Relax, people: Jensen Huang says there’s nothing to worry about.

The Nvidia (NVDA) CEO was looking to assure the U.S. government that it did not need to be concerned about the AI-chip superpower’s technology being used by the Chinese military.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰

“We don’t have to worry about that because the Chinese military — no different to the American military — will not seek to build on top of each other’s technology,” Huang said in an interview with CNN. “They simply can’t rely on it. It could, of course, be limited at any time.”

The U.S. government, under both the Biden and Trump administrations, has implemented and progressively tightened restrictions on the sale of advanced AI chips to clients in China, citing national security concerns.

“If you just think about the number of supercomputers that are in China, built by amazing Chinese engineers that are already in operation, they don’t need Nvidia’s chips or American tech stacks in order to build their military,” he said.

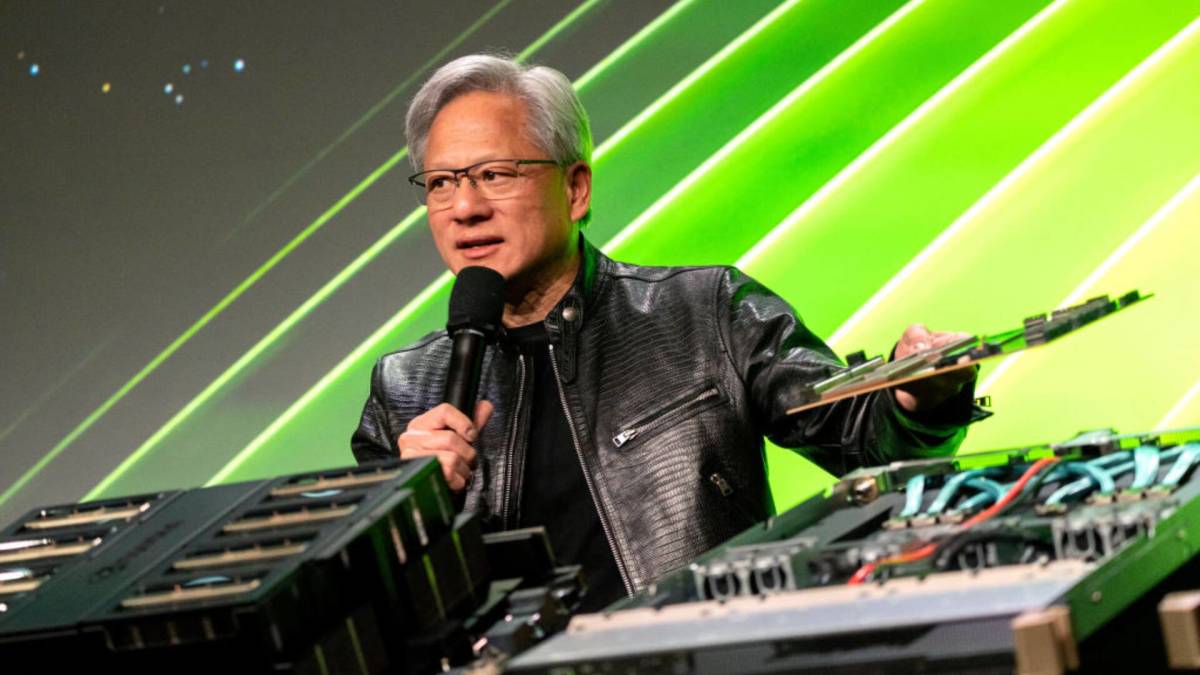

Nvidia CEO Jensen Huang says the U.S. government shouldn’t worry about its technology being used by the Chinese military.

Nvidia CEO Jensen Huang says the U.S. government shouldn’t worry about its technology being used by the Chinese military.

Image source: Morris/Bloomberg via Getty Images

Nvidia CEO wants U.S. tech to be global standard

He said that export controls had been counterproductive to the ultimate goal of U.S. tech leadership, and that half the world’s AI researchers are in China.

“We want the American tech stack to be the global standard. … [In] order for us to do that, we have to be in search of all the AI developers in the world,” he said.

More Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock could surge after surprising Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computing

Huang, who recently met with President Donald Trump and government and industry officials in Beijing, said Nvidia was filing applications to sell the Nvidia H20 GPU again.

The H20, a less powerful version of Nvidia’s Hopper architecture H100 GPU, was created to meet U.S. export-control regulations while still enabling Nvidia to maintain a presence in the Chinese market.

This news was music to the ears of a lot of people in the investment community, including TheStreet Pro’s Chris Versace.

“This should not only remove an overhanging question as to the future of Nvidia’s China business but restore revenue that was written off as lost due to government restrictions,” the lead portfolio manager of TheStreet Pro portfolio said in his July 15 column.

China generated $17 billion in revenue for Nvidia in 2024, roughly 13% of the company’s total revenue, Versace said.

In response to the news, he lifted his Nvidia price target to $200 from $185 and reiterating his One rating.

“We are also thinking this is a positive step in smoothing U.S.-China trade conversations as the two countries work on a larger trade deal,” he said.

President Trump is slated to announce $70 billion in artificial intelligence and energy investments, Versace said, which lends additional support for the price target increase.

Fund manager sees continued AI data center demand

In a related development, Versace said CoreWeave (CRWV) , a key Nvidia customer, will commit as much as $6 billion for a Lancaster, Pa., 100-megawatt data center that could be expanded to 300 MW.

“We suspect there will be similar announcements from other companies as part of Trump’s larger announcement, much the way we saw with the Stargate announcement in January,” he said, referring to the joint venture that plans to invest up to $500 billion in AI infrastructure.

Related: Nvidia CEO hits Warren Buffett milestone

Versace said these announcements should affirm expectations for AI and data center demand in the coming quarters.

Connecting the dots, Versace said that would be “a positive demand driver for not only Nvidia and Marvell (MRVL) shares, but also Eaton (ETN) , United Rentals (URI) , and others.”

Several investment firms issued research reports on Nvidia, including Bank of America Securities, which raised its price target to $220 from $180 and affirmed a buy rating on the shares.

The Department of Commerce allowing Nvidia and AMD (AMD) to resume artificial intelligence chip sales to China is an incremental positive for both companies, the firm said, according to The Fly.

B of A said the move expanded the addressable opportunity in AI for U.S. chipmakers by as much as 10% and improves the U.S.’s ability to dominate the global tech stack.

Piper Sandler maintained an overweight rating on Nvidia after the company said it expects to be granted licenses to resume H20 chip sales to China.

During the April quarter, the company posted $4.6 billion in sales for H20 and left an additional $2.5 billion on the table due to the ban, the firm said.

Piper said the estimated impact from the ban in the July quarter was around $8 billion in sales. The firm said that it suspected strong demand for these chips would have continued had the ban not been in place.

Related: Fund-management veteran skips emotion in investment strategy