The legendary musical “Oklahoma!” opens with the classic song “Oh, What a Beautiful Morning.”

Verizon (VZ) was having a beautiful morning of its own on July 21, thanks in part to what President Donald Trump called the “One Big Beautiful Bill,” which he’d signed into law on July 4.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰

The telecom-services giant’s shares were climbing 4.5% at last check after the company beat Wall Street’s second-quarter earnings expectations.

Hans Vestberg, Verizon’s chairman and CEO, cited the recently passed bill during the company’s earnings call.

“Clearly, the tax reform is helping us to get faster to the priorities we have,” he told analysts. “So we feel good about that.”

Among other features, the tax reform enables companies to immediately deduct the cost of new manufacturing plants.

Verizon pays the highest cash taxes among major U.S. telecom companies, CNBC reported, citing Wells Fargo analysts, who said the tax law will provide a significant financial boost to the industry.

Verizon executives say the company got a boost from tax reform legislation.

Verizon executives say the company got a boost from tax reform legislation.

Image source: Shutterstock

Verizon CFO cites tax reform, raises guidance

“The second quarter demonstrated our ability to deliver strong financial results even in the period of elevated promotional activity and broad economic uncertainty,” Verizon Chief Financial Officer Anthony Skiadas said.

“Our strong operational execution in the first half of the year, coupled with favorable tax reform, gives us the confidence to increase our guidance for the full year.”

Verizon lifted its 2025 outlook for free cash flow to a range of $19.5 billion to $20.5 billion, driven by an estimated benefit of $1.5 billion to $2 billion from the tax legislation as well “as the disciplined operational execution that drove our strong adjusted Ebitda and free cash flow performance” in the first half.

More Tech Stocks:

- Amazon tries to make AI great again (or maybe for the first time)

- Veteran portfolio manager raises eyebrows with latest Meta Platforms move

- Google plans major AI shift after Meta’s surprising $14 billion move

“This past quarter, we achieved strong sales focusing on high-quality customers without overspending for growth,” he said. “Even with public sector challenges and ongoing consumer postpaid phone churn pressure, we maintained our financial discipline.”

Churn is the rate at which customers switch service providers. Skiadas said that last month Verizon launched initiatives designed to improve the customer experience, including leveraging artificial intelligence for more personalized support.

Wireless-service revenue rose 2.2% to $20.9 billion, the company said, while wireless equipment revenue totaled $6.3 billion, up 25.2%.

“I think the whole industry is up,” Vestberg said, adding that the company was “very encouraged about what the team is doing and how they are working on the loyalty and retention of our customers.”

He noted that AI Connect, the company’s suite of products for businesses to deploy AI workloads at scale, is “generating strong interest.”

“Our sales funnel has nearly doubled to $2 billion since launch earlier in the year,” Vestberg said. “This growth highlights a surging demand for high-bandwidth fiber capacity and diverse routes, both LIP and DOC fiber, to serve different customer needs.”

“As AI transitions from centralized training to widespread real-time applications, compute power at the network edge becomes essential,” he added.

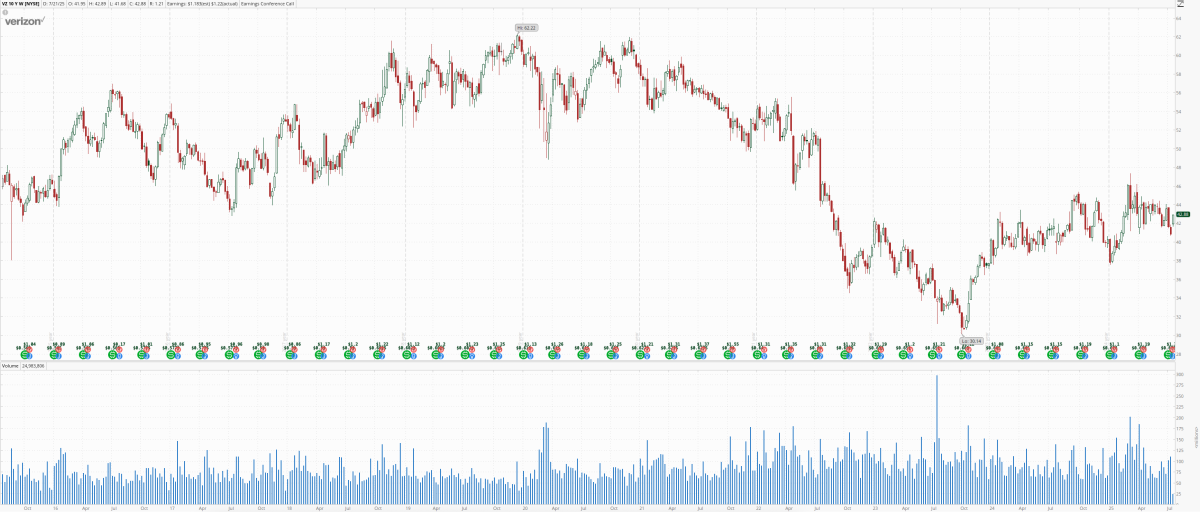

A 10-year chart of Verizon shares

A 10-year chart of Verizon shares

Verizon CEO points to AI transitions

Verizon shares are up nearly 7% this year and up 2.6% from a year ago.

Related: Verizon sends bold message to frustrated customers

In May the Federal Communications Commission approved Verizon’s $20 billion deal to acquire fiber-optic internet provider Frontier Communications after the company agreed to end its diversity, equity and inclusion programs.

“We’re encouraged by Frontier’s performance and look forward to closing the transaction to further accelerate our fiber expansion,” Vestberg said.

The deal is expected to close early next year.

Goldman Sachs analyst James Schneider said he expected Verizon’s stock to hold its gains following a quarter in which headline financial metrics were solid,, according to The Fly.

Schneider said VZ’s wireless trends were better than feared, even as management didn’t reiterate its guidance for improving net-subscriber-addition metrics.

Given that the company raised guidance when Wall Street expected a reiteration, the analyst says the stock could outperform in the short term since it believes investors were negatively positioned given their expectations for slower growth.

Schneider called encouraging Verizon’s result in earnings before interest, taxes, depreciation and amortization, and its free cash flow.

On the negative side, the wireless environment remains competitive, and the broadband market appears relatively weak overall, the investment firm said.

Goldman Sachs has a buy rating on VZ shares and a $52 price target.

Related: Fund-management veteran skips emotion in investment strategy