Nvidia (NVDA) achieved something that doesn’t happen very often in the stock market: It turned one of its biggest critics into a believer.

And then, in a move that could be even more important, it quietly rewired the rules of enterprise AI security.

The trillion-dollar chipmaker silenced one of the lone bearish voices on Wall Street, and before the dust settled on the upgrade, it went ahead and laid out an ambitious partnership with CrowdStrike (CRWD) , a big name in cybersecurity.

This isn’t some technological integration that you have to go through developer manuals to find. It’s a smart move to manage how AI acts, grows, and keeps in check in the actual world.

The timing of both of these developments is interesting. As Wall Street tries to figure out how far Nvidia’s supremacy can go, regulators, CEOs, and even the White House are raising broader questions: Who gets to create the next generation of AI bots that can work on their own? Who looks out for them? And what if no one can?

With CrowdStrike bringing the guardrails and Nvidia supplying the rocket fuel, the answer might now be: the same people.

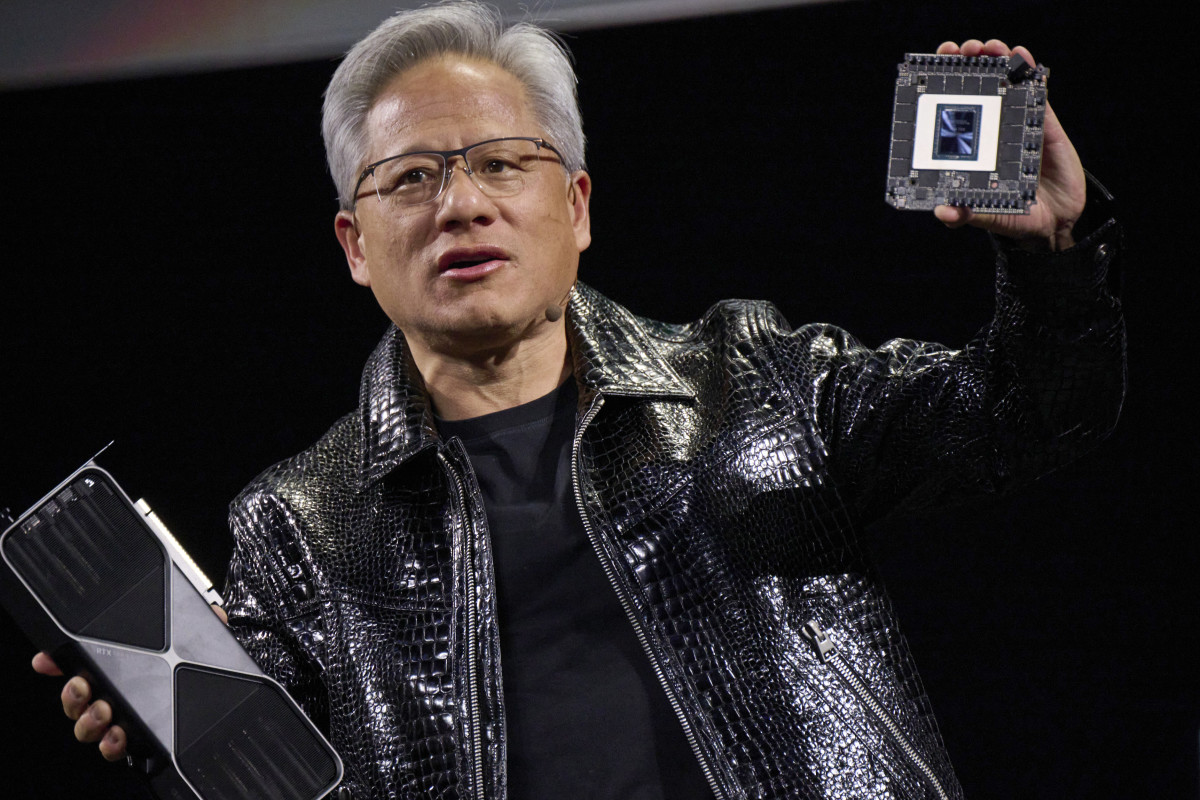

Nvidia CEO Jensen Huang unveils the company’s latest AI chip during a keynote presentation.

Nvidia CEO Jensen Huang unveils the company’s latest AI chip during a keynote presentation.

Image source: Bennett/Bloomberg/Getty Images

Nvidia didn’t wait for the skeptics — it converted them

“The reports of my death are greatly exaggerated,” Mark Twain once famously said when there were rumors that he was ominously ill, but the often misremembered quote can just as easily be used for Nvidia’s valuation.

Standing at a whopping market cap of $4.25 trillion, very few companies can compete with the size and scale of Nvidia.

Related: Inside Google’s Quiet Rebuild: Changes Outpace AI Hype

While bulls will hold up Nvidia’s record of consistently beating analyst estimates, critics will point to a flawed valuation. With a 49.76x P/E ratio, it’s hard to argue that Nvidia is a value stock by any stretch.

But what cannot be argued is its track record, which is pushing even the biggest critics of the semiconductor giant into submission, with DA Davidson the latest to fall.

What makes the latest upgrade stand out from the rest is how much DA Davidson has veered from its stance on Nvidia.

DA Davidson wasn’t just apprehensive about Nvidia. Back in March, the company predicted a 48% drop, calling AI euphoria overblown and warning that hyperscale expenditure would peak by 2026.

Fast forward to Sept. 11, and the same analysts, headed by Gil Luria, have assigned a buy recommendation. Their new price objective is $210, or nearly 18% above current levels.

Related: Jensen Huang Isn’t Sweating Nvidia’s Slowdown For This $4 Trillion Reason

Why the 180-degree turn?

“Overwhelming growth in demand for compute,” the analysts stated. Translation: Nvidia’s AI dominance has become too strong to question. Not even a slew of dangers, such as margin compression, ASIC competition, and infrastructure bottlenecks, could offset the sheer rate of adoption.

Even Nvidia CEO Jensen Huang intimated that this was only the beginning, telling legislators at an AI event in Washington that America’s advantage “depends on staying ahead in compute.”

CrowdStrike joins Nvidia’s orbit — and plots a secure AI future

And as if the DA Davidson upgrade was not enough: CrowdStrike and Nvidia announced a strategic collaboration at Fal.Con 2025 in Las Vegas.

CrowdStrike’s Charlotte AI AgentWorks, a no-code platform for generating AI security agents, will now include Nvidia’s Nemotron models, resulting in a full-stack solution that allows analysts to spin up and deploy AI bots under enterprise-grade supervision.

More News:

- Jim Cramer flips the playbook on the S&P 500

- Qualcomm just made a massive leap into Tesla’s turf

- Cathie Wood goes biotech shopping, shells out $7.7 million

Consider it a fortified command center for the agentic era, in which every AI decision is traceable, governable, and secure.

It is the next step in Nvidia’s dominance: not only does it fuel AI, but it also controls its behavior in the wild, ultimately leading to more applause lines and analyst upgrades.

And CrowdStrike isn’t stopping there. With a $111 billion market capitalization and the recent purchase of Pangea, the cybersecurity company is banking big on what it calls “AI Detection and Response” — a security layer that might become as important as the agents themselves.

Power, paranoia, and the fight to control AI

Why does this matter right now? Because artificial intelligence is more than simply a tool; it is a force.

The corporations who construct it are rushing forward. But who secures it? They may be the only checks remaining.

CrowdStrike’s Daniel Bernard did not mince words: “We’re laying the groundwork for the agentic SOC.”

Justin Boitano of Nvidia highlighted the concern, saying, “Trust and governance will define AI at scale.”

With hyperscaler expenditures continuously skyrocketing, Nvidia’s position in that architecture is growing, not shrinking. And with Wall Street shifting from fear to FOMO, the issue isn’t whether Nvidia can continue to expand.

The question is, who, if anybody, can stop it.

Related: Google’s Gemini has scored a major victory in the AI wars