There’s a new face in the race.

President Donald Trump said Aug. 5 he still has four candidates on tap to replace his nemesis Jerome Powell as chair of the Federal Reserve.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

But this comes after one of the top names under consideration asked to be removed from the short list of nominees the evening of Aug. 4.

Related: A divided Federal Reserve mulls interest rate cut after wild week

At least two of the president’s four candidates have advocated for lower interest rates, a campaign that the president has been adamant is necessary to complement his administration’s efforts to keep the U.S. economy out of recession.

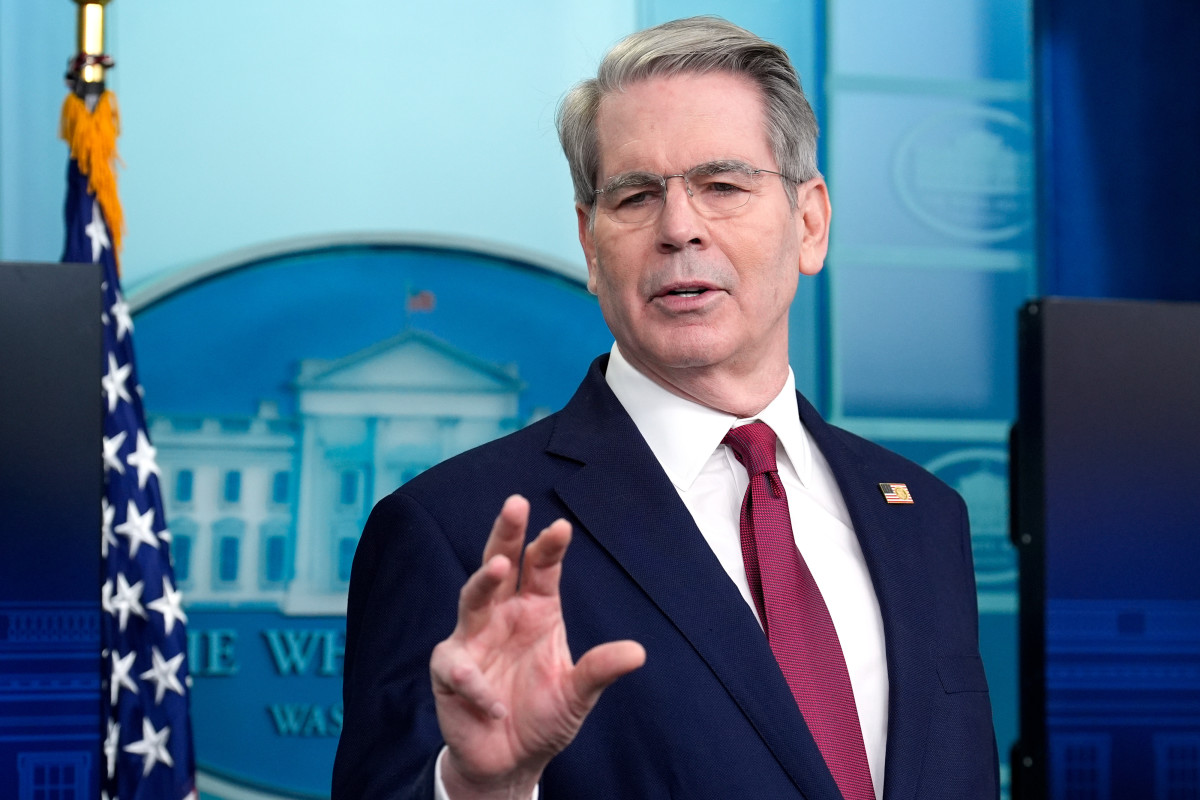

Treasury Secretary Scott Bessent dropped a surprise into President Trump’s efforts to name a replacement for Federal Reserve Chair Jerome Powell.

Treasury Secretary Scott Bessent dropped a surprise into President Trump’s efforts to name a replacement for Federal Reserve Chair Jerome Powell.

Image source: Bloomberg/Getty Images

Trump winnows the list of Fed chair candidates

Trump has narrowed the field of Powell replacements to four candidates, two of whom are former Fed Governor Kevin Warsh and key Trump ally Kevin Hassett, the director of the National Economic Council.

“Both Kevins are very good, and there are other people that are very good, too,” President Trump told CNBC.

Fed Governor Christopher Waller also is believed to be in the running to become Fed chair when Powell’s term as head of the central bank expires at the end of May.

Trump’s blazing attacks criticizing Powell have escalated since the Federal Open Market Committee last week voted to hold the benchmark Federal Funds Rate steady at 4.25% to 4.50%.

The last rate cut was in December 2024.

Waller and fellow Fed Governor Michelle Bowman, Trump appointees like Powell, opined last week that it was time for a .25% cut due to softness on the jobs front.

Hassett and Warsh have also come out in favor of lower rates.

Maximum employment and low inflation with price stability are the twin priorities — officially called the dual congressional mandate — of the Federal Reserve.

Related: Jobs report shocker resets Fed interest rate cut bets

These goals require a delicate balance of monetary policy because higher interest rates lower inflation but increase job losses, while lower interest rates lower unemployment but increase inflation.

The independent central bank uses interest rates as a tool to manage its dual mandate.

The recent “wait-and-see” approach reflects a cautious stance of monetary policy in a post-pandemic economy marked by persistent inflation and ongoing geopolitical uncertainties, including the lagging impact of the president’s tariffs on the supply chain and ultimately on consumers.

Trump-Powell flap escalates

President Trump has been demanding a massive and immediate reduction of 3 percentage points in the Federal Funds Rate to make it easier for Americans to borrow money.

He cites the slumping housing market as a key factor, plus the amount of interest on the nation’s $9 trillion deficit.

In his most frequent form of rhetorical name-calling, the president deems the Fed chair “Too Late Powell” for failing to slash short-term interest rates.

The President Trump has also demanded that Powell step aside, and even threatened to fire him.

The Supreme Court signaled in May that such a move to politicize the central bank would likely be illegal.

Related: Why the Federal Reserve matters so much

Powell has said he won’t resign before May, and declined to comment on the president’s remarks.

In return, the president has alluded that he would appoint a “shadow chair” to beef up the pressure on Powell and the FOMC.

President Trump chided Powell in the CNBC interview for allegedly telling him in the past, “I’ll keep interest rates so low. I’m a low interest rate person.”

He also called Powell a “political” person.

Thanks but no thanks: Scott Bessent

Treasury Secretary Scott Bessent, a one-time leading candidate to take over from Powell, took himself off the short list late Aug. 4, President Trump said.

“Well, I love Scott, but he wants to stay where he is,” Trump said. “I asked him just last night, ‘Is this something you want?’’’

The president said that Bessent, a former hedge fund manager, replied “Nope, I want to stay where I am…I want to work with you.’’

Trump described Bessent’s decision to stay at Treasury as “such an honor.”

“He likes being Treasury Secretary,” the president said, declining to name the fourth candidate for the role.

A final decision will be made “fairly soon,’’ President Trump said.

More Federal Reserve:

- GOP plan to remove Fed Chair Powell escalates

- Trump deflects reports on firing Fed Chair Powell ‘soon’

- Former Federal Reserve official sends bold message on ‘regime change’

Meanwhile, Fed Governor Adriana Kugle announced Friday that she is resigning effective this week to return to an academic appointment at Georgetown University.

Her early departure is a “pleasant surprise,” Trump said.

This opens the door for the president to place his potential chair replacement on the Fed earlier than expected.

Will the Fed cut interest rate in September?

The FOMC meets Sept. 17 to consider changes to the Federal Funds Rate.

The widely respected CME Group FedWatch Tool tracks the likelihood of a rate cut at 87.2%.

That figure rose significantly after Friday’s new and revised jobs reports from the Bureau of Labor Statistics showed significant cooling in hiring for July, June, and May.

(The president did fire the BLS commissioner over those numbers.)

Mary Daly, president of the San Francisco Federal Reserve Bank, said it may be time for the FOMC to consider a rate cut based on additional data on inflation and jobs due before Sept. 17.

She noted that the Fed’s “dot plot” in June showed a willingness by FOMC members to consider two .25% rate cuts before the end of the year.

“I think the more likely thing is that we might have to do more than two,” Daly told Reuters.