Sometimes, the economy sputters or stalls, causing a recession and big job losses, or it overheats, resulting in skyrocketing prices that crimp budgets and zap savings.

Since neither is great, there needs to be a solution that can help prevent those outcomes as much as possible.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Welcome to the Federal Reserve System, the central bank of the United States.

The Fed has the unenviable task of keeping the economy humming along, a Herculean task given the size of the US economy and competing, and often very vocal, interests.

That’s certainly been true lately. Seemingly, everyone is talking about the Fed, and nobody appears happy.

Here’s what you need to know about how the Federal Reserve works, and why everyone is so focused on it.

The Federal Reserve is under fire over monetary policy associated with its dual mandate.

The Federal Reserve is under fire over monetary policy associated with its dual mandate.

TheStreet/Shutterstock

What does the Federal Reserve do?

The Fed performs five general functions to promote the effective operation of the U.S. economy and, more generally, the public interest.

The Federal Reserve System:

- Conducts the nation’s monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy.

- Promotes the stability of the financial system and seeks to minimize and contain systemic risks through active monitoring and engagement in the U.S. and abroad.

- Promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system as a whole.

Related: Trump deflects reports on firing Fed Chair Powell ‘soon’

- Fosters payment and settlement system safety and efficiency through services to the banking industry and the U.S. government that facilitate dollar transactions and payments.

- Promotes consumer protection and community development through consumer-focused supervision and examination, research and analysis of emerging consumer issues and trends, community economic development activities, and the administration of consumer laws and regulations.

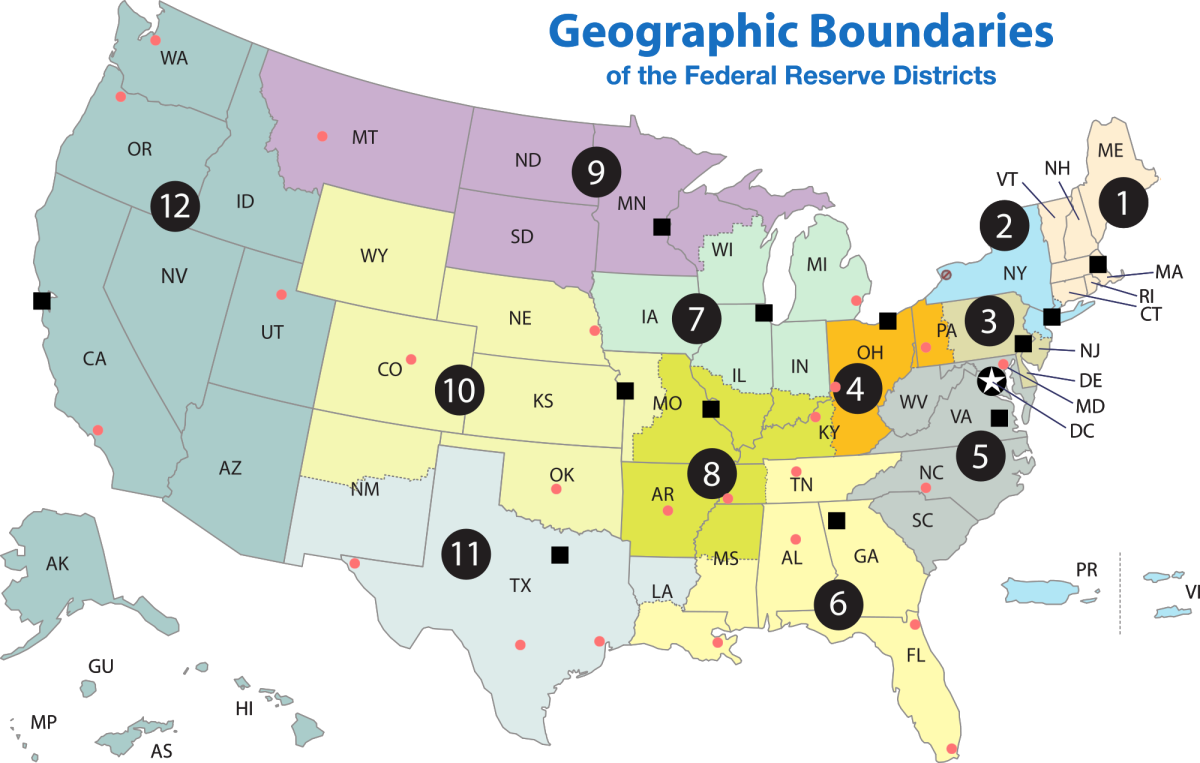

Twelve Federal Reserve Banks around the country help ensure all household, community, and business economic conditions and perspectives inform Fed policies, actions, and decision making.

Twelve Federal Reserve Banks around the country help ensure all household, community, and business economic conditions and perspectives inform Fed policies, actions, and decision making.

ChrisnHouston, CC BY-SA 3.0 via Wikimedia Commons

Elements of the Federal Reserve System

The Federal Reserve was created by the Federal Reserve Act of 1913 to establish a monetary system that could respond effectively to the stresses in the banking system.

The Federal Reserve System includes:

- The Board of Governors, an independent federal agency located in Washington, D.C.

- Twelve Federal Reserve Banks around the country that help ensure all household, community, and business economic conditions and perspectives inform Fed policies, actions, and decision making.

- The 12 voting members from around the System who serve on the Federal Open Market Committee and help set crucial U.S. monetary policy.

Role of the Board of Governors

The Board of Governors, located in Washington, D.C., is the governing body of the Federal Reserve System.

The board:

- Is run by seven members, or “governors” serving staggered 14-year terms, who are nominated by the president and confirmed in their positions by the U.S. Senate.

- Includes a chair and vice chair, who may be appointed for one or more additional four-year terms.

- Guides the operation of the Federal Reserve System to promote the goals and fulfill the responsibilities given to the Federal Reserve by the Federal Reserve Act.

- Oversees the operations of the 12 Reserve Banks and shares with them the responsibility for supervising and regulating certain financial institutions and activities.

- Is an independent federal agency that reports to and is directly accountable to Congress.

Role of the Federal Open Market Committee

The Federal Open Market Committee, or FOMC, is a 12-person group of Federal Reserve System officials that sets crucial U.S. monetary policy at meetings held at least eight times each year.

The FOMC’s monetary policy actions influence interest rates and credit conditions, which can significantly impact financial conditions, including economic productivity and even spending and investment decisions by households, communities, and businesses.

Related: Fed official voices blunt 3-word message on Fed rate cuts

The FOMC makes all decisions regarding the appropriate position or “stance” of monetary policy to help move the economy toward the congressionally mandated goals of maximum employment and price stability.

The FOMC’s 12 voting members include:

- The seven members of the Board of Governors.

- The president of the Federal Reserve Bank of New York.

- Four of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis.

In addition, all the remaining seven Reserve Bank presidents attend FOMC meetings and participate in FOMC deliberations.

Why the Federal Reserve is independent

Though Congress specified the goals for monetary policy, it established the Federal Reserve as an independent agency to ensure that its decisions are based on facts and objective analysis and serve the best interests of all Americans.

Studies have shown that central bank independence is an important factor that supports the ability of monetary policy to achieve solid economic performance and stable prices over time.

At the same time, the Federal Reserve must be accountable to Congress and the American people for its actions.

It does so by being transparent about its policy deliberations and actions through a range of official communications.

How the Fed Achieves Its Dual Mandate

In August 2020, the FOMC released a revised mission statement after conducting an 18-month review of its strategic framework for monetary policy.

More Federal Reserve:

- Fed interest rate cut decision resets forecasts for the rest of this year

- Federal Reserve prepares strong message on long-term interest rates

- Fed official revamps interest-rate cut forecast for this year

The new statement reaffirmed many key aspects of the Federal Reserve’s role but also included some innovations to reflect important changes in the economy that had become apparent in recent years.

In particular, the FOMC acknowledged that the level of the Federal Funds Rate consistent with maximum employment and price stability over the longer run has declined relative to its historical average.

The Federal Funds Rate is the overnight interest rate the Fed charges banks. It is linked to the cost of borrowing money for all Americans.

Short-term interest rates impact credit cards, auto and student loans and other forms of lending.

Longer-term interest rates and the prices for a wide range of financial and nonfinancial assets, including stocks, bonds, and real estate, respond to changes in the current and expected path of the federal funds rate.

That is, medium- and longer-term interest rates are affected by how people expect the Federal Funds Rate to change in the future.

For example, if borrowers and lenders think, today, that the FOMC is likely to lower its target for the Federal Funds Rate substantially over the next several years, medium- and longer-term interest rates today will incorporate those expectations, and those rates then will be lower than would otherwise be the case.

The FOMC is prepared to use its full range of tools to achieve its maximum employment and price stability goals.

Employment’s role in monetary policy:

In the 2020 statement, the FOMC recognized that the maximum level of employment is a broad-based and inclusive goal that is not directly measurable and changes over time for reasons unrelated to monetary policy.

Consequently, the FOMC does not set a fixed goal for employment but bases its policy decisions on assessments of the shortfalls of employment from its maximum level.

The committee considers a wide range of indicators when making these assessments.

Inflation’s role in monetary policy:

In the 2020 statement, the committee reaffirmed its judgment that inflation at the rate of 2%, as measured by the annual change in the price index for personal consumption expenditures, or PCE, is most consistent over the longer run with the Federal Reserve’s statutory mandate.

The committee noted that longer-term inflation expectations that are well anchored at 2% foster price stability and moderate long-term interest rates.

They enhance the FOMC’s ability to promote maximum employment in the face of significant economic disturbances.

In order to anchor longer-term inflation expectations at this level, the committee noted that it seeks to achieve inflation that averages 2% over time.

Working toward the twin goals:

The 2020 statement noted that in setting monetary policy, the FOMC seeks over time to mitigate employment shortfalls from the committee’s assessment of its maximum level and deviations of inflation from its longer-run goal.

Most of the time, the Federal Reserve’s goals for employment and inflation are complementary.

The FOMC could, however, face situations where its goals are pulling policy in opposite directions.

In these circumstances, the committee indicated that it will take into account the employment shortfalls and inflation deviations as well as the potentially different time horizons over which employment and inflation are projected to return to their desired levels.

To learn more about the Federal Reserve System, visit federalreserve.gov.

Related: Federal Reserve chair sends strong message on July interest rate cut