The Schwab U.S. Dividend Equity ETF (SCHD) was once the gold standard for dividend investors. It’s got a history of strong dividend growth, a high yield, years of strong returns and low fees. These are the things that ALL investors love!

But lately, it’s been stumbling—actually, it’s been crashing and burning. Over the past three years, it’s become one of the weakest performers among major dividend ETFs. Its performance has been trailing the Vanguard Dividend Appreciation ETF (VIG), the Vanguard High Dividend Yield ETF (VYM), and the iShares Core Dividend Growth ETF (DGRO) by double digits.

SCHD’s performance, yield and Morningstar rating no longer stick out. That leaves investors to ask a tough question: Is it time to move on from SCHD?

The Schwab US Dividend Equity ETF has struggled recently relative to Vanguard’s dividend ETFs.

The Schwab US Dividend Equity ETF has struggled recently relative to Vanguard’s dividend ETFs.

Shutterstock

How Schwab’s ETF built a reputation as dividend leader

SCHD launched in 2011 with a simple premise. It was going to try to target the best of the best dividend stocks. To accomplish this, its strategy looked at dividend growth, dividend yield and quality in order to produce a portfolio of 100 stocks that met a very stringent set of criteria.

For years, it worked great. In fact, for 9 straight years, its returns were in the top ⅓ of Morningstar’s Large Cap Value category. That kind of consistent greatness is almost unheard of in the dividend ETF space.

As a result, SCHD held a 5-star Morningstar rating for years. Its total assets under management (AUM) ballooned to more than $71 billion, making it the second-largest dividend ETF in the world, only behind Vanguard’s VIG.

More ETFs

- Forget VOO, SPY, VTI: Best stock investing pick is this Fidelity fund

- Dividend ETFs: One unexpected ETF is outperforming Vanguard’s VIG and VYM

- Best Vanguard ETFs for the rest of 2025

Why SCHD’s performance is lagging

Its descent began in 2023, when the dominance of tech stocks and the magnificent 7 started. Dividend ETFs have been an afterthought ever since.

But SCHD is underperforming even among dividend ETF peers. How have things gone so wrong?

- SCHD’s 9% allocation to technology stocks compared with roughly 35% in the S&P 500 has been a major drag: The tech sector has almost single-handedly been driving the S&P 500 higher. With the “Magnificent 7” driving much of the index’s gains, the Schwab Dividend ETF has struggled to keep pace.

- It’s been buying stocks in underperforming sectors, including energy and staples: After its May rebalance, SCHD made significant additions to these two sectors, two of the worst performers of 2025. In addition to its healthcare exposure, SCHD has more than 50% of its portfolio invested in three of the worst-performing sectors year-to-date.

- It has almost zero growth stock exposure: According to FactSet, the S&P 500 has 56% of the index allocated to growth stocks. SCHD has just 0.27% of the fund in growth.

In short, SCHD has been invested in all the wrong places. Any sector adjustments it made during its May rebalance were almost all in the wrong direction. And it’s been this way for a while.

Comparing SCHD to rival dividend ETFs Like VIG & DGRO

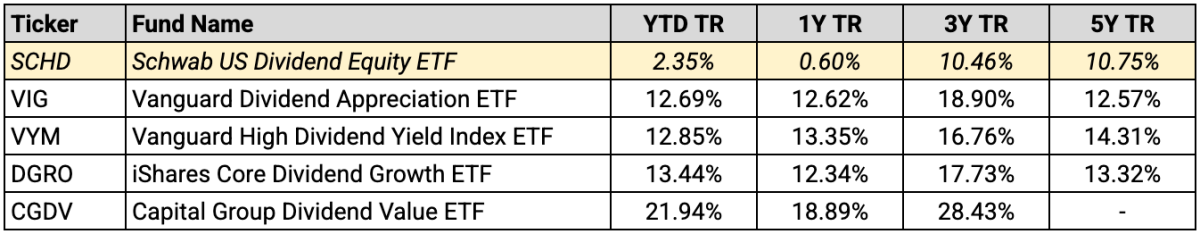

How bad has SCHD performance been in 2025? Let’s compare it to other well-known dividend ETFs:

source: author

source: author

Over the past year, SCHD returns have been virtually nothing. And the fund trails all of its major peer ETFs by at least 12%. Among the best dividend ETFs for income, SCHD’s long-term performance has been trailing significantly for several years.

Is it time to sell the Schwab Dividend ETF?

Is SCHD still worth holding? Should you sell SCHD?

If you think that the rally in tech, growth and AI stocks will continue, there’s almost no evidence suggesting that SCHD is ready to outperform any time soon. Most dividend ETFs are likely to underperform during market rallies simply due to their more conservative nature.

SCHD, however, has lagged almost every group it could fall into – dividend ETFs, value ETFs, low volatility ETFs. Unless market conditions change and non-tech stocks begin to show strength, it’s unlikely that SCHD returns will improve soon.

Key Takeaways

- SCHD has been one of the worst-performing dividend ETFs in 2025 and the past three years.

- SCHD vs. VIG (3-year average annual returns): 10.5% vs. 18.9%.

- SCHD has been investing more in deeply out of favor sectors.

- There’s almost no evidence suggesting that SCHD is ready to outperform any time soon.

The bottom line for dividend ETF investors

If the first decade of returns were (in hindsight) too good to be true, the last three years might also be too bad to be true.

Performance this disappointing isn’t going to last forever, and there’s likely to be some mean reversion at some point. When will SCHD begin to outperform again? It’s unclear.

To be fair, SCHD does have a robust and well-constructed investment strategy. It just clearly hasn’t worked out lately.