Ever since the end of World War II, owning a home has been the cornerstone of the “American Dream,” the most tangible symbol of success in a society that valued hard work.

But a lot has changed since the passage of the GI Bill, which made mortgages more accessible for millions of Americans, although owning a home remains the main wealth-building source for middle-class Americans.

For many young people today, faced with economic realities that did not exist for earlier generations, this once-unquestionable goal feels increasingly out of touch.

Why is homeownership so difficult for young people?

One reason is that home-price inflation has far outpaced wage growth. According to NPR, it used to be common to find a home that cost three times a buyer’s annual income, but the COVID-19 pandemic skewed that ratio sharply higher. Now, median home prices are five times the median household income.

This has increased the amount of money a first-time buyer needs, not only for a down payment, but also for a higher average ongoing monthly mortgage payment.

Compounding the problem are high interest rates (around 6–7% for mortgages as of early 2026) and tight inventories, which have intensified competition and sparked bidding wars, further inflating prices.

All of these reasons are why Ramit Sethi’s advice to new homebuyers may be met with welcome relief.

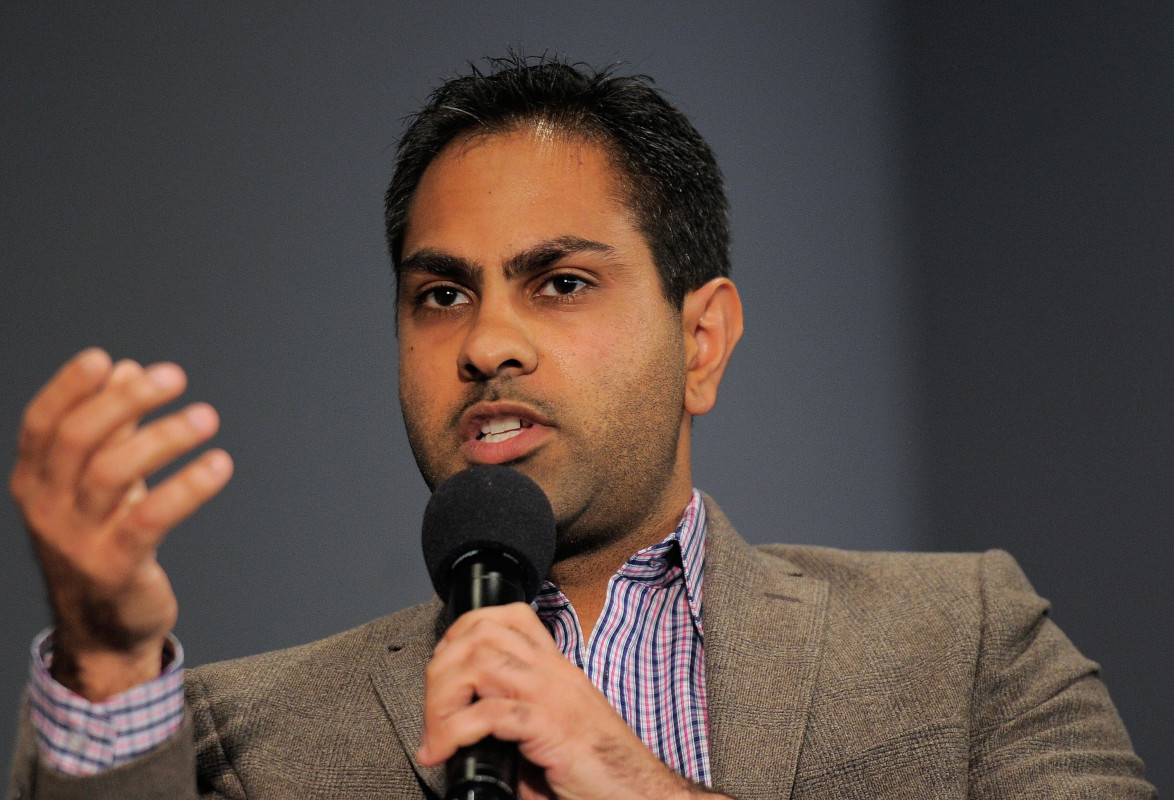

Ramit Sethi became a millionaire in his 20s, and now he helps others better understand their finances.

Ramit Sethi became a millionaire in his 20s, and now he helps others better understand their finances.

Photo by Jemal Countess on Getty Images

Who is Ramit Sethi? Why is he an iconoclast?

Sethi, a popular podcaster and financial guru, became a millionaire in his 20s. While studying psychology and sociology at Stanford University, he founded his own financial education company, I Will Teach You to Be Rich, which has helped millions of people get out of debt, build long-term wealth, and even make money on the side.

The insights of Sethi, a Millennial, often fly in the face of Boomer pundits like Dave Ramsey and Suze Orman, who emphasize deprivation and frugality—think cutting up your credit cards—to achieve financial stability.

Sethi believes you don’t have to starve yourself to save for your future.

And you don’t need to own a home to amass substantial net wealth, either.

“What’s the point of buying a house?” This is a great video! #tiktokreviews #rentvsbuy #rentingorbuying #howtogetrich #iwillteachyoutoberich

Ramit Sethi’s 5 best pieces of advice for homebuyers?

When discussing real estate, Sethi pairs emotionally intelligent insights with “opportunity cost” thinking, particularly around the question of whether to buy or rent. Sethi himself is a lifelong renter, having professed to have invested what would have been his down payment in low-cost index funds long ago.

With his estimated net worth of at least $25 million in 2026, you could say that this strategy has worked out nicely for Sethi.

Here are his top 5 insights:

1. Run the numbers before you buy

On a 2024 episode of Steven Bartlett’s “Diary of a CEO” podcast, Sethi emphasized the importance of understanding the total cost of owning a home, including closing fees, property taxes, insurance, utilities, and estimated maintenance.

That number may be far higher than you think—it might even top $1 million, according to Sethi.

These “phantom costs,” as he calls them, aren’t readily apparent up front, but they materially affect your long-term return, and Sethi believes they could be adding as much as 30–50% to the monthly expenses of owning a home.

2. Adopt a long-term approach

Sethi encourages people to consider how long they will actually be residing in their home before they purchase it: If it’s less than 10 years, he says, they should consider renting instead.

That’s because the fees associated with buying and selling the home will erase any equity you gain, he explained on his blog.

Consider the fact that it costs approximately 10% to sell your home, he adds, and you could actually be losing money on the whole endeavor.

“Don’t give in to peer pressure to buy a house if you might not stay there for the long term. If you know you’ll move in fewer than 10 years, you will likely make more money by renting and investing in S&P index funds,” he says.

3. The 28/36 Rule

“When it comes to personal finance, I like to be aggressive in certain areas, like investing,” Sethi writes on his blog. “However, when it comes to real estate, I’m typically as conservative as possible.”

After all, what good is owning a home if you can’t do anything else?

More on personal finance:

- Ramit Sethi’s top 5 ways to get out of debt fast

- Clark Howard’s 5 best financial tips for smarter spending, saving & investing

- Ramit Sethi’s 5 best financial insights for building a rich life

To avoid being house poor, Sethi encourages people to follow the 28/36 Rule, a formula used by lenders to determine how much house a person can afford—and how much risk they are shouldering.

- Your maximum monthly household expenses should not be greater than 28% of your gross monthly income. An example he provides is that if your gross income is $4,000 a month, the most your mortgage should be is $1,120 a month.

- Your debt-to-income ratio should not be more than 36%. You can calculate this by dividing your monthly debt expense by your gross monthly income.

Sethi notes that while 36% is the ideal maximum number, most lenders out there will grant people a mortgage with debt-to-income ratios up to 49%—and that’s simply too risky.

“If you make a poor financial decision upfront, you’ll end up struggling — and it can compound and become a bigger problem throughout the life of your loan,” he cautions. “Don’t let this happen, because it will undo all the hard work you put into the other areas of your financial life.”

4. Aim for that 20% down payment

Paying 20% of your home’s price up front is the standard for homebuyers because it’s the minimum lenders require to avoid Private Mortgage Insurance (PMI).

After all, a mortgage is a private loan, and homebuyers aren’t the only ones incurring risk. Every transaction exposes lenders to significant risks, too—such as credit risk, when homebuyers default on their loans, leading to costly foreclosures.

While Sethi recommends you save up that 20%, conventional lenders only require a minimum down payment of 9%, and FHA loans require as little as 3.5% down.

Sethi wants people to avoid these types of mortgage products because written in the “fine print” is the fact that they come with additional, long-term costs. (After all, lenders are in business to make a profit.)

He also advises people to have an emergency fund equal to at least six months of home expenses, in addition to their down payment and closing costs, before they take on a home investment.

5. Understand that the housing market doesn’t always go up

Case in point, during the Financial Crisis of 2008, average home prices fell 18.2% nationwide. According to Wikipedia, this was the largest price drop in the history of the Case-Shiller Index, which measures changes in U.S. residential real estate values, and it only happened 18 years ago.

In this video, Sethi debunks the myth that a house doubles in value every ten years. Even if prices do increase, he cautions homebuyers to beware of the harsh reality that the expenses of owning and maintaining their home will, too.

Nasdaq sums up his philosophy well by stating that Sethi believes a home “should be looked at as a ‘purchase’ first and an ‘investment’ second,” one that often comes with high risk and low returns.

Sethi says he’s just trying to help people understand the many “myths and propaganda to be aware of BEFORE deciding to buy.”

He adds: “Renting has been a better financial decision for me than buying.”