Warren Buffett isn’t one to flinch often, but Berkshire Hathaway’s (BRK.A, BRK.B) latest move turned heads.

The company quietly sold $6.1 billion in stock in Q3, with the company’s balance sheet looking a lot less like a shopping spree and more like a waiting room.

Berkshire’s profits still came in hot, but its appetite for deals cooled substantially, a clear signal that even Buffett, who’s long been considered the stock market’s optimist-in-chief, might be bracing for rougher seas.

Warren Buffett is famous for saying opportunities come at times when others are fearful. Lately, though, he seems to think everyone’s a little too confident.

Buffett’s disciplined approach shows again as Berkshire quietly reshapes its massive portfolio.

Buffett’s disciplined approach shows again as Berkshire quietly reshapes its massive portfolio.

Image source: Zuchnik/WireImage via Getty Images

Warren Buffett’s Berkshire dumps $6.1 billion in stock

Warren Buffett isn’t known for blinking, but Berkshire’s Q3 results show the 95-year-old investor is in a rare defensive crouch.

The big headline is that the investing giant offloaded $6.1 billion in common stock during the three months ending September 30.

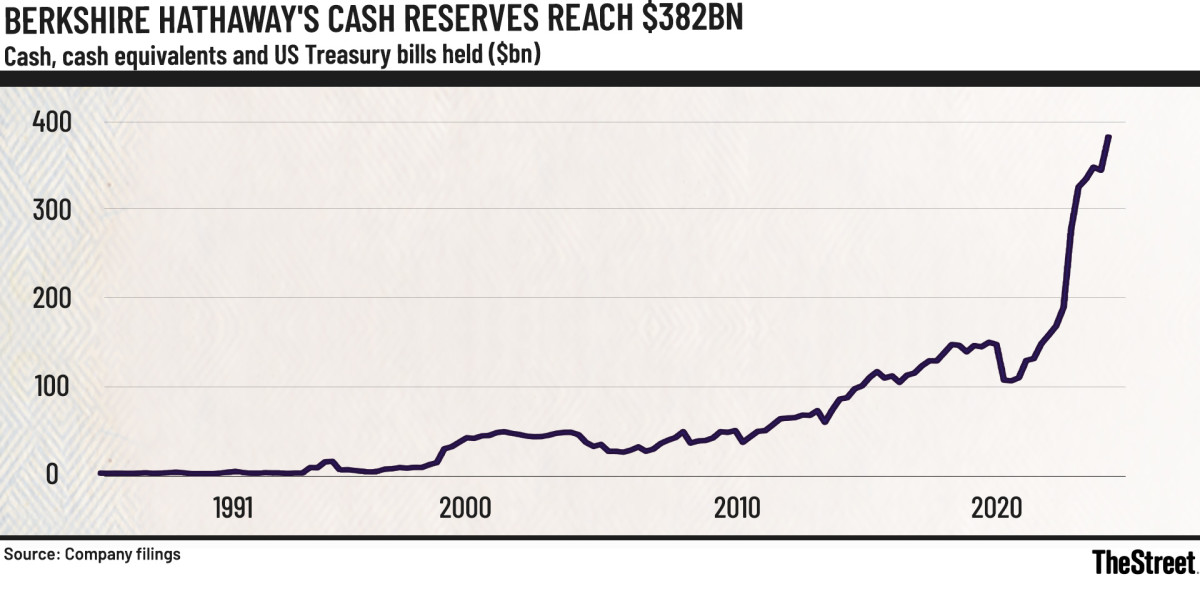

That was the third straight year of net selling, while its cash till soared to a record $382 billion. Additionally, that incredible cash mountain excludes another $23 billion parked in short-term Treasuries, highlighting how Buffett sees more value in waiting than in buying.

For decades, Berkshire has built a reputation for scooping up bargains when markets stumbled.

More Warren Buffett:

- Bank of America quietly echoes Warren Buffett’s favorite strategy

- Warren Buffett’s Berkshire Hathaway reveals homebuying move

- Warren Buffett lines up Berkshire’s biggest deal in years

- Warren Buffett’s retirement creates a buying opportunity

However, with AI bubble chatter all around, he’s opting for patience over aggression. Also, Berkshire hasn’t repurchased shares for five consecutive quarters, while its Class A stock has lagged the S&P 500 by 12% since Buffett announced his retirement earlier this year.

Even after trimming billions in stock, though, Berkshire’s portfolio remains tightly focused. As of September 30, 2025, just five companies made up 66% of Berkshire’s stock holdings.

These 5 stocks comprise two-thirds of Berkshire Hathaway’s holdings:

- Apple (AAPL)

- American Express (AXP)

- Bank of America (BAC)

- Coca-Cola (KO)

- Chevron (CVX)

Why selling now breaks Buffett tradition

Buffett has built his empire by running toward fear, not away from it.

Every Buffett fan is familiar with his mantra to “be greedy when others are fearful,” spearheaded by some of his boldest bets in the 2008 crisis and opportunistic moves during 2020’s Covid chaos.

Related: Palantir could be staring at a big problem

That’s exactly why selling into strength in Q3 may feel off-script.

Nevertheless, the markets are firm, and pricing multiples are rich. For perspective, Factset estimates that on a 12-month basis, the S&P 500 is trading around 22.9 times earnings (10-year average at 18.6 times).

Moments when Buffett went against the crowd:

- Sept. 2008 – Buys Goldman in the panic: Berkshire injected $5 billion into Goldman Sachs’ preferred stock at the height of the crisis.

- Aug. 2011 – Bails out BofA: Puts $5 billion into Bank of America preferred shares, along with $700 million worth of warrants (coming at a remarkably low point).

- May 2020 – Dumps airlines early: Exited all stakes in American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines, saying “the world has changed,” while others kept chasing the reopening rally. Source:Reuters

Berkshire’s war chest nears $390 billion

Berkshire Hathaway’s cash machine continues to roar.

It wrapped up Q3 with roughly $382 billion in cash and Treasury bills, up from $344 billion in June (the biggest quarterly jump in its history).

Berkshire Hathaway’s cash reserves reach $382 billion chart

Berkshire Hathaway’s cash reserves reach $382 billion chart

Berkshire Hathaway

Moreover, the Omaha giant’s operating profit skyrocketed by 33.6% year over year to $13.49 billion, led by a sharp rebound in insurance underwriting, where profits nearly tripled to $2.37 billion.

Related: ChatGPT maker OpenAI could soon set another record

At the same time, net income rose 17.3% to $30.8 billion, due to strength across virtually every major business. Its reported Q3 earnings per share of $6.25 beat market estimates by a handsome 52 cents.

Even a relative laggard like BNSF Railway posted a 4.8% gain in after-tax earnings, while profits in manufacturing and retail jumped over 8%.

Life after the Oracle of Omaha‘s retirement

As he steps down on December 31, 2025, Buffett officially passes the baton to Greg Abel, who becomes CEO in January 2026.

Abel takes the reins at a time when Berkshire is sitting on a record cash pile with zero buybacks, giving him room to move without swinging blind.

Three challenges new Berkshire CEO Greg Abel faces:

- Capital allocation at scale: Deploying a $380 billion cash war chest without diluting returns.

- Maintaining the Berkshire “moat”: Preserving decentralized autonomy backed by capital discipline while tightening risk controls in areas such as insurance, utilities, and other capital-intensive units.

- Signaling to markets: Communicating a clear playbook (buybacks, deals, dividends).

Related: Apple CEO’s iPhone 17 pitch has clear message for users