In the last six months, AI stocks have been anything but boring.

After a few years of massive gains, AI stocks kicked off the year getting slammed as a bubble. Talk of bloated valuations and too much hype had investors wondering if the party was over.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Then in April, President Donald Trump’s surprise tariffs crashed the market, pulling down the S&P 500 by nearly 19%.

AI bellwether stocks like Nvidia (NVDA) and Microsoft (MSFT) tanked, and many felt the AI rally was dead and buried.

Yet here we are with the S&P 500 at an all-time high, lifted by a roaring AI comeback driven by chip leaders and cloud giants.

Now one of Wall Street’s sharpest has AI back at the helm, pointing to two giants ready to win big.

A bold Nvidia, Microsoft stock prediction shows the AI boom’s power.

A bold Nvidia, Microsoft stock prediction shows the AI boom’s power.

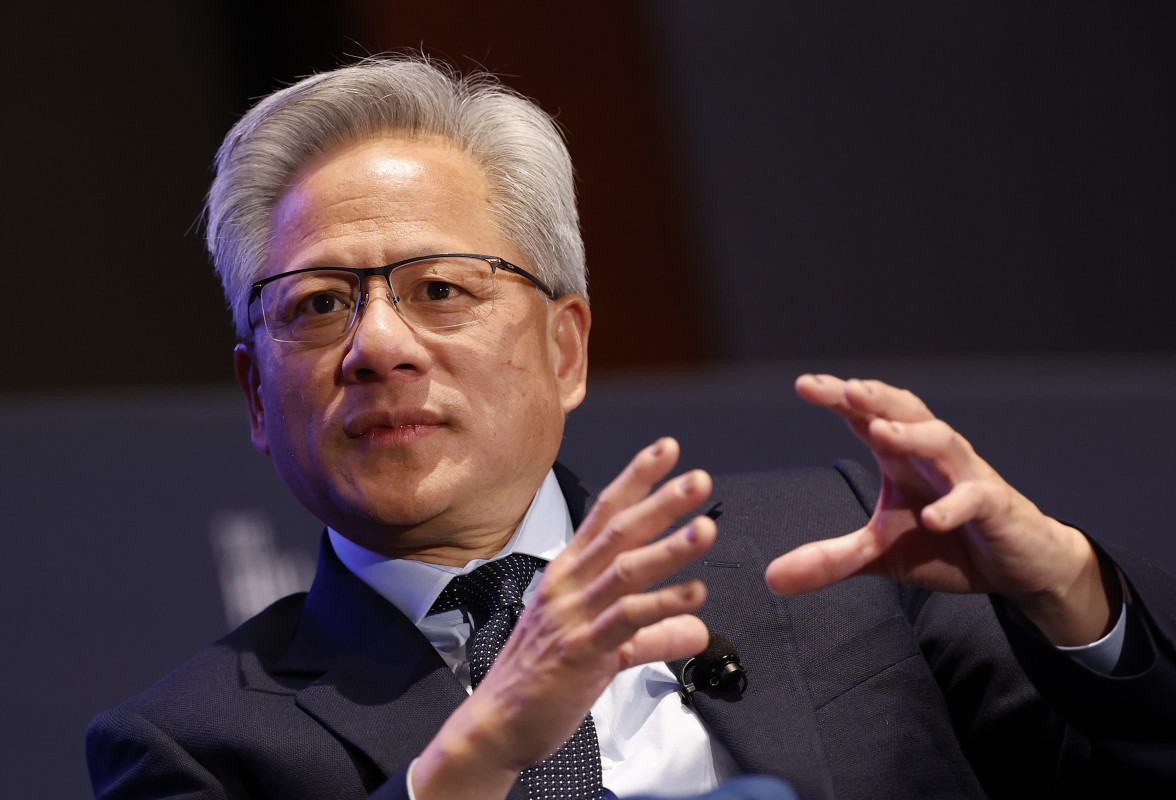

Image source: Kevin Dietsch/Getty Images

Together, Nvidia and Microsoft power the AI revolution

In the AI race, Nvidia and Microsoft play different but critical roles in advancing the industry.

Nvidia’s ubiquitous AI-ready GPUs are the go-to hardware for training and inference.

Its latest Blackwell Ultra chips, for instance, promise 1.5 times the punch of earlier models, rolling out even cheaper versions for China to dodge export curbs and grow its reach.

Speaking of reach, Nvidia’s data-center accelerators handle a whopping 90% of AI workloads globally.

Related: Veteran analyst drops bold new call on Nvidia stock

On the software side, CUDA keeps millions of developers hooked on fine-tuning performance. On top of that, its patented tools like TensorRT and NeMo make deploying models simpler, and DGX Cloud brings on-demand AI clusters to the table.

Take CoreWeave, one of Wall Street’s biggest stories this year, which shows how anything Nvidia touches turns to gold. Backed by a 7% Nvidia stake, Coreweave stock has built monster AI supercomputers and is up 308% from its IPO earlier this year.

Hence, with a powerful full-stack approach, Nvidia remains an inseparable partner in building next-gen AI.

More Tech Stock News:

- Circle’s stock price surges after stunning CEO comment

- Robotaxi rivalry heats up as new cities come online

- Analyst reboots AMD stock price target on chip update

Microsoft, by contrast, is all-in on software and services to layer AI across its ecosystem.

Front and center is Microsoft’s massive multi-billion-dollar OpenAI partnership, weaving ChatGPT into Azure, Teams, and Office 365. Microsoft’s robust cloud service in Azure packs prebuilt and custom models and low-code tools.

Similarly, Microsoft 365 Copilot amps up Word and Excel, while the Windows Copilot pushes AI deep into daily work.

Together, Nvidia’s cutting-edge chips and Microsoft’s cloud and tools power the entire AI stack, pushing them ahead of their peers.

Nvidia, Microsoft eyed for $5 trillion club as AI surges

Wedbush thinks Nvidia and Microsoft could touch $4 trillion in market cap this year and ride the AI wave to $5 trillion by next year.

This bold call lands as Nvidia just reclaimed the top spot from Microsoft, hitting new highs. As of yesterday’s close, Nvidia’s market cap stood at $3.78 trillion, while Microsoft sported a $3.7 trillion market cap.

Apple’s the other tech giant in the $3 trillion club, and it was once the world’s most valuable company.

Veteran analyst Dan Ives, in his note, wrote,

“The poster children for the AI Revolution are led by Nvidia and Microsoft, as both are foundational pieces of building on the biggest tech trend we have seen in our 25 years covering tech stocks on the Street.”

Related: Veteran Tesla bull drops surprising 3-word verdict on robotaxi ride

AI use cases have exploded of late, from cybersecurity and software to chips and robotics. Nvidia CEO Jensen Huang believes robotics will be the next multi-trillion-dollar catalyst after AI.

Ives agrees that the ripple effect is huge, that every dollar spent on Nvidia sparks another $8 to $10 across the wider tech world.

In crunching the numbers, Microsoft’s market cap has slipped 10.8% over the past year, losing about $400 billion. Conversely, Nvidia soared nearly 25%, adding $950 billion from its AI GPU boom.

Stretch that to three years, and the gap gets even wider. Microsoft’s up a robust 21%, but Nvidia’s exploded 472% as it pivoted from gaming chips to the AI driver’s seat.

Wedbush’s $4 trillion call equates to a 5.2% bump from Nvidia’s current market cap and an 8.4% jump for Microsoft.

Pushing to $5 trillion in 18 months ups the game, with Nvidia potentially rising 31.5% and Microsoft at 35.5%.

Related: Tesla fires longtime insider as Europe slump deepens