Mortgage rates could move sooner than many homebuyers expect but not because of interest-rate cuts — rather because of how the Federal Reserve manages itsbalance sheet.

Federal Reserve Governor Stephen Miran said Feb. 10 that the central bank’s $6.6 trillion balance sheet needs to be smaller to reduce its footprint in financial markets and give monetary policymakers options in the event of a future economic crisis.

It could also result in lower mortgage rates for the stagnated U.S. housing market.

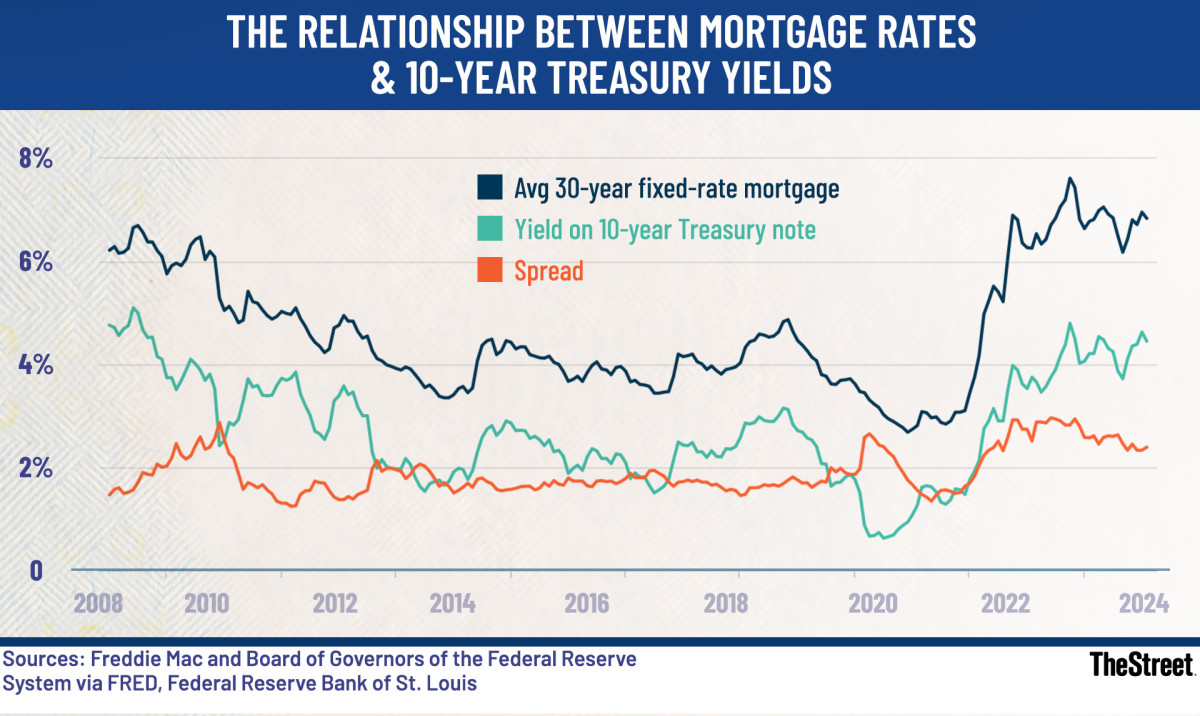

The Relationship Between Mortgage Rates & 10-Year Treasury Yields Chart.

The Relationship Between Mortgage Rates & 10-Year Treasury Yields Chart.

Freddie Mac/Federal Reserve/TheStreet

Warsh calls for aggressive shrinking of the balance sheet

Kevin Warsh, President Donald Trump’s nominee for the Federal Reserve Chair, has long been a vocal critic of the central bank’s “bloated” balance sheet for the past decade.

Warsh, a former Fed governor, said that a large central-bank footprint distorts market signals, encourages excessive government spending and misallocates capital.

To thread the needle between a smaller Fed balance sheet and lower interest rates, Warsh and other proponents of this strategy rely on a shift in how the Fed manages the economy.

Traditionally, shrinking the balance sheet or quantitative tightening (QT) pulls liquidity out of the market and pushes long-term rates like mortgage rates higher.

Quantitative easing (QE) is used when the Fed — instead of changing interest rates — injects money directly into the financial system by buying massive amounts of long-term assets, primarily U.S. Treasury securities and mortgage-backed securities. This process increases the money supply and expands the Fed’s balance sheet.

Quantitative easing is used when lowering short-term interest rates are not stimulating the economy because they are already near zero.

Warsh makes bold statement on Fed balance sheet

Mortgage lenders and housing economists say balance-sheet policy, not just interest rate cuts, is increasingly shaping borrowing costs.

More Federal Reserve:

- Billionaire Dalio sends 2-words on Fed pick Warsh

- Fed Chair Powell sends frustrating message on future interest-rate cuts

- Warsh nomination stirs Fed independence fears on Wall Street

In May 2025, Warsh suggested that if the balance sheet had grown at the same rate as the economy since his previous term in 2006-2011, it would be $3 trillion today instead of its current $6.6 trillion size.

“If Warsh decides to return to quantitative tightening by shrinking the Fed’s balance sheet, the additional supply of bonds will mean higher Treasury yields, and as a result, upward pressure on lending rates,’’ Todd Campbell, a 30-year Wall Street veteran and co-editor-in-chief of TheStreet, said.

“In the past, Warsh has criticized the use of the Fed’s balance sheet to influence the market, so it’s not a stretch to think a tweaking of the Fed balance sheet policy is in the cards,’’ Campbell said.

Miran’s take on quantitative easing of the balance sheet

Miran is serving a temporary role on the seven-member Fed Board of Governors.

“Expanding our balance sheet when you’re at the zero-lower bound, at the middle of a financial crisis, is the right move,” Miran said.

“But you should keep your powder dry for when you need to make a move like that.”

Miran turns to U.S. dollar valuations

In discussing weaker U.S. dollar valuations relative to reserve currency peers, Miran said, “You need a really big move for it to sort of really be a first-order issue that would really affect consumer inflation in the United States. The result is that it doesn’t matter that much for consumer inflation.”

Miran said he does not expect recent dollar weakness to impact central bankers in the implementation of monetary policy.

Veteran/longtime Wall Street analyst Stephen Guilfoyle in a TheStreet Pro post said he agreed with this statement to a point.

Related: J.P. Morgan predicts what’s next for mortgage rates, housing market

“Lower dollar valuations force higher prices for commodities and goods and services at the producer / wholesale levels. These impacts would, in a controlled laboratory, produce in higher consumer prices,’’ Guilfoyle said.

However, Guilfoyle said Miran is incorrect to assume that a weaker dollar will not impact inflation.

“To do so could be akin to mistaking art for science and vice versa. Economics, no matter how much economists want to claim it is a science, will always be art, as conditions can never be constant,’’ Guilfoyle said.

Latest U.S. mortgage rate averages

Mortgage rates have hovered just under or around 6% recently.

This is far below the 7%+ peaks in prior years but well above the sub-3% pandemic lows.

Here’s the latest snapshot of national averages of U.S. mortgage rates:

• 30-year fixed-rate mortgage: ~5.9 % to 6.0 % • 15-year fixed: ~5.4 % • 20-year fixed: ~5.9 % • 5/1 ARM: ~5.97 % • 7/1 ARM: ~6.2 %

Housing experts say whether mortgage rates fall will depend less on rhetoric and more on how quickly markets can absorb any increase in Treasury and MBS supply.

Related: Redfin predicts what’s next for mortgage rates, housing market