Dan Niles was all set to watch the Super Bowl last Sunday, but first he had to take care of business.

The veteran analyst took to X on Feb. 9 to share his thoughts about the Magnificent 7.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

“I had concerns over the Mag 7 to start the year,” he said. The six that have reported have had [revenue] estimates revised lower for the March quarter. The three hyperscalers, AMZN, GOOGL and MSFT, all had cloud revs miss, (albeit slightly) for Amazon.”

Eventually, return on investment and cash flow matter, said the founder of Niles Investment Management. And as a result the Mag 7 are down 0.2% on average to start the year compared with the S&P 500’s 2.5% advance.

Five of the Mag 7 are down year-to-date, and if we exclude Facebook parent Meta Platforms (META) , which is up 22%, the average would be much worse, Niles added.

Just to recap, the Magnificent 7 stocks are a septet of the world’s largest tech companies: Apple (AAPL) , Microsoft (MSFT) , Amazon (AMZN) , Google parent Alphabet (GOOGL) , Meta Platforms, Nvidia (NVDA) and Tesla (TSLA) .

B of A warned of ‘Lagnificent 7’

The Mag 7 companies run the gamut from AI to EVs, not to mention cloud services, e-retail and social media. And they have made their presence felt on the market.

The S&P 500 Index had a total return of 25% in 2024, with the Magnificent 7 accounting for 53.7% of that return.

More 2025 stock market forecasts

- Veteran trader who correctly picked Palantir as top stock in ‘24 reveals best stock for ‘25

- 5 quantum computing stocks investors are targeting in 2025

- Goldman Sachs picks top sectors to own in 2025

- Every major Wall Street analyst’s S&P 500 forecast for 2025

Bank of America analyst Michael Hartnett coined the term in 2023 with a nod to the 1960 western classic, which starred Yul Brenner, Steve McQueen and Charles Bronson.

“I’ve always been a big fan of that movie, which played in my childhood at Christmas in the UK,” Hartnett told Reuters in October. “But the genesis of it was a view that the market has a very, very strong preference for quality and a very great dislike of leverage.”

Hartnett described how capital flowed into anything that has a monopolistic ability to ensure that its sales, earnings and balance sheets remain dominant and attractive.

“It just felt that those were the seven stocks that not only had all of those characteristics, but also had very strong brands that almost everyone in America was comfortable owning,” Hartnett said.

Hartnett has been concerned, however, about the group’s performance, warning in a recent note that the tech giants are set to become “The Lagnificent Seven.”

“US exceptionalism now exceptionally expensive, exceptionally well-owned, outperformance to peak in ’25,” he wrote, “as excess government [spending] ends, immigration reduced, and DeepSeek means peak in [artificial intelligence capital spending] return expectations.”

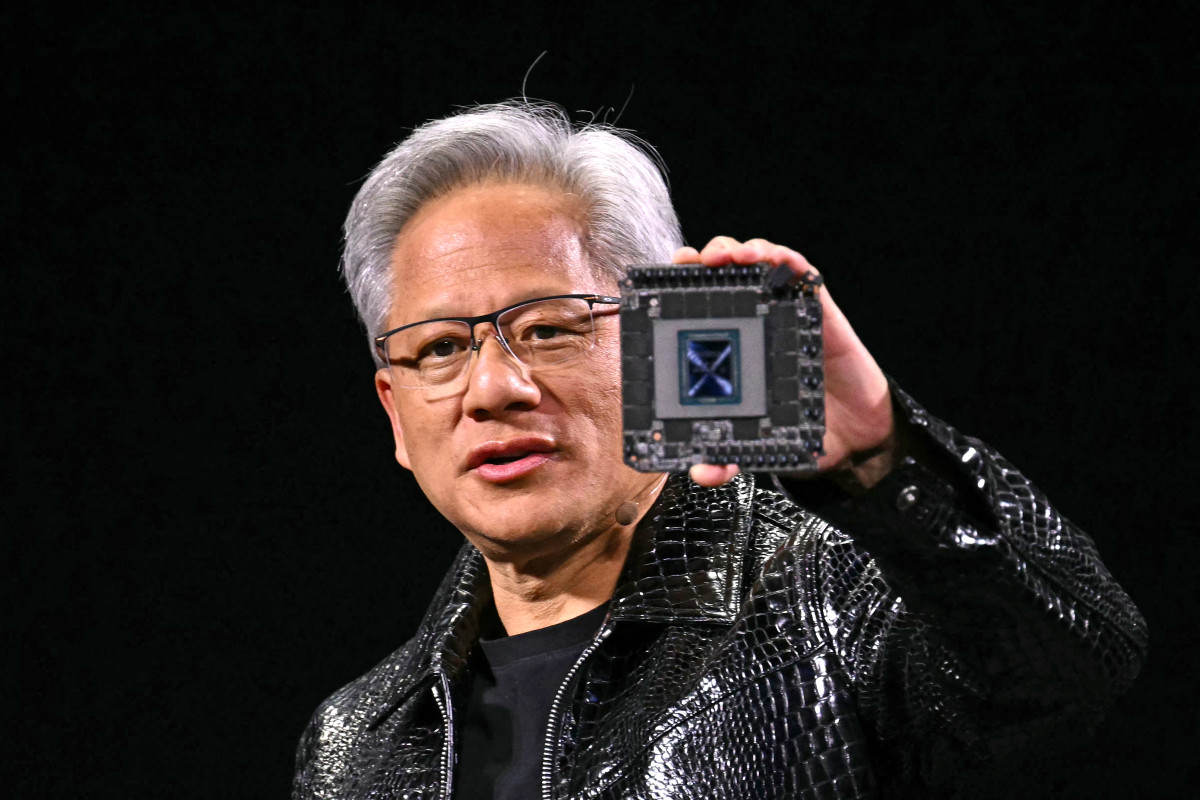

DeepSeek is the Chinese AI chatbot that rocked Nvidia and other AI chips right down to their socks last month. It claimed equal quality at much less cost compared with U.S. artificial-intelligence offerings like Microsoft-backed ChatGPT.

Analyst sees ‘AI capex digestion’ at midyear

Hartnett said a second wave of inflation is the biggest threat to U.S. indexes, noting that “so long as US Treasury yields range-bound and US consumer spending resilient, peak US exceptionalism relative not absolute theme (‘Magnificent 7’ becomes ‘Lagnificent 7’) supports broadening of US and global equity and credit market.”

The growth of AI has meant a massive boost in capital spending, which will continue into this year.

Related: Cathie Wood pares $21 million of beaten-down tech stock

Meta, Amazon, Alphabet and Microsoft intend to spend as much as $320 billion combined on AI technologies and data-center buildouts in 2025, CNBC reported.

That’s based on comments from their CEOs early this year and throughout earnings calls in the past two weeks. And the figure is up from $230 billion in total capital expenditures in 2024.

Niles does not see it that way.

“As for the health of AI spending, contrary to the common take that AI capex forecasts were good for the semiconductor suppliers, in fact AI capex forecasts make me feel MORE confident of an AI capex digestion phase by midyear,” he said.

Niles sees sequential growth in artificial-intelligence-related capital outlays slowing from roughly 15% on average for the past four quarters to closer to mid-single digits for the next two quarters.

Analyst sees upside from Stargate

The veteran analyst did say he expected some upside from Stargate, a private initiative focused on developing and building advanced AI technology in the U.S. The project was unveiled at the White House last month.

Niles said, however, that 10 Stargate data centers were already under construction in Texas before the recent announcement.

“The main positive I see in the near term is due to pull-ins of AI-chip demand from foreign countries afraid of sanctions that are probably imminent,” he said.

“But this is just delaying the eventual AI-capex-digestion phase I see coming in 2025. NVDA, the poster child for the AI trade, which reports later this month, will be interesting.”

Related: Analysts rework Palo Alto Networks stock price target before earnings

While he expects solid results, Niles said he was wondering about the forecast for the AI-chip giant’s April quarter.

“Can downside from their US customers be offset by upside from Stargate and their international customers trying to get in front of sanctions?” Niles asked,

He said that he continues to enjoy being invested outside the Mag 7 in general and is looking more broadly for ideas.

“I believe networking and getting access to the data that has been created by AI investments over the past two years supports my view on both Cisco (CSCO) and Adtran Holdings (ADTN) , which are two of my top 5 picks for the year,” Niles said.

The earnings season for the banks also was strong, Niles said. And a gentler regulatory environment is also likely to lead to more M&A, IPOs and financings, which should boost their capital-market revenues, he said.

Invesco KBW Bank ETF (KBWB) is another top 5 pick for 2025. The iShares S&P Mid-Cap 400 Value ETF (IJJ) , also remains a favorite for Niles, “given its more defensive nature if the Fed does indeed not cut or hike later this year.”

Niles said Meta and Amazon were top 5 picks for him last year, and while they are not for 2025, they would be his favorites out of the Magnificent 7.

Meta is continuing to use AI the best to drive its own business through recommendations and ad monetization, he said.

Amazon’s stock is driven partly by the growth of cloud-services provider AWS, and the efficiency and margins of its retail business is helped by its investments in AI and robotics, he said.

“With that, it is time to go watch the Super Bowl!” he concluded.

Related: Veteran fund manager issues dire S&P 500 warning for 2025