to replace about 40% of your pre-retirement income from sources such as IRAs, 401(k)s, and employer-sponsored pensions. That’s generally what it takes to sustain a lifestyle comparable to the one you enjoyed while working.

Given that, it’s worth carefully considering where you live in retirement – especially since some states tax these income sources heavily, while others offer full or partial exemptions. Choosing a tax-friendly state could help your retirement savings go further.

This article is part of an ongoing series examining how states tax various sources of income, including Social Security benefits, retirement account distributions, defined benefit pensions, investment income (capital gains, dividends, interest), earned income, pass-through income (K-1), rental income, and other income typically reported on Form 1099.

In this installment, we focus on which states are most tax-friendly when it comes to income from retirement accounts and pensions.

💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰

Here are the states where your retirement income goes furthest.

Here are the states where your retirement income goes furthest.

Image source: Olegs Jonins on Unsplash

State taxes on retirement income: What retirees need to know

The tax treatment of retirement and pension income varies significantly across states, according to Tim Bjur, a senior content management analyst at Wolters Kluwer. Broadly speaking, states fall into one of four categories:

- Some impose no state income tax at all.

- Others exempt all or some retirement income.

- A few offer tax credits for retirement income.

- And some tax all or most of it.

Bjur notes that while states typically introduce numerous bills each year to reduce the tax burden on retirees, no significant changes have been enacted since 2023. That year, two notable updates occurred:

- Michigan began phasing out its complex three-tier retirement income tax structure, which was based on birth year and federal adjusted gross income (AGI), with capped deductions for Tiers 2 and 3.

- Rhode Island raised the exemption cap on retirement income to $50,000, effective in the 2025 tax year.

A few states also made minor adjustments to military retirement income tax rules by expanding eligibility to more branches of the armed forces.

Why the pause in broader tax reform? Bjur believes it’s tied to uncertainty about federal tax policy and its potential impact on state revenues. Still, he points out that some states – like Kansas, which taxes most retirement income – are pursuing general income tax cuts that could benefit retirees, even without specific changes to retirement income taxation.

Related: How the IRS taxes Social Security income in retirement

States with the most favorable tax treatment

Nine states do not tax individual income, including retirement income:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Four states exempt all or most retirement income:

- Illinois

- Iowa

- Mississippi

- Pennsylvania

Twenty states offer partial exemptions or deductions, often with AGI-based phaseouts:

- Alabama

- Arkansas

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Kentucky

- Louisiana

- Maine

- Maryland

- Michigan

- Missouri

- New Jersey

- New York

- Oklahoma

- Rhode Island

- South Carolina

- Virginia

- Wisconsin

Fourteen states and the District of Columbia tax most or all private retirement income:

- Arizona

- California

- District of Columbia

- Idaho

- Indiana

- Kansas

- Massachusetts

- Minnesota

- Montana

- Nebraska

- New Mexico

- North Carolina

- North Dakota

- Vermont

- West Virginia

Three states offer tax credits for retirement or pension income:

- Ohio

- Oregon

- Utah

Special rules for military and government pensions

Some states offer full or partial exemptions for:

· Military retirement pay (e.g., Hawaii, Indiana, Oklahoma: fully exempt)

· Federal government pensions (e.g., Maryland, Kentucky: special exemptions)

· Railroad Retirement Benefits (exempt in nearly all states)

The shifting landscape of retirement income

By way of background, 26.3 million retired Americans — and their beneficiaries — received pension income from public and private sector plans in 2022, according to the National Institute on Retirement Security.

Meanwhile, IRAs continue to play a pivotal role in retirement savings. By mid-2024, 57.9 million U.S. households — about 43.8% — owned IRAs, according to the Investment Company Institute. Among households with traditional IRAs, 31% took withdrawals in tax year 2023 — and 90% of those were retired. Of these retirees, approximately 73% withdrew only the required minimum distribution — or RMD.

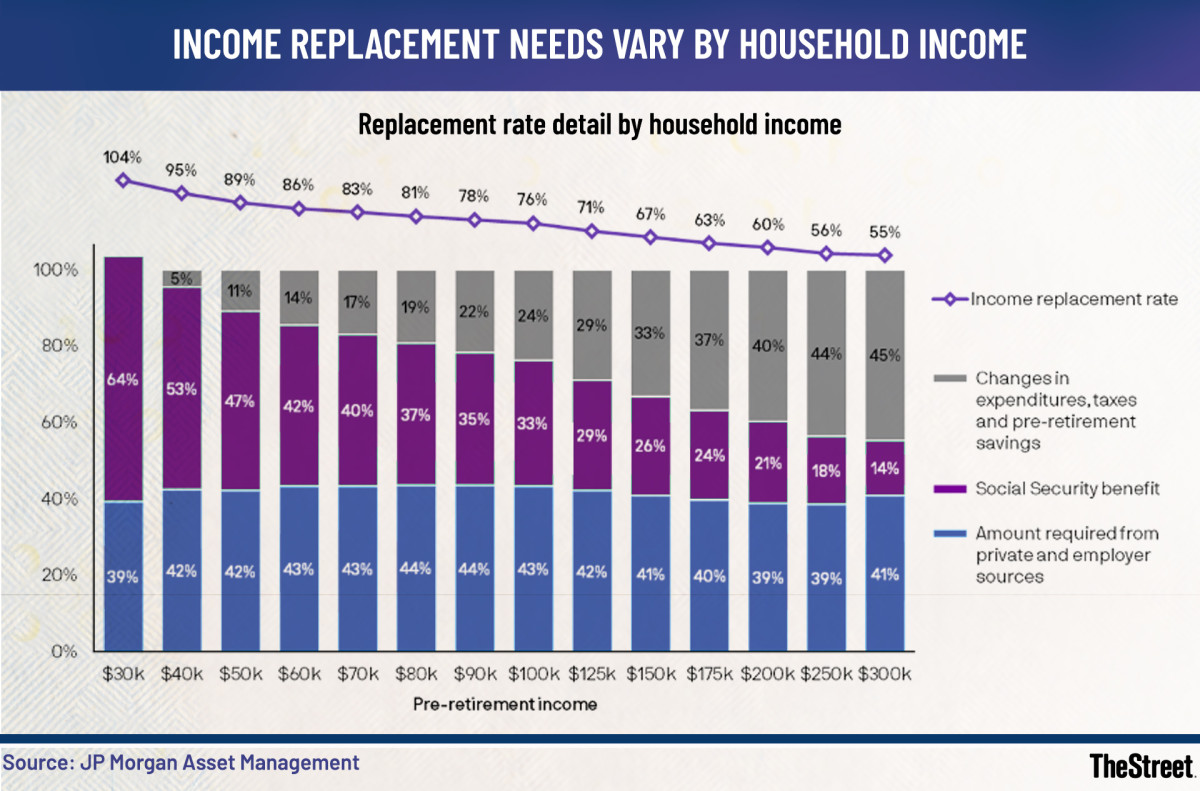

According to J.P. Morgan Asset Management, you’ll likely need to replace around 40% of your pre-retirement income from sources like IRAs, 401(k)s, and employer-sponsored pensions. That’s typically what’s needed to maintain a standard of living comparable to what you had while working.

Income replacement needs vary by household income Chart

Income replacement needs vary by household income Chart

Planning opportunities for retirees

Jean-Luc Bourdon, a wealth advisor with Lucent Wealth Planning, notes that pension income offers limited tax-planning flexibility. As a result, moving to a more tax-friendly state is often one of the most effective ways for pensioners to reduce their tax burden.

In contrast, IRA and 401(k) holders have more options:

- Qualified Charitable Distributions (QCDs) can reduce the tax impact of Required Minimum Distributions (RMDs).

- Strategic Roth conversions during low-income years or market downturns can help manage long-term tax liability.

For those considering relocation, Bourdon suggests targeting low-tax states that offer additional lifestyle benefits. “Arizona, for instance, combines a favorable flat 2.5% income tax rate with abundant sunshine,” he said.

Related: These are the most tax-friendly states if you work in retirement