Jensen Huang has places to go and people to meet.

The co-founder and CEO of Nvidia (NVDA) is heading to Beijing, where he will meet with senior Chinese officials, including the commerce minister, at the International Supply Chain Expo, Bloomberg reported,

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰

The conference, which runs July 16-20, is one of the Chinese government’s signature events. It has featured such tech superstars as Apple CEO Tim Cook.

The AI-chip superpower’s market cap has been on a roll touching $4 trillion on July 9.

“How Huang comes out of this meeting will be key,” TheStreet Pro’s Stephen Guilfoyle said in a recent column. “So will be what comes of the continued negotiations between Washington and Beijing that come with their August 12 deadline of their own.”

China, initially singled out with tariffs exceeding 100%, has until that date to reach an agreement with the White House to keep President Donald Trump from reinstating additional import curbs he’d imposed during tit-for-tat tariff exchanges in April and May, Reuters reported.

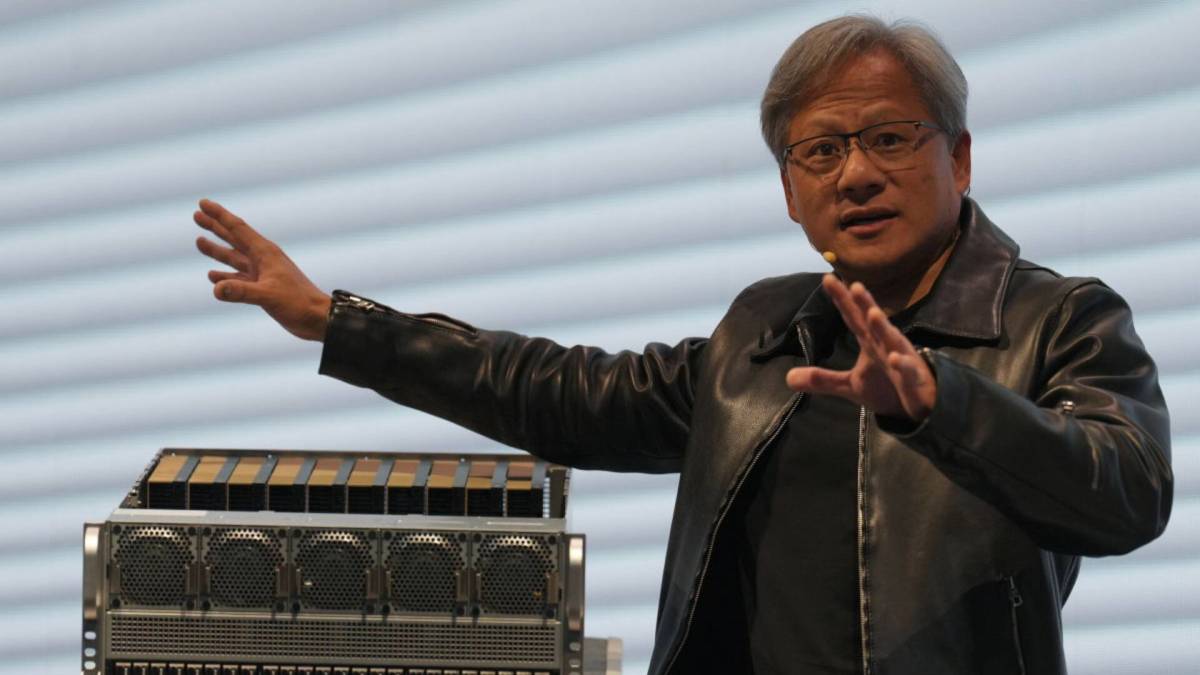

Nvidia CEO Jensen Huang is reportedly meeting with Chinese officials in Beijing

Nvidia CEO Jensen Huang is reportedly meeting with Chinese officials in Beijing

Image source: SOPA Images/Getty Images

Nvidia CEO wants US to be global AI leader

Huang has consistently argued against US restrictions on the sale of advanced semiconductors to China, citing the strategic and economic importance of accessing the world’s largest semiconductor market.

In May, for example, Huang said that U.S. chip export controls are a “failure” and warned that the restrictions are doing more damage to American business than to China.

More Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock could surge after surprising Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computing

Huang told lawmakers in Washington in April that China was quickly gaining ground on the U.S. in artificial intelligence. “China is right behind us,” Huang said. “We are very close. Remember this is a long-term, infinite race.”

He pointed to the Chinese tech company Huawei, which reportedly is developing its own advanced chip to rival Nvidia.

“They’re incredible in computing and network technology, all these essential capabilities to advance AI,” Huang said. “They have made enormous progress in the last several years.”

And he told CNBC’s Jim Cramer that it’s necessary to export his company’s artificial intelligence technology to China, saying trade with the country was vital if the U.S. wanted to be a global leader in AI.

“We want every developer in the world to prefer the American technology stacks,” Huang said. Once that happens, he said, “American technology stacks will run AI the best all over the world.”

Huang told Cramer that “we understand the technology best, and we understand how computing works.”

“We understand how AI works, and we’ve been in China for 30 years, and so this is an area that we have a lot of, a lot of expertise, and we’re going to continue to share that,” he said.

Separately, Chinese firms are looking to install more than 115,000 Nvidia AI chips in about three-dozen data centers across the country’s western deserts, Bloomberg reported.

Citi analyst cites growing addressable market for NVDA

Operators in Xinjiang intend to house most of those processors in a single compound. While the complex would still be dwarfed by the scale of AI infrastructure in the US, it would significantly boost China’s computing power.

Chinese AI labs intend to deploy Nvidia’s flagship H100 and H200 GPUs, which are sourced primarily from third-party suppliers.

Related: Veteran analyst drops new clue on Nvidia’s next big move

Nvidia’s shares are up nearly 22% this year and up 21% from this time in 2024.

TheStreet Pro’s Guilfoyle, whose career dates back to the floor of the New York Stock Exchange in the 1980s, told readers that his $165 target price has essentially been met and will likely be surpassed this week. He boosted his target to $175.

Goldman Sachs analyst James Schneider kicked off coverage of Nvidia on July 10 with a buy rating and $185 price target, according to The Fly.

The analyst initiated the U.S. digital semiconductor and electronic design automation software group, saying the investment firm is most constructive on merchant silicon and electronic design automation vendors tied to AI-related capital spending.

The AI-investment cycle is in transition but can sustain growth from current levels, Schneider said.

On July 7, Citi analyst Atif Malik boosted the firm’s price target on Nvidia to $190 from $180 and maintained a buy rating on the shares.

The analyst cited the company’s expanded total addressable market in AI for the target-price increase.

Citi said that it now assumed the addressable market in 2028 for data-center semiconductors in AI to reach $563 billion, 13% above its prior expectation of $500 billion.

The increase is attributable in part to higher-than-expected sovereign AI demand, Malik said, referring to nations’ increasing need to develop and control their own artificial intelligence capabilities

Related: Fund-management veteran skips emotion in investment strategy